Socso New Contribution Rate Memory

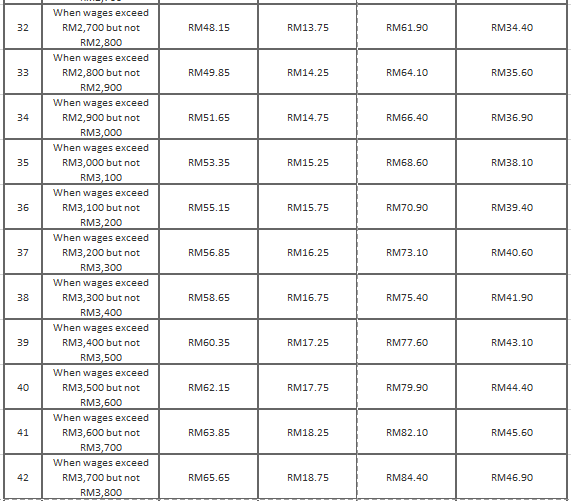

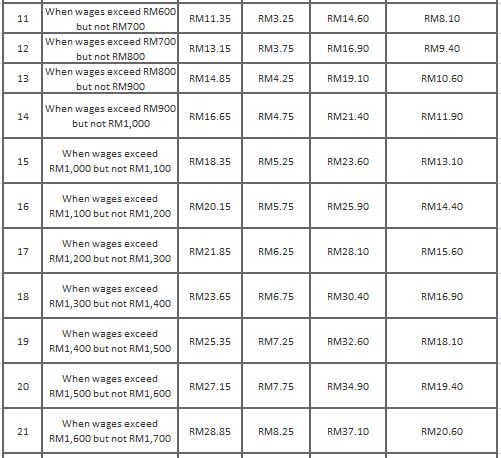

Socso New Contribution Rate Memory Contribution rate. update on contribution amount for act 4 and act 800 in accordance with the increment of the wage ceiling limit. effective 1st september 2022, perkeso will enforce a new wage ceiling for contributions from rm4,000 to rm5,000 per month. the contribution amount that apply to employees with salaries exceeding rm4,000 per month is. As of 2024, the socso contribution rates are structured as follows: employee contribution: employees contribute 0.5% of their monthly salary. employer contribution: employers contribute 1.75% of the employee’s monthly wage . there are 2 categories for which the socso rates differs. the first category applies only to employees under 60 years old.

Socso New Contribution Rate Memory Rm86.65. rm24.75. rm111.40. rm61.90. socso rate table for foreign workers effective july 2024 effective from july 2024, foreign workers below 60 years of age are now covered by socso’s invalidity scheme, a benefit that was once limited to malaysian employees. this coverage includes 24 hour protection and funeral repatriation. June 26, 2024. the dewan rakyat today approved amendments to increase the contribution wage ceiling for insured persons from rm5,000 to rm6,000 under the workers’ social security act 1969 (act 4) and the employment insurance system act 2017 (act 800). the amendments were unanimously approved with support from all members of parliament present. The invalidity scheme extension for foreign workers provides 24 hour protection and covers funeral repatriation costs. this change will increase costs for employers, raising the employer’s contribution to 1.75% of monthly wages from the current 1.25%. socso ceo datuk seri dr. mohammed azman aziz mohammed emphasized that these contributions. An employee only contributes 0.5% of their monthly salary, whereas an employer contributes 1.25% of the employee’s monthly wage. however, socso contribution rates vary for increased monthly wages. an employee earning more than rm4,000 per month has a fixed contribution rate of rm19.75, and the employer has to pay rm49.50. these rates are.

Epf Contribution Rate Table Socso New Contribution Rate Memory The invalidity scheme extension for foreign workers provides 24 hour protection and covers funeral repatriation costs. this change will increase costs for employers, raising the employer’s contribution to 1.75% of monthly wages from the current 1.25%. socso ceo datuk seri dr. mohammed azman aziz mohammed emphasized that these contributions. An employee only contributes 0.5% of their monthly salary, whereas an employer contributes 1.25% of the employee’s monthly wage. however, socso contribution rates vary for increased monthly wages. an employee earning more than rm4,000 per month has a fixed contribution rate of rm19.75, and the employer has to pay rm49.50. these rates are. Perkeso, socso contribution, socso contribution table. Contribution rates. effective from 1 july 2024, socso coverage has been extended to foreign workers, including expatriates, with updated contribution requirements and benefits. the contribution rates for foreign workers will align with those of local employees. employers will contribute 1.75% of the worker’s monthly wages, an increase from.

Socso Contribution Table 2023 Portal Matrix Eis Rate Vrogue Co Perkeso, socso contribution, socso contribution table. Contribution rates. effective from 1 july 2024, socso coverage has been extended to foreign workers, including expatriates, with updated contribution requirements and benefits. the contribution rates for foreign workers will align with those of local employees. employers will contribute 1.75% of the worker’s monthly wages, an increase from.

Comments are closed.