Texas Cpa Exam Requirements 2024 3 Critical Steps

Texas Cpa Exam Requirements 2024 3 Critical Steps One of the main texas cpa exam requirements is that you must have 150 semester hours of college credits, including 30 semester hours of upper level accounting courses, 24 semester hours of upper level business courses, and 3 semester hours of ethics courses according to the texas state board of accountancy. January 19, 2024. requirements to take the exam and additional education requirements for cpa certification. effective september 1, 2023, the texas public accountancy act has been amended. it permits candidates with a baccalaureate or higher degree recognized by the board and 120 semester hours of board recognized courses, including no fewer.

Tsbpa Welcome To Texas State Board Of Public Accountancy Exam Candidate Expiration of exam credits were also extended from 18 months to 30 months, effective jan. 1, 2024. the applicant reassessment program from the texas state board of public accountancy invites those who lost exam credits between jan. 1, 2020, and jan. 1, 2024, due to expiration to reach out for potential reinstatement of those credits. Exam qualifications – requirements for examination. you must meet the following qualifications to take the cpa exam. complete the electronic fingerprint process for a background check of the criminal history files of the texas department of public safety (dps) and the federal bureau of investigation (fbi). Texas public accountancy act. has been amended. it permits candidates with a baccalaureate or higher degree recognized by the board and 120 semester hours of board recognized courses, including no fewer than 24 semester hours of accounting, of which 21 must be upper level accounting, to take the cpa exam. in addition to the accounting courses. Learn the 7 simple steps to qualifying to become a licensed cpa in texas! find cpa exam requirements and qualifications, fees, if 150 credit hours required, fulfilling the education class requirements, licensing, ethics, residency, citizenship, and age requirements for texas.

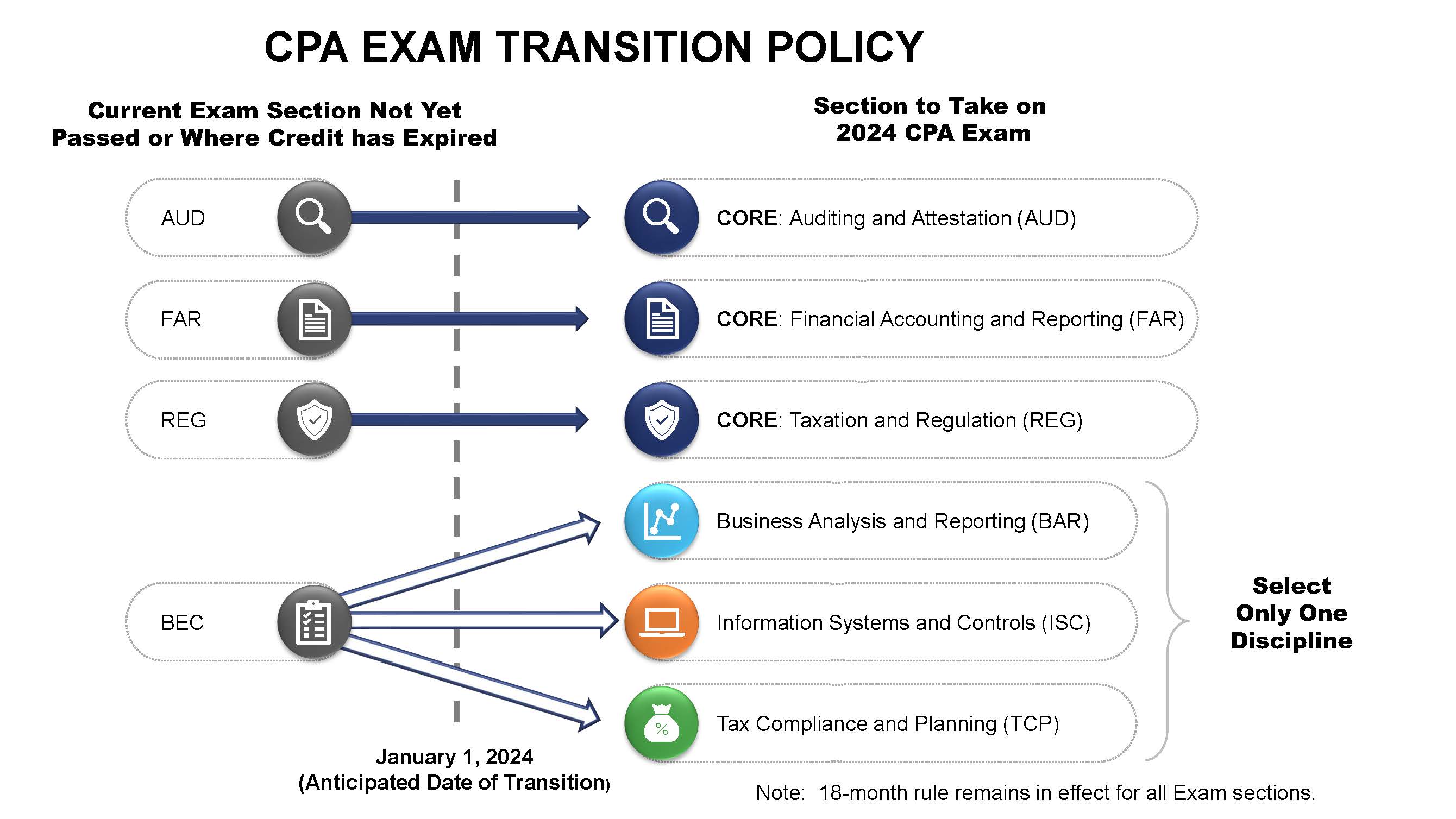

Texas Cpa Education Requirements 2024 Texas public accountancy act. has been amended. it permits candidates with a baccalaureate or higher degree recognized by the board and 120 semester hours of board recognized courses, including no fewer than 24 semester hours of accounting, of which 21 must be upper level accounting, to take the cpa exam. in addition to the accounting courses. Learn the 7 simple steps to qualifying to become a licensed cpa in texas! find cpa exam requirements and qualifications, fees, if 150 credit hours required, fulfilling the education class requirements, licensing, ethics, residency, citizenship, and age requirements for texas. Design of 2024 exam each core and discipline exam will be composed of a combination of multiple choice questions and task based simulations. figure 5 presents the design of the 2024 cpa exam by core and discipline section. infrastructure changes aicpa plans the following infrastructure changes for the 2024 exam (aicpa, 2022b):. No need to be a resident of texas. cpa exam requirements for licensure. 150 hours (including b.a.) pass the exam. score 75 in each section within 18 months to pass. work experience. 1 year of full time accounting work experience. ethics exam requirements. pass the texas rules of professional conduct exam.

Cpa Exam Requirements Texas Cpaexam Design of 2024 exam each core and discipline exam will be composed of a combination of multiple choice questions and task based simulations. figure 5 presents the design of the 2024 cpa exam by core and discipline section. infrastructure changes aicpa plans the following infrastructure changes for the 2024 exam (aicpa, 2022b):. No need to be a resident of texas. cpa exam requirements for licensure. 150 hours (including b.a.) pass the exam. score 75 in each section within 18 months to pass. work experience. 1 year of full time accounting work experience. ethics exam requirements. pass the texas rules of professional conduct exam.

Comments are closed.