Impact Lessons From A Community Foundation Investing In Local

Community Foundations And Place Based Impact Investing Greenmoney Journal In the first year, the knight foundation matched $1.2 million in donations to 57 newsrooms. and, in 2017, newsmatch raised over $4.8 million for 109 participating newsrooms, including $3 million in funding from knight, the john d. and catherine t. macarthur foundation, and the democracy fund. in 2018, newsmatch has continued to pool funds from. So, in an effort to contribute to the work, in 2017 cfsem established the detroit journalism engagement fund, in partnership with the knight foundation and the ford foundation. read the full article about impact lessons from a local journalism investor by lindsay green barber at media impact funders.

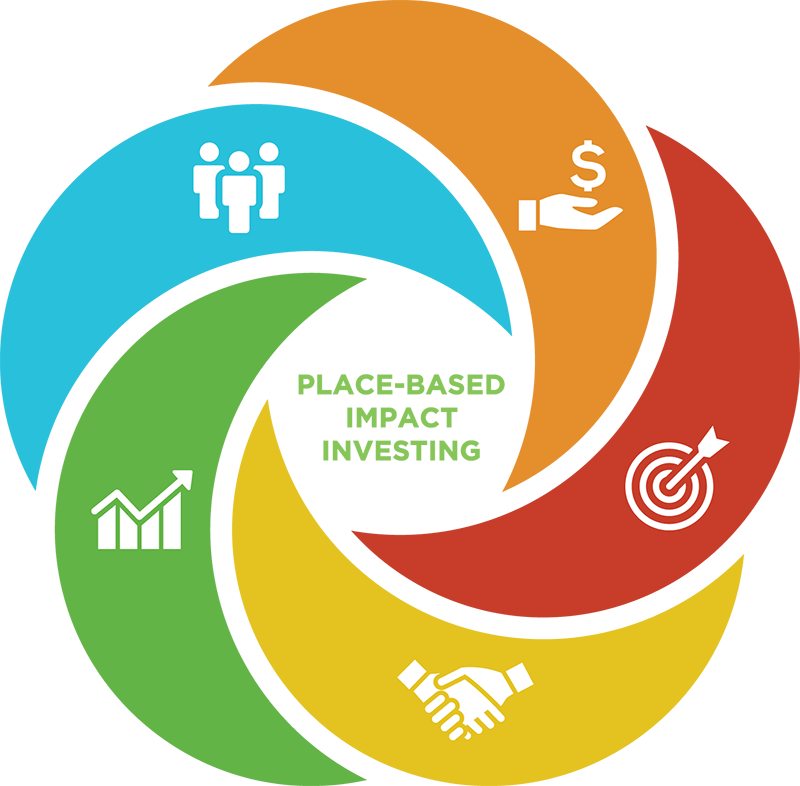

Place Based Impact Investing Community Foundation Of Bloomington And Community foundation field guide to impact investing. community foundations serve people who share a common interest—improving the quality of life in their local areas. given their place based focus and commitment to activate resources to meet their missions, more and more community foundations are adding impact investments to their toolbox. E. project partners included the city of grand rapids, michigan state housing development authority, dyer ives foundation, and habitat for humani. s:$462,025 loan at two percent interest, payable originally over three yea. s. the foundation renegotiated the loan with the investee, extending its term into 20. This article takes a practitioner’s view on the issue, reflecting on lessons learned by a sponsor of donor advised funds that has long accommodated the impact investing interests of its donors. teri behrens joined the dorothy a. johnson center for philanthropy in 2009, serving in several roles throughout her tenure at the organization. Launched in 2020, the omaha community foundation’s community loan fund makes impact investments structured as flexible, affordable loans to local nonprofits. currently, loans are focused on assisting local small business owners in marginalized communities and addressing one of our community’s most basic needs: affordable housing.

Courses Impact Finance Center This article takes a practitioner’s view on the issue, reflecting on lessons learned by a sponsor of donor advised funds that has long accommodated the impact investing interests of its donors. teri behrens joined the dorothy a. johnson center for philanthropy in 2009, serving in several roles throughout her tenure at the organization. Launched in 2020, the omaha community foundation’s community loan fund makes impact investments structured as flexible, affordable loans to local nonprofits. currently, loans are focused on assisting local small business owners in marginalized communities and addressing one of our community’s most basic needs: affordable housing. By baltimore community foundation. bcf launched the invest for more impact investing program in 2018, committing 4% of the bcf long term pool to community development programs and projects that yield a financial return alongside social and economic benefits for communities. since then, we have deployed $4.5 million in loans for affordable. Philanthropy also relies on partnerships. impact investing, in particular, allows the community foundation to bridge the private and public sectors. mainstream financial capital in washtenaw county under invests in areas with high poverty and neighborhoods where people of color are a majority, resulting in a persistent inequitable local economy.

Impact Lessons From A Community Foundation Investing In Local By baltimore community foundation. bcf launched the invest for more impact investing program in 2018, committing 4% of the bcf long term pool to community development programs and projects that yield a financial return alongside social and economic benefits for communities. since then, we have deployed $4.5 million in loans for affordable. Philanthropy also relies on partnerships. impact investing, in particular, allows the community foundation to bridge the private and public sectors. mainstream financial capital in washtenaw county under invests in areas with high poverty and neighborhoods where people of color are a majority, resulting in a persistent inequitable local economy.

Comments are closed.