Save Income Tax Using Old Tax Regime No Tax ођ

Save Income Tax Using Old Tax Regime No Tax On 10%. ₹ 10 lakh ₹ 12 lakh. 15%. ₹ 12 lakh ₹ 15 lakh. 20%. more than 15 lakh. 30%. standard deductions under the new tax regime has been increased to rs.75,000, however for fy 2023 24 the standard deduction will remain the same. family pension deduction of rs 15,000 has been increased to rs.25,000. Default regime: starting from fy 2023 24, the new income tax regime will be set as the default option. if you want to continue using the old regime, you must submit the income tax return along with form 10 iea before the due date. you will have the option to switch between the two regimes annually to check the tax benefits.

Income Tax Slabs For Fy 2022 23 Fy 2021 22 Section 80ccd. you can save tax under section 80c and 80ccd by investing in nps. under section 80c, you can invest the maximum amount of rs. 1,50000, which is eligible for a deduction in any financial year.furthermore, you can also get an additional deduction of up to rs. 50,000 under section 80ccd on specific criteria. In short. new tax regime remains default option for taxpayers. taxpayers can switch between old and new regime. switching frequency depends on income type. the new income tax regime has become the default option for taxpayers fiscal year 2024 25. taxpayers who fail to specify their preference between the old and new regime will have their taxes. E tax subject to a maximum of rs. 12,500 . in the new tax regime, the rebate is increased to rs. 25,000 or 100 percent of income tax where the. otal income does not exceed rs. 7,00,000 .10) while filing itr for fy 2023 24 (ay 2024 25), i want to opt for the old tax regime instead of the default new tax regime, should i file form 10 ie. The choice between the new and old tax regimes depends on your eligible deductions and exemptions. new tax regime – beneficial if you have minimal deductions. features lower tax rates but disallows most exemptions and deductions. old tax regime – favourable if you claim significant deductions like section 80c, 80d, and home loan interest.

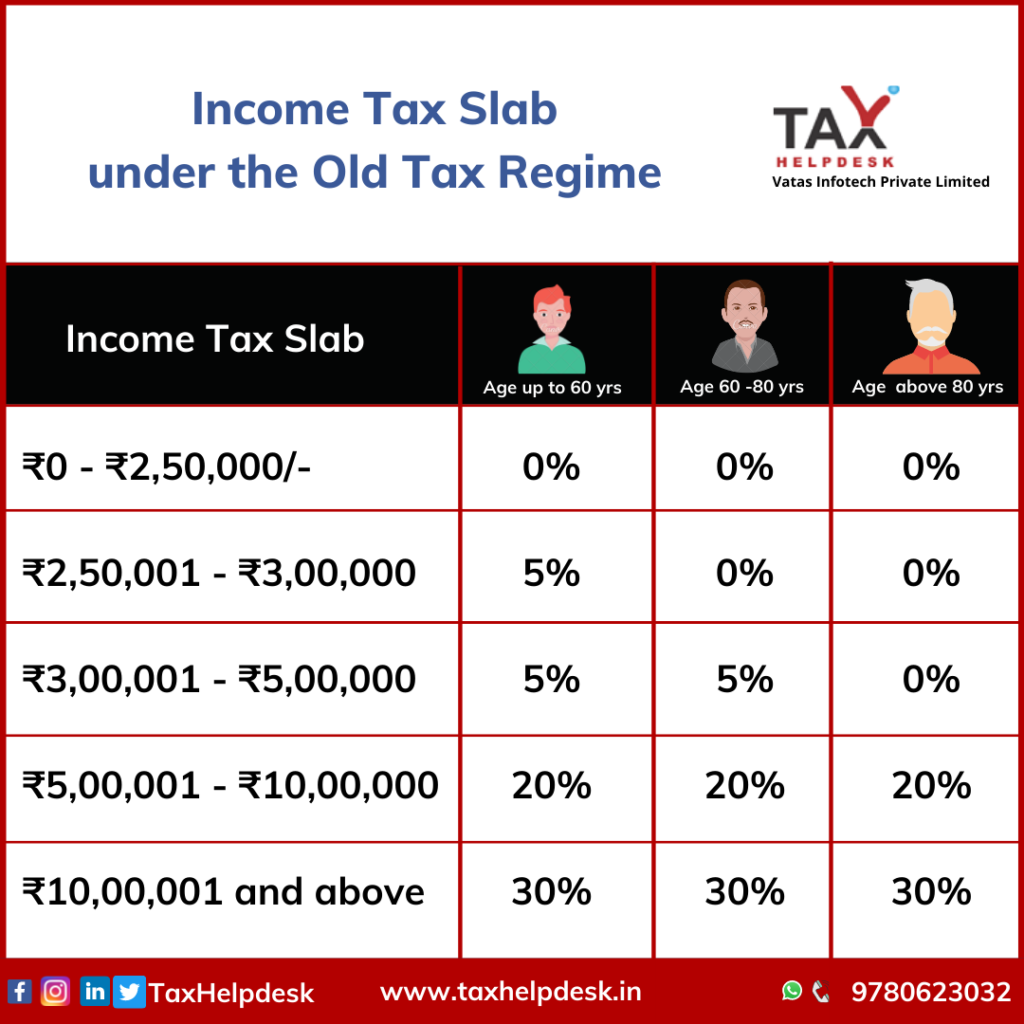

How To Save Income Tax Tax Saving Income Tax New Regime E tax subject to a maximum of rs. 12,500 . in the new tax regime, the rebate is increased to rs. 25,000 or 100 percent of income tax where the. otal income does not exceed rs. 7,00,000 .10) while filing itr for fy 2023 24 (ay 2024 25), i want to opt for the old tax regime instead of the default new tax regime, should i file form 10 ie. The choice between the new and old tax regimes depends on your eligible deductions and exemptions. new tax regime – beneficial if you have minimal deductions. features lower tax rates but disallows most exemptions and deductions. old tax regime – favourable if you claim significant deductions like section 80c, 80d, and home loan interest. Under the new regime, new tax slabs were introduced with existing rates which are slashed on income up to inr 15 lakh. the tax slab rates as per the ‘new income tax regime’ and ‘old income tax regime’ are as follows: income range. rates as per old regime. rates as per new regime(up to ay 2023 24) up to inr 2,50,000. nil. The income tax rule changes from april 1, 2024 make sure taxpayers can get rid of complex tax planning as these changes aim to simplify tax planning. with the introduction of the new income tax regime, the basic exemption limit has been elevated from rs.2.5 lakhs to rs.3 lakhs. this increased exemption limit makes the novel tax regime more.

Comments are closed.