Mortgage Fico Credit Scores Vs Online Consumer Credit Scores

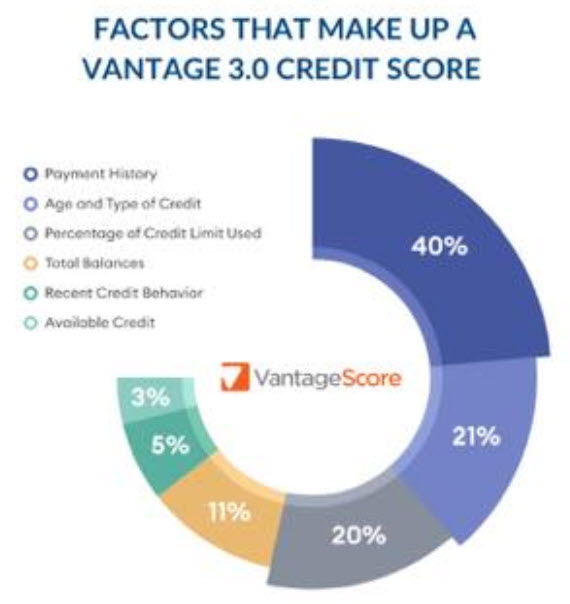

Mortgage Ficoв Credit Scores Vs Online Consumer Credit Scores Youtube Mortgage lenders use a fico score, which is different from the vantage 3.0 consumer credit score that individuals may access through services like credit karma. key points: mortgage credit score (fico): used by over 90% of mortgage lenders and emphasizes payment history (35%), credit utilization (30%), credit length (15%), credit mix (10%), and inquiries (10%). When mortgage lenders check a prospective borrower’s credit, they’ll typically see one mortgage credit score from each of the three credit bureaus and use the median score. often, the result is that a score you see online may differ from the score you see when financing a mortgage, which could be different still from a score that an auto dealer or credit card company sees.

Mortgage Ficoв Credit Scores Vs Online Consumer Credit Scores Get Fha The three credit bureaus use the following fico ® scoring models for mortgage loan applications: experian™: fico ® score 2. transunion®: fico ® score 4. equifax®: fico ® score 5. each of these scores weighs several variables of your creditworthiness differently, but the specifics of the differences between each score are not known. Consumer credit scores, also known as educational credit scores, are credit scores that can be accessed by consumers. typically, consumer credit scores only use information from one of the credit bureaus. additionally, they’re calculated using consumer scoring models, rather than mortgage credit scoring models. Originally known as fair, isaac, and company, fico started providing consumer credit scores in 1989. as the leader in the industry, the company now generates credit scores for 90% of the top. The fico score includes many of the same elements as the vantagescore, but it includes information from all three of the major credit bureaus. if the scores are different, the fico score will generally use the median score. if two of the scores agree, the fico score will use that repeating score. if you are applying for a mortgage along with.

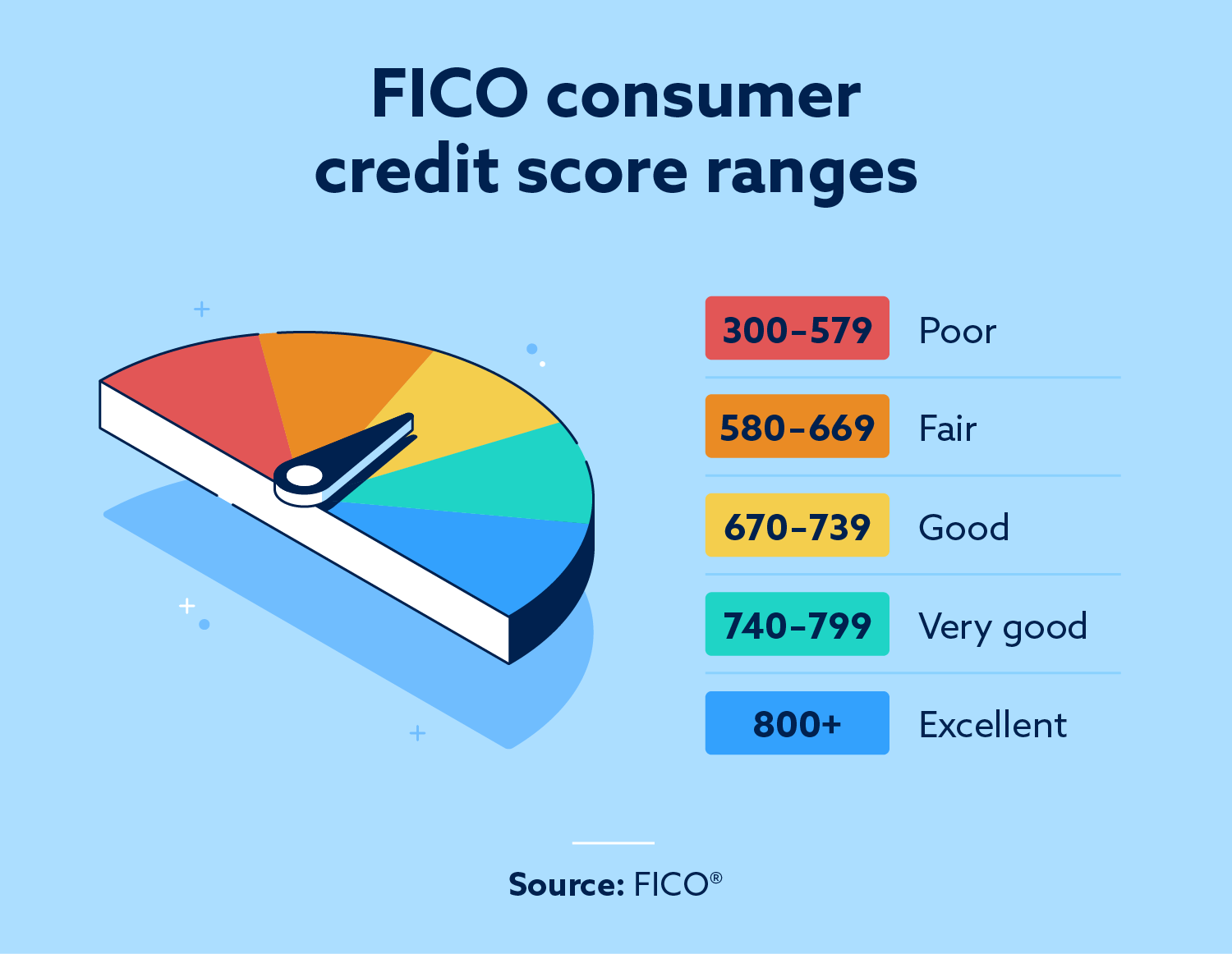

Mortgage Ficoв Credit Scores Vs Online Consumer Credit Scores Get Fha Originally known as fair, isaac, and company, fico started providing consumer credit scores in 1989. as the leader in the industry, the company now generates credit scores for 90% of the top. The fico score includes many of the same elements as the vantagescore, but it includes information from all three of the major credit bureaus. if the scores are different, the fico score will generally use the median score. if two of the scores agree, the fico score will use that repeating score. if you are applying for a mortgage along with. According to fico, a borrower with a credit score of 760 can expect an interest rate of 6.47% on a 30 year fixed mortgage. for a borrower with a score between 620 and 639 (considered subprime. The scoring range is from 300 to 850 and is based on six credit factors instead of five like your fico score. mortgage credit scores. each consumer credit bureau uses a unique mortgage related.

What Is A Good Credit Score вђ Forbes Advisor According to fico, a borrower with a credit score of 760 can expect an interest rate of 6.47% on a 30 year fixed mortgage. for a borrower with a score between 620 and 639 (considered subprime. The scoring range is from 300 to 850 and is based on six credit factors instead of five like your fico score. mortgage credit scores. each consumer credit bureau uses a unique mortgage related.

Credit Score Ranges Explained Lexington Law

Comments are closed.