Nsf Returned Item Fee Charged Multiple Times Says Plaintiff Top

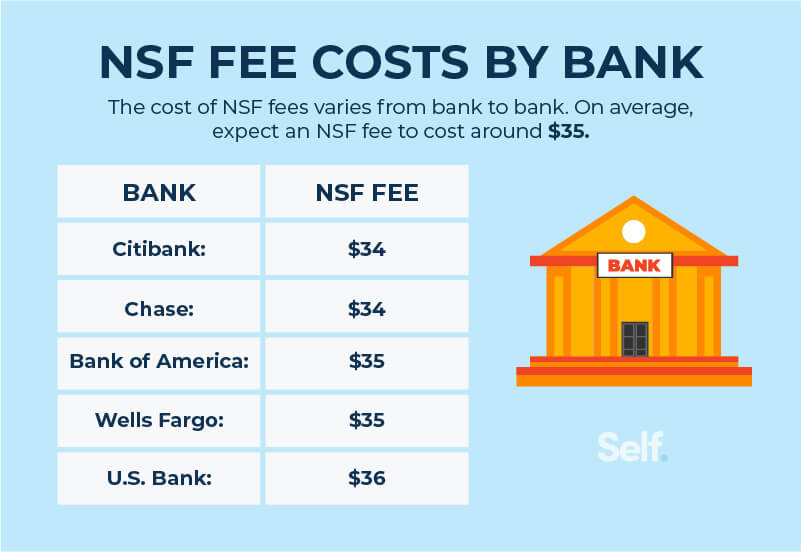

Processing Returned Items Nsf Complete Management Software Nsf returned item fee charged multiple times, says plaintiff. a recent class action lawsuit alleges that td bank of new jersey has been charging customers an nsf returned item fee multiple times on a single transaction. in other words, when the amount of money in an account is insufficient to cover a transaction (such as a paper check or ach. What is an nsf returned item fee? an nsf returned item fee, or a non sufficient fund fee, is a fee assessed by a bank or credit union when a customer attempts to make a purchase despite not having the required amount of money in their account. nsf checks are often referred to as “bounced checks.”. nsf fees are generally between $25 to $40.

Nsf Returned Item Fee Charged Multiple Times Says ођ Dufault claims that in december of 2020 he was charged nearly $100 in nsf fees by tb bank for a mere $.45 shortage in his account. dufault attempted to make a one time online payment of $19.49 from his td bank account on dec. 2, 2020; however, he allegedly only had $19.04 in the account at the time. the next day, td allegedly rejected the. In one lawsuit, fifth third bank is accused of charging more than one $35 bank returned item fee on the same transaction even though its own contract says each transaction can only incur one such fee. another customer alleges bank of america charged both a $35 return item fee and a $35 overdraft fee on the same transaction. Consumers have also filed a class action lawsuit canada over non sufficient fund (nsf) fees. similar to overdraft fees, nsf fees are levied on accounts without sufficient funds to cover pending transactions. the nsf fee class action lawsuit alleges that ten banks charged exorbitant penalties on customers, between $45 to $65. Td bank, n.a. faces a proposed class action over its alleged practice of charging both an overdraft fee and an insufficient funds (nsf) fee on a single transaction. per the lawsuit, td bank violated the terms of its account documents by charging more than one fee on a single item despite promising to charge either a single $35 nsf fee or a.

Usaa Allegedly Charged Nsf Return Item Fee Three Times On One Tr Consumers have also filed a class action lawsuit canada over non sufficient fund (nsf) fees. similar to overdraft fees, nsf fees are levied on accounts without sufficient funds to cover pending transactions. the nsf fee class action lawsuit alleges that ten banks charged exorbitant penalties on customers, between $45 to $65. Td bank, n.a. faces a proposed class action over its alleged practice of charging both an overdraft fee and an insufficient funds (nsf) fee on a single transaction. per the lawsuit, td bank violated the terms of its account documents by charging more than one fee on a single item despite promising to charge either a single $35 nsf fee or a. Fdic provides guidance on multiple nsf fees for re presented items. april 1, 2022. reading time: 2 mins read. in its latest issue of consumer compliance supervisory highlights, the fdic addressed the charging of multiple non sufficient funds fees for transactions presented multiple times against insufficient funds in the customer’s account. 18. td rejected payment of that item due to insufficient funds and charged plaintiff perks a $35 nsf fee. 19. seven days later, on october 1, 2018, the same item was re submitted for payment, and again td bank rejected the item due to insufficient funds and charged plaintiff perks another $35 nsf fee. 20.

Venmo Nsf Fee Item Returned Avoiding Nsf Item Returned Fdic provides guidance on multiple nsf fees for re presented items. april 1, 2022. reading time: 2 mins read. in its latest issue of consumer compliance supervisory highlights, the fdic addressed the charging of multiple non sufficient funds fees for transactions presented multiple times against insufficient funds in the customer’s account. 18. td rejected payment of that item due to insufficient funds and charged plaintiff perks a $35 nsf fee. 19. seven days later, on october 1, 2018, the same item was re submitted for payment, and again td bank rejected the item due to insufficient funds and charged plaintiff perks another $35 nsf fee. 20.

Non Sufficient Funds Nsf Fees What They Are And How To Avoid Them

Comments are closed.