Index Funds Vs Mutual Funds Vs Etf Which One Is B

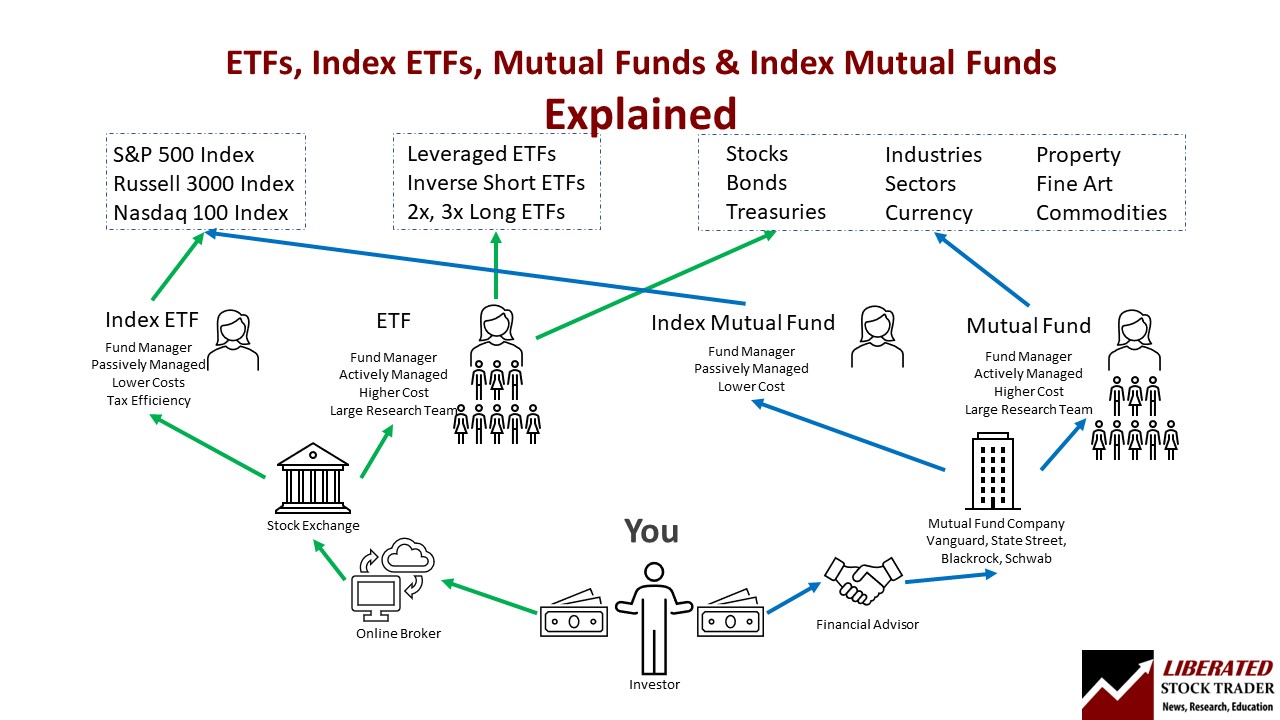

Etf Vs Mutual Fund Vs Index Fund Similarities Differences One key distinction is how they are traded. etfs can be traded like stocks, picked up or dropped at any time during trading hours. mutual funds, however, can only be purchased at the end of the market day. index funds, on the other hand, are a type of mutual fund or etf. and as such, get traded and settled according to its structure, whether. Etfs are more tax efficient than index funds because they are structured to have fewer taxable events. as mentioned previously, an index mutual fund must constantly rebalance to match the tracked.

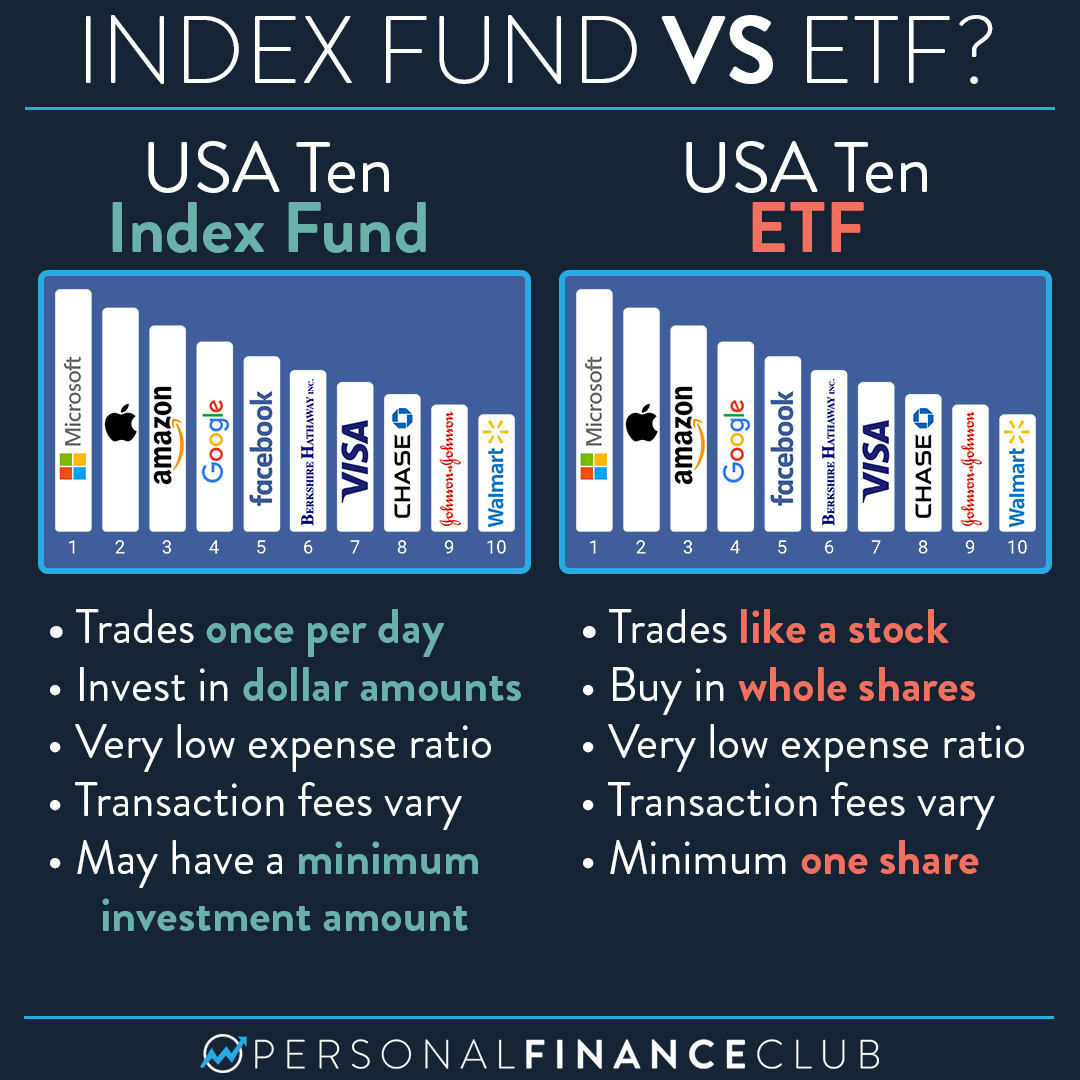

Etfs Vs Mutual Funds Vs Index Funds Simply Explained 2023 The biggest difference between index funds and mutual funds is that index funds invest in a specific list of securities (such as stocks of s&p 500 listed companies only), while active mutual funds. Index fund vs. etf. the biggest difference between etfs and index funds is that etfs can be traded throughout the day like stocks, whereas index funds can be bought and sold only for the price set. Etfs vs. index funds. what are index funds? index funds are a type of mutual fund or etf. so when you’re shopping for index funds, you may come across index mutual funds or index etfs (which can get confusing, we know!). no matter the structure, an important thing to know about index funds is that they follow a specific investment strategy. Mutual fund vs. etf: what's the difference?.

Index Funds Vs Mutual Funds Vs Etfs Differences Similariti Etfs vs. index funds. what are index funds? index funds are a type of mutual fund or etf. so when you’re shopping for index funds, you may come across index mutual funds or index etfs (which can get confusing, we know!). no matter the structure, an important thing to know about index funds is that they follow a specific investment strategy. Mutual fund vs. etf: what's the difference?. Etfs are built for speed, all else being equal, as they carry no such arrangements. mutual funds also often have purchase minimums that can be high, depending on the account in which one invests. Etfs are generally better for frequent trading because you can buy and sell shares throughout the trading day. index mutual funds only let you buy and sell at the very end of each trading day. etfs also give you up to date information on the fund investment value throughout the trading day.

Whatтащs The юааdifferenceюаб юааbetweenюаб An юааindexюаб юааfundюаб And An юааetfюаб тау Personal Etfs are built for speed, all else being equal, as they carry no such arrangements. mutual funds also often have purchase minimums that can be high, depending on the account in which one invests. Etfs are generally better for frequent trading because you can buy and sell shares throughout the trading day. index mutual funds only let you buy and sell at the very end of each trading day. etfs also give you up to date information on the fund investment value throughout the trading day.

Comments are closed.