The Importance Of Financial Protection For The Self Employed Vintage

The Importance Of Financial Protection For The Self Employed Vintage A minimum of 8% of an employee’s salary is paid into the scheme, of which at least 3% must be contributed by the employer. those who are self employed would be wise to set up a private pension. retirement often lasts 25 years or more and it is important to plan financially beyond the state pension in order to live as comfortably as possible. These findings demonstrate how important income protection is, particularly for the self employed who cannot fall back on sick pay. ip is one step towards providing a financial safety net, so if.

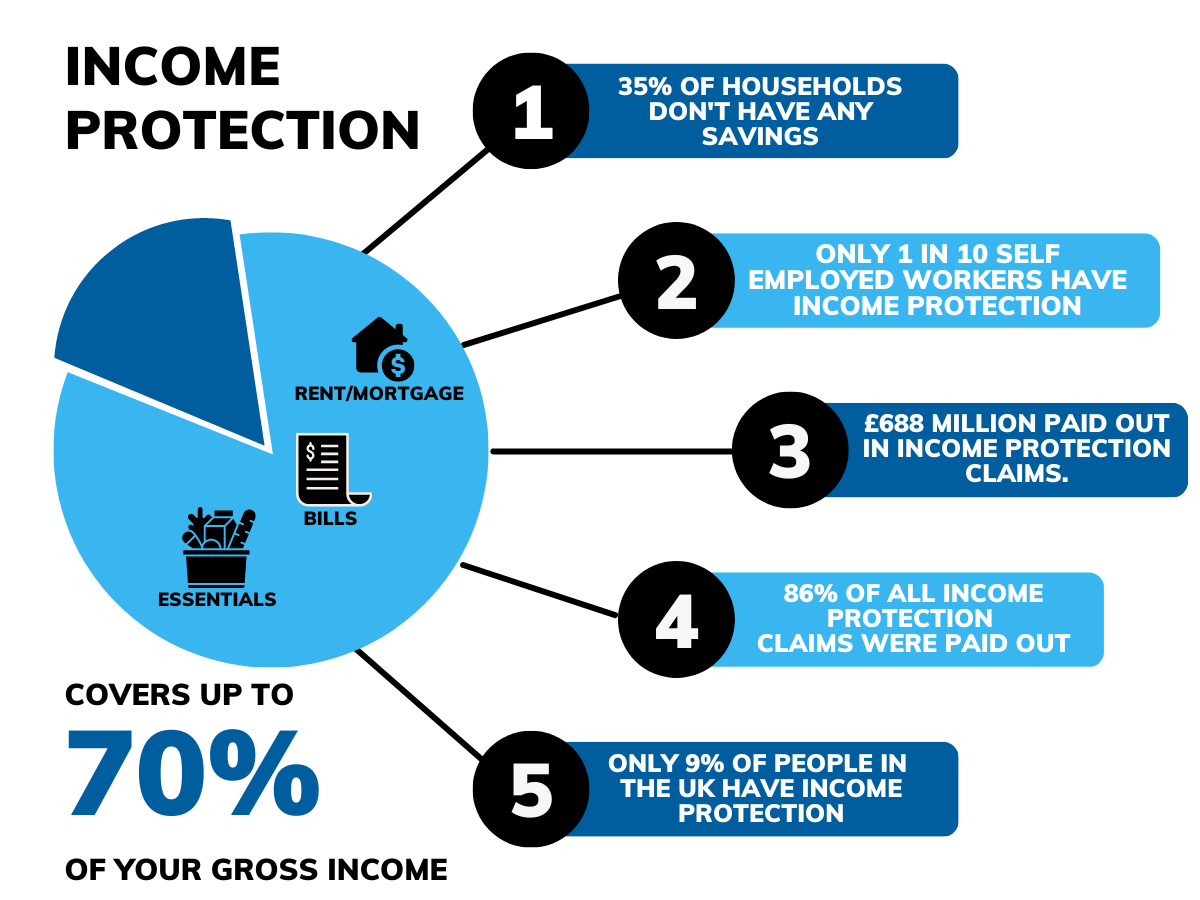

3 Reasons Why Income Protection Is Important For The Self Employed New government guidance relating to taxes for the self employed is making things even more difficult for those that work for themselves. coupled with rising numbers of people choosing to become self employed, now is a pertinent time to take a broad look at the best way for this demographic to organise finances and optimise outcomes. the. It is possible to get income protection for as little as £10 per month, but the average monthly expense is closer to £60. when it comes to paying, the best income protection for self employed people allows you to dictate your required level of protection. unlike when on the pay roll and receiving a salary through paye, self employed income. 1. not delegating or prioritizing. self employed people often act as their own stunt doubles in their business during the incipient stages because of budget constraints. however, trying to do it. Income protection for self employed people is an insurance product that provides you with a monthly income if you're unable to work due to sickness or injury. the monthly benefit payments are designed to cover your financial commitments, such as your mortgage or rent, utilities and food.

The Importance Of Financial Protection 1. not delegating or prioritizing. self employed people often act as their own stunt doubles in their business during the incipient stages because of budget constraints. however, trying to do it. Income protection for self employed people is an insurance product that provides you with a monthly income if you're unable to work due to sickness or injury. the monthly benefit payments are designed to cover your financial commitments, such as your mortgage or rent, utilities and food. Yes! being self employed doesn't mean you're left out in the cold when it comes to income protection insurance. whether you're a business owner or a freelancer, you're eligible to apply. as long as you're putting in around 20 hours of paid work per week (though this can vary by policy), you're good to go. the coverage amount will depend on your. Think of income protection insurance as sick pay for the self employed. an income protection policy provides you with a monthly, tax free, income if you're unable to work in your chosen profession due to illness, injury, or disability.

Protection For The Self Employed Osborne Financial Yes! being self employed doesn't mean you're left out in the cold when it comes to income protection insurance. whether you're a business owner or a freelancer, you're eligible to apply. as long as you're putting in around 20 hours of paid work per week (though this can vary by policy), you're good to go. the coverage amount will depend on your. Think of income protection insurance as sick pay for the self employed. an income protection policy provides you with a monthly, tax free, income if you're unable to work in your chosen profession due to illness, injury, or disability.

Income Protection Insurance Carew Co Solutions

Comments are closed.