Post Office Savings Account Benefits And How To Open An Account

Post Office Savings Account Eligibility Interest Rate How To Open Post office saving schemes. Post office savings account interest rate. currently, an individual earns interest at the rate of 4% on their account balance. the interest is calculated monthly and credited annually into the account. interest rates for post office savings accounts are decided by the reserve bank of india.

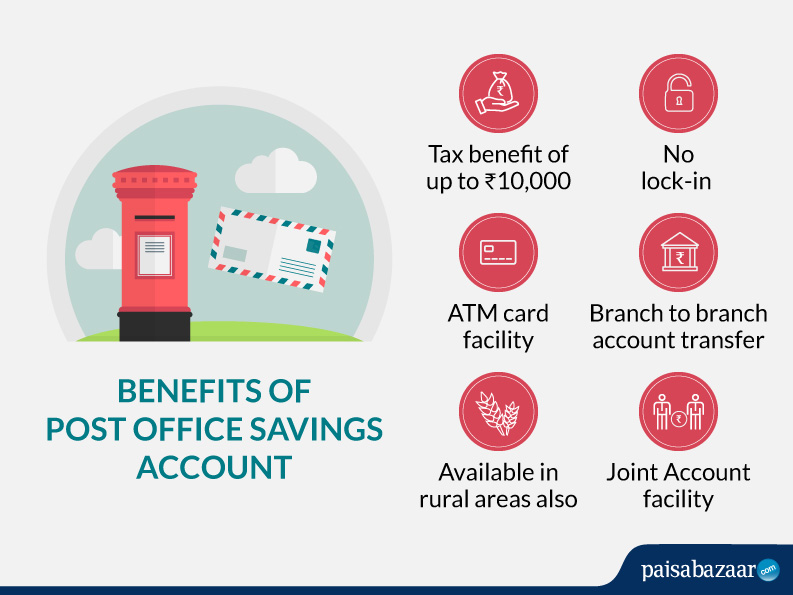

Post Office Savings Account Benefits And How To Open An Account Here are the key features and benefits of choosing a post office savings account. accessibility; post office savings accounts are easily accessible to individuals as post offices are found in almost every locality, making it convenient for people to open and operate an account. Aadhaar & pan card is mandatory for opening digital savings account. to avail unrestricted banking services kindly upgrade your digital savings account to regular savings account within 1 year by visiting any ippb access point. please complete your full kyc within 1 year. non compliance of the same can result in account closure. Benefits of post office savings account. opening a savings account through post office is way easier than savings accounts in banks. let us take a look at its benefits. a post office savings account requires a minimum balance of rs. 500 to open the account. the cash can be withdrawn either partly or completely if need be. Here the the significant features of the post office monthly income scheme 2024 . lock in period: when you open a monthly income scheme account with a post office, you cannot withdraw the amount deposited in such account prior to 5 years. maximum limit: you can make a maximum investment of rs. 9 lakhs in the scheme.

How To Open A Office Savings Account Office Savings A Vrogue Co Benefits of post office savings account. opening a savings account through post office is way easier than savings accounts in banks. let us take a look at its benefits. a post office savings account requires a minimum balance of rs. 500 to open the account. the cash can be withdrawn either partly or completely if need be. Here the the significant features of the post office monthly income scheme 2024 . lock in period: when you open a monthly income scheme account with a post office, you cannot withdraw the amount deposited in such account prior to 5 years. maximum limit: you can make a maximum investment of rs. 9 lakhs in the scheme. Rates: click here to see the detailed schedule of charges. click here. call 155299 or 033 22029000 to avail doorstep banking services to open a premium savings account with ippb. *charges levied will be reversed post verification of the transaction. benefits will be accrued within 90 days of a successful transaction. A. if you don't have a posa, ippb can help you open a new posa and link it with your regular savings account. if you do not wish to open a posa, your regular savings account will be restricted to rs. 2 lakh at the end of the day. any transaction beyond this permissible limit will be rejected. q.

Post Office Savings Account 2024 Interest Rate Eligibility Rates: click here to see the detailed schedule of charges. click here. call 155299 or 033 22029000 to avail doorstep banking services to open a premium savings account with ippb. *charges levied will be reversed post verification of the transaction. benefits will be accrued within 90 days of a successful transaction. A. if you don't have a posa, ippb can help you open a new posa and link it with your regular savings account. if you do not wish to open a posa, your regular savings account will be restricted to rs. 2 lakh at the end of the day. any transaction beyond this permissible limit will be rejected. q.

Comments are closed.