Insurance Basics

/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

Basics To Help You Understand How Insurance Works Learn what insurance is, how it works, and the main types of policies for personal and business needs. find out the key components of insurance policies, such as premium, deductible, and policy limit. Simply put, the definition of insurance is a contract between an individual (known as the “policyholder”) and an insurance company. in this contract, the insurance company, or carrier, agrees to provide the insured individual (or individuals) named on the policy with a certain amount of financial reimbursement after a covered loss.

Basics Of Insurance Youtube Learn about different types of insurance, how to shop for the best coverage, and how to prepare for disasters. find facts, insights, and guidance from the insurance information institute, a trusted source for insurance knowledge. Coverage amounts are typically low, usually between $1,000 and $5,000. comprehensive and collision coverage. these coverage types work together to pay for damage to your vehicle. collision. Insurance underwriters determine whether an applicant is insurable and, if so, what premium amount they will pay for the level of coverage they purchase. insurance is also a way of managing risk. understanding basic risk management methods is a great way to decide what insurance is right for you. risk management methods include the following. Conclusion. insurance is a vital tool for protecting yourself, your loved ones, and your assets from unexpected events. by understanding the basics of insurance, different policy types, and the claim process, you can make informed decisions about your coverage. remember to assess your needs, research policies, compare coverage and premiums, and.

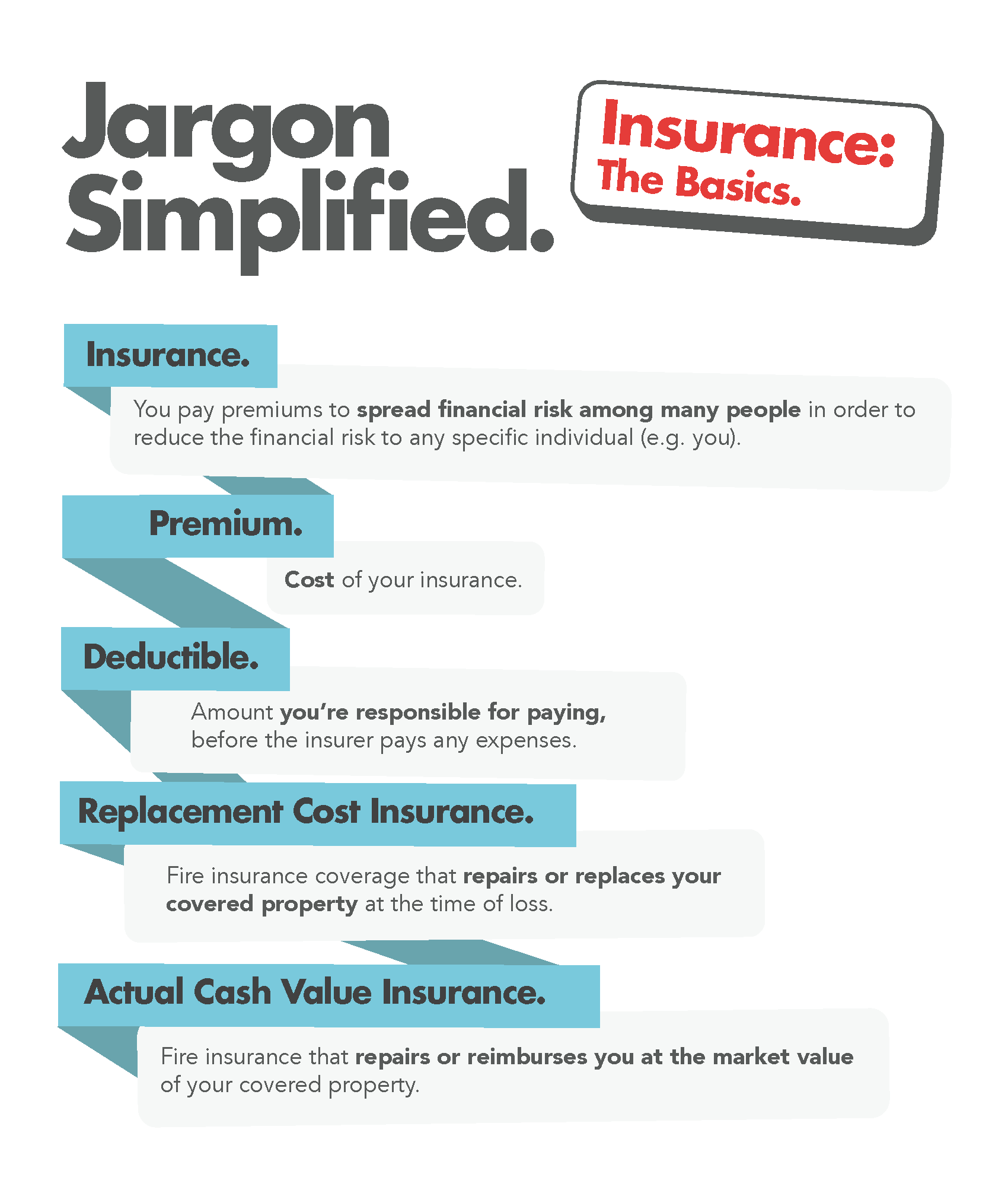

Financial Jargon Simplified Insurance Basics State Farmв Insurance underwriters determine whether an applicant is insurable and, if so, what premium amount they will pay for the level of coverage they purchase. insurance is also a way of managing risk. understanding basic risk management methods is a great way to decide what insurance is right for you. risk management methods include the following. Conclusion. insurance is a vital tool for protecting yourself, your loved ones, and your assets from unexpected events. by understanding the basics of insurance, different policy types, and the claim process, you can make informed decisions about your coverage. remember to assess your needs, research policies, compare coverage and premiums, and. Key takeaways. insurance coverage refers to the amount of risk or liability that is covered for an individual or entity by way of insurance services. the most common types of insurance coverage. The health insurance marketplace lets you compare individual and nongroup plans in your area. marketplace plans are also eligible for subsidies that reduce the cost of health insurance. there are multiple types of health insurance plans, including ppos and hmos. premiums, deductibles and coinsurance are all health insurance costs that members pay.

Comments are closed.