Neoclassical Theory Of Investment Slideshare Home Business

Neoclassical Theory Of Investment Slideshare Home Business Neeluskumar1. neoclassical theory of investment behavior is based on optimal capital accumulation determined by factor prices. fixed business investment refers to purchases of machines, factories, warehouses, and buildings by businesses. the theory explains how much capital a firm desires at a time and that investment is determined by the speed. The document discusses the neo classical approach to management theory, which includes the human relations movement and behavioral theory. the human relations movement was pioneered by elton mayo through the hawthorne studies in the 1920s 1930s. a key finding was that social and psychological factors strongly influence worker productivity.

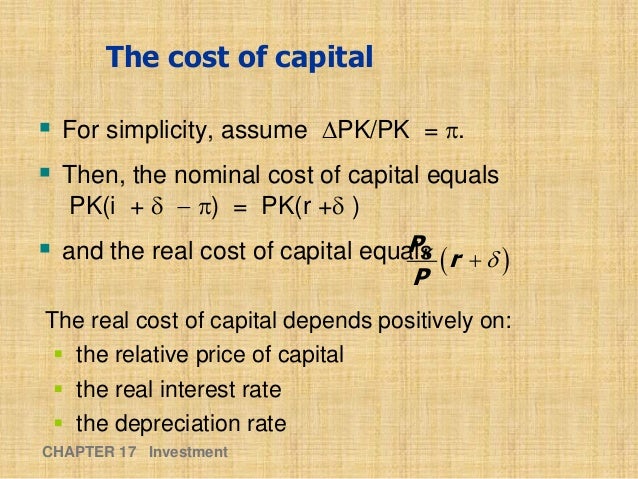

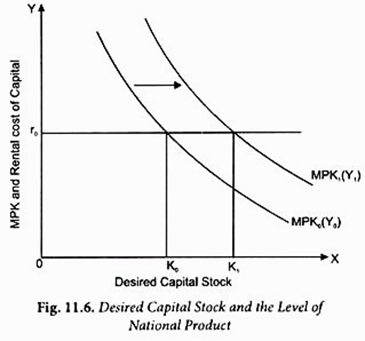

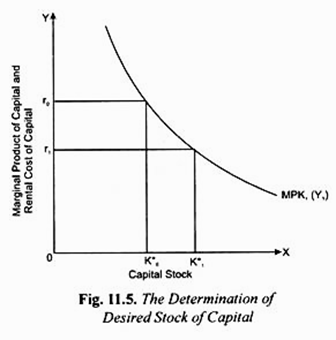

Neoclassical Theory Of Investment Slideshare Home Business Investment. this document provides an overview of investment. it discusses three types of investment: business fixed investment, residential investment, and inventory investment. it then explains the neoclassical model of business fixed investment, which shows how investment depends on the marginal product of capital, interest rate, and tax rules. The neoclassical theory explains that at a particular time how much capital stock a firm desires to achieve. further, according to this theory, rate of investment is determined by the speed with which firms adjust their capital stocks towards the desired level. because it takes time to build and install new machines, construct new factories. The modern approach to business investment is based on dale jorgenson’s approach known as the neo classical theory of investment. jorgenson’s theory provides the micro foundation of the aggregate investment function. for analytical convenience, we classify an economy’s firms into two broad categories, viz., (i) production firms that. The q theory of investment implicitly considers the marginal costs of adjusting the capital stock. hence, in contrary to the neoclassical theory of investment, the q theory of investment is not primarily based on the assumption of an optimal capital stock, but emphasizes the optimal adjustment path towards the new capital stock. suggest.

The Neoclassical Theory Of Investment With Diagram The modern approach to business investment is based on dale jorgenson’s approach known as the neo classical theory of investment. jorgenson’s theory provides the micro foundation of the aggregate investment function. for analytical convenience, we classify an economy’s firms into two broad categories, viz., (i) production firms that. The q theory of investment implicitly considers the marginal costs of adjusting the capital stock. hence, in contrary to the neoclassical theory of investment, the q theory of investment is not primarily based on the assumption of an optimal capital stock, but emphasizes the optimal adjustment path towards the new capital stock. suggest. This study is motivated by the idea that a systematic perspective on the neoclassical theory of investment { a theory which implicitly or explicitly underlies many economic models, much heuristic thinking, and several policy discussions { can be helpful in clarifying important contemporary issues and debates. The term ‘neoclassical synthesis’ appears to have been coined by paul samuelson to denote the consensus view of macroeconomics which emerged in the mid 1950s in the united states. this synthesis remained the dominant paradigm for another 20 years, in which most of the important contributions, by hicks, modigliani, solow, tobin and others.

The Neoclassical Theory Of Investment With Diagram This study is motivated by the idea that a systematic perspective on the neoclassical theory of investment { a theory which implicitly or explicitly underlies many economic models, much heuristic thinking, and several policy discussions { can be helpful in clarifying important contemporary issues and debates. The term ‘neoclassical synthesis’ appears to have been coined by paul samuelson to denote the consensus view of macroeconomics which emerged in the mid 1950s in the united states. this synthesis remained the dominant paradigm for another 20 years, in which most of the important contributions, by hicks, modigliani, solow, tobin and others.

Ppt Economics 122 Investment Fall 2012 Powerpoint Presentation Free

Comments are closed.