Texas Cpa Exam And Licensing Requirements Cpa Exam Cpa Business Courses

How To Become A Cpa In Texas Cpa Exam License Requirements Learn the 7 simple steps to qualifying to become a licensed cpa in texas! find cpa exam requirements and qualifications, fees, if 150 credit hours required, fulfilling the education class requirements, licensing, ethics, residency, citizenship, and age requirements for texas. January 19, 2024. requirements to take the exam and additional education requirements for cpa certification. effective september 1, 2023, the texas public accountancy act has been amended. it permits candidates with a baccalaureate or higher degree recognized by the board and 120 semester hours of board recognized courses, including no fewer.

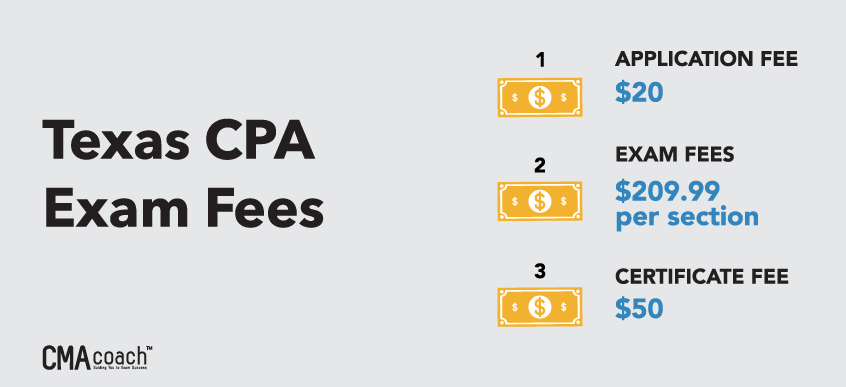

Texas Cpa Exam And License Requirements 2023 Exam qualifications – requirements for examination. you must meet the following qualifications to take the cpa exam. complete the electronic fingerprint process for a background check of the criminal history files of the texas department of public safety (dps) and the federal bureau of investigation (fbi). Texas cpa exam & licensing cost and fees. candidates applying for the cpa exam in texas must submit an application of intent followed by the eligibility application fee, each requiring a nonrefundable fee of $20 and $15, respectively. the tentative fee for each exam section is $254.80. please note that the exam section fees are subject to change. Meet the new education requirements to take the cpa exam. after you have passed all sections of the cpa exam you are required to submit additional transcripts showing that you completed no fewer than 150 semester hours of board recognized courses, six additional semester credit hours of upper level accounting, and completion of a three semester. Steps to get a cpa license in texas. educational requirements: fulfill the necessary educational qualifications, including 150 semester hours of college coursework. work experience: complete the required amount of verified work experience under the supervision of a licensed cpa. cpa exam: successfully pass all sections of the cpa exam.

Texas Cpa Requirements In 2020 Licensing Exam Meet the new education requirements to take the cpa exam. after you have passed all sections of the cpa exam you are required to submit additional transcripts showing that you completed no fewer than 150 semester hours of board recognized courses, six additional semester credit hours of upper level accounting, and completion of a three semester. Steps to get a cpa license in texas. educational requirements: fulfill the necessary educational qualifications, including 150 semester hours of college coursework. work experience: complete the required amount of verified work experience under the supervision of a licensed cpa. cpa exam: successfully pass all sections of the cpa exam. In texas, to become a cpa you are required to: complete a 150 hour degree program in accounting at an accredited college or university, pass the uniform cpa examination and attain a level of professional work experience in accounting. applying for the cpa exam. a candidate for the cpa exam must show completion of the following education. Texas cpa cpe requirements. all licensed cpas in texas must complete 120 continuing professional education (cpe ) credit hours per three year reporting period, and a minimum of 20 cpe credit hours must be earned per one year period. anyone who has been licensed for less than 12 months does not have to meet texas cpa cpe requirements.

Texas Cpa Requirements In 2020 Licensing Exam In texas, to become a cpa you are required to: complete a 150 hour degree program in accounting at an accredited college or university, pass the uniform cpa examination and attain a level of professional work experience in accounting. applying for the cpa exam. a candidate for the cpa exam must show completion of the following education. Texas cpa cpe requirements. all licensed cpas in texas must complete 120 continuing professional education (cpe ) credit hours per three year reporting period, and a minimum of 20 cpe credit hours must be earned per one year period. anyone who has been licensed for less than 12 months does not have to meet texas cpa cpe requirements.

Comments are closed.