The Housing Boom 2000 07 Economics Help

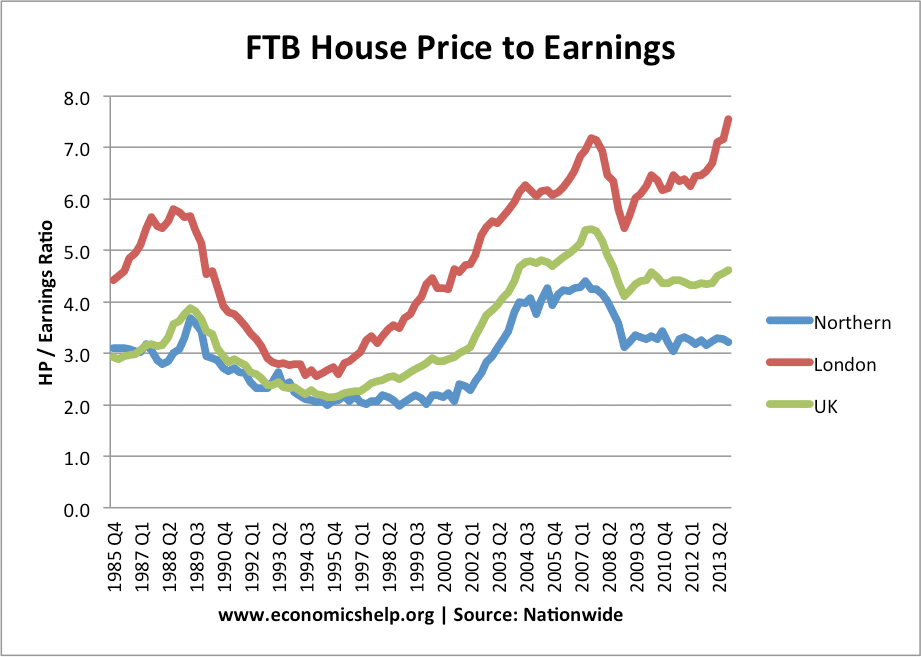

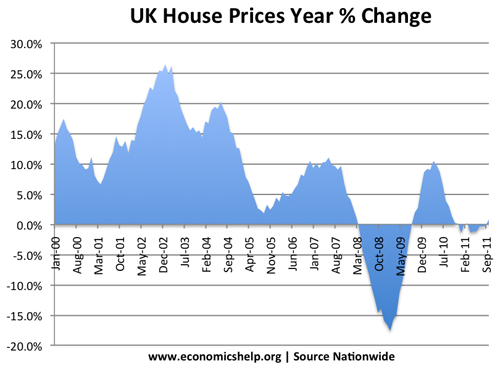

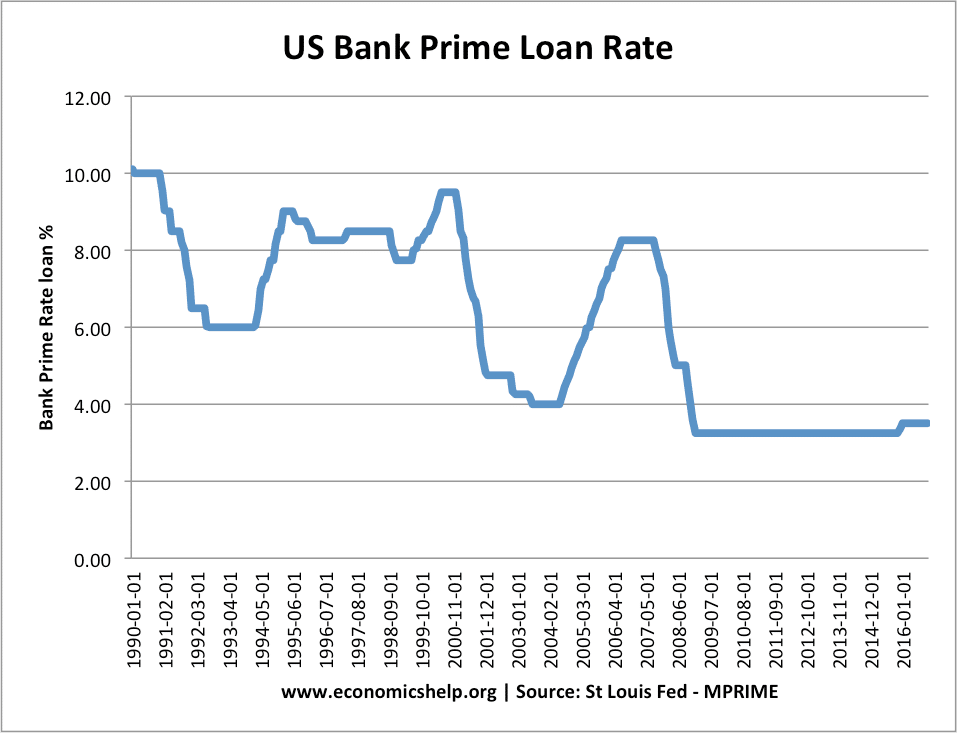

El Boom Inmobiliario 2000 07 Economics Help Tu Economia This is partially correct. the great housing boom lasted from 1994 to 2006 07. but, in particular the period 2000 to 2007. mortgage lenders in both the us, uk and europe became very keen to lend more mortgages because of rising prices, but also other factors, such as over confidence, ability to borrow short term money resell mortgage bundles. For example, in 2000 2007, there was a housing boom, but the mpc didn’t change interest rates because they were focused on inflation and economic growth. similarly, from 2012 to 2016, house prices rose rapidly – especially in london, but interest rates stayed at 0.5%. evaluation of housing market on economy 1. importance of housing.

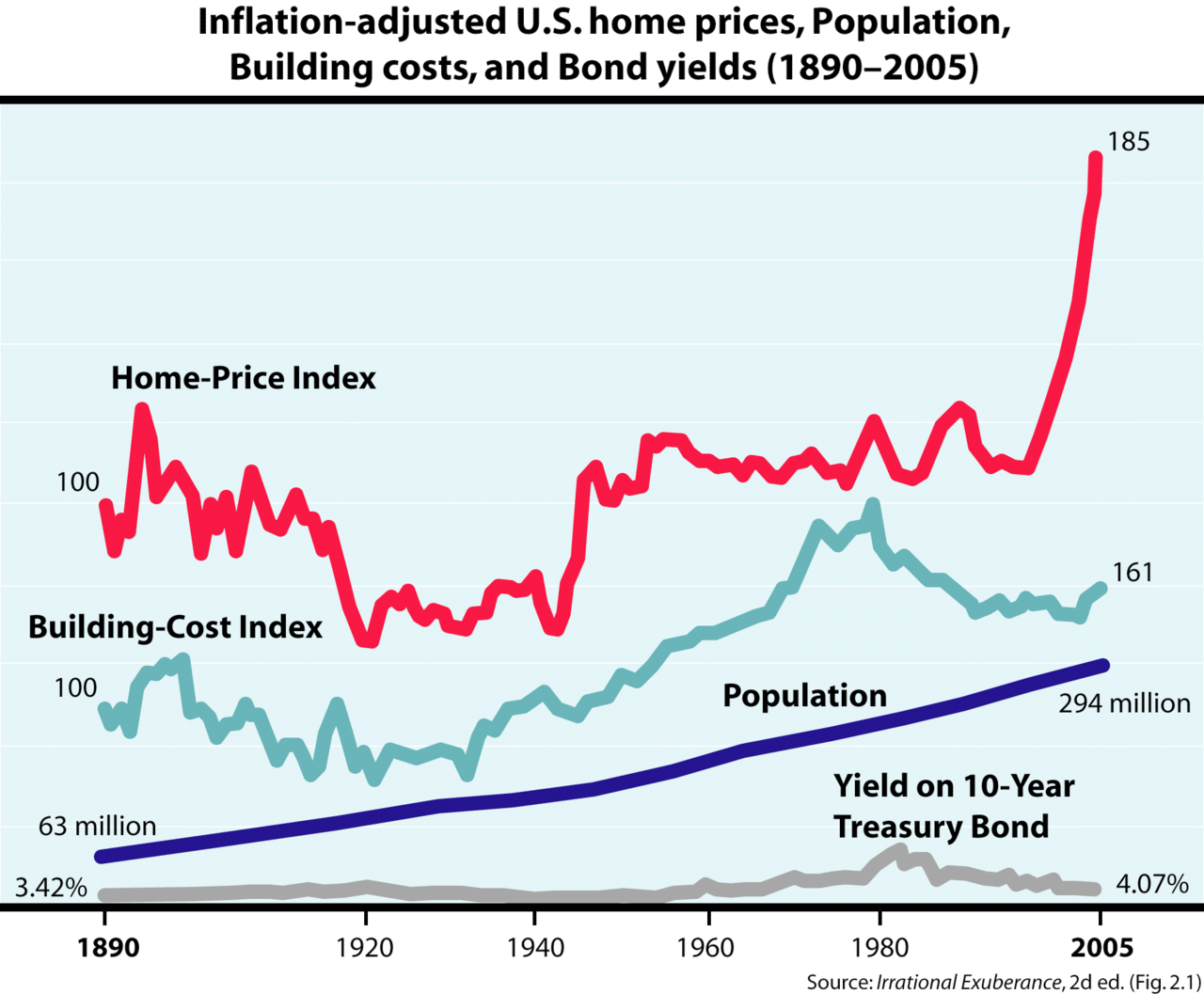

The Housing Boom 2000 07 Economics Help A large portion of the housing boom between 2000 and 2006 was driven by the fundamentals. if there was over building in 2004 and 2005, it was modest in scale and limited to a handful of metropolitan areas. if homes were overpriced at the end of 2005, it was probably by 10 or 15 percent nationally, not 30 percent. The 2000s united states housing bubble or house price boom or 2000s housing cycle[2] was a sharp run up and subsequent collapse of house asset prices affecting over half of the u.s. states. in many regions a real estate bubble, it was the impetus for the subprime mortgage crisis. housing prices peaked in early 2006, started to decline in 2006. According to wachter, a primary mistake that fueled the housing bubble was the rush to lend money to homebuyers without regard for their ability to repay. as the mortgage finance market expanded. Housing prices in the u.s. rose sharply from the early to mid 2000s, followed by a sharp drop after 2007. 1 this period of accelerated price increases is often called the “housing bubble” and its decline is known as the “housing bubble burst.” concurrent with this housing bubble bursting was a serious economic downturn.

Will The Housing Market Crash In 2020 Ireland The Housing Boom 2000 According to wachter, a primary mistake that fueled the housing bubble was the rush to lend money to homebuyers without regard for their ability to repay. as the mortgage finance market expanded. Housing prices in the u.s. rose sharply from the early to mid 2000s, followed by a sharp drop after 2007. 1 this period of accelerated price increases is often called the “housing bubble” and its decline is known as the “housing bubble burst.” concurrent with this housing bubble bursting was a serious economic downturn. Observers and analysts have attributed the reasons for the 2001–2006 housing bubble and its 2007–10 collapse in the united states to "everyone from home buyers to wall street, mortgage brokers to alan greenspan ". [3] other factors that are named include " mortgage underwriters, investment banks, rating agencies, and investors", [4] "low. These bubbles are caused by a variety of factors including rising economic prosperity, low interest rates, wider mortgage product offerings, and easy access to credit. forces that make a housing.

The Housing Boom 2000 07 Economics Help Observers and analysts have attributed the reasons for the 2001–2006 housing bubble and its 2007–10 collapse in the united states to "everyone from home buyers to wall street, mortgage brokers to alan greenspan ". [3] other factors that are named include " mortgage underwriters, investment banks, rating agencies, and investors", [4] "low. These bubbles are caused by a variety of factors including rising economic prosperity, low interest rates, wider mortgage product offerings, and easy access to credit. forces that make a housing.

Comments are closed.