The Money Management Forex Traders Must Understand

The Money Management Forex Traders Must Understand Money Management Fx money management is the one thing that makes your account go up or down. so why do so many videos ignore it? i know exactly why, and we talk about it in. Traders need to make a decision on which markets to trade. after analysing the different markets, the trader decided to trade both forex and commodities. by doing this they have narrowed down the markets and then can allocate $5,000 for each market with a 50 50 split of their trading capital. 2. position sizing.

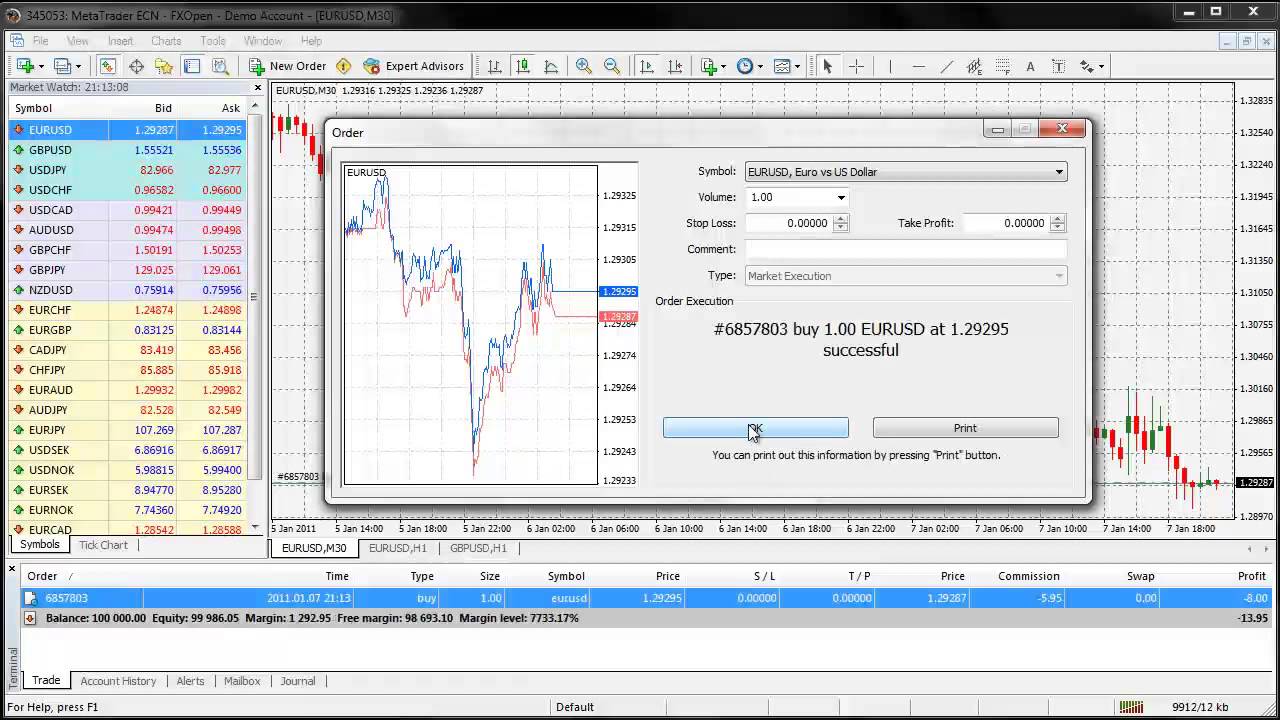

The Top 10 Forex Trading Money Management Tricks You Must Follow Traders must understand market dynamics, implement sound money management strategies, and address the psychological aspects of trading to achieve consistent profitability. by integrating these elements into their approach, traders can navigate the challenges of the forex market and emerge as successful, disciplined, and resilient participants. 4. keep emotions in check: emotions can cloud judgment and lead to impulsive decisions. successful traders maintain discipline and stick to their money management strategies, regardless of market conditions. 5. regularly review and adjust: money management is not a one time task; it should be a continuous process. 2. a fixed percentage. the most common approach is to risk a fixed percentage of your account balance on each trade. therefore, if a trader has an account balance of £10,000 and they decide they want to risk 2% of their capital per trade, the first trade would risk £200. Remember, forex money management rules need a complete understanding of intermarket correlation. checking both the 'historical' and 'now moment' correlation is important. if you use metatrader, then metatrader 4's supreme edition is the right tool for you. it will make decisions based on your overall account exposure.

Understand Money Management Advanced Forex Trading Strategies 2. a fixed percentage. the most common approach is to risk a fixed percentage of your account balance on each trade. therefore, if a trader has an account balance of £10,000 and they decide they want to risk 2% of their capital per trade, the first trade would risk £200. Remember, forex money management rules need a complete understanding of intermarket correlation. checking both the 'historical' and 'now moment' correlation is important. if you use metatrader, then metatrader 4's supreme edition is the right tool for you. it will make decisions based on your overall account exposure. Understanding the theories and techniques of money management is fundamental, but practical implementation requires discipline and practice. here are some valuable tips for mastering money management: formulate a trading plan. your trading plan should outline your financial goals, risk tolerance, trading strategies, and money management rules. Successful forex traders understand the importance of money management. they know that they must allocate their funds wisely and use appropriate risk management strategies to stay in the game. money management is about managing risk, and it is a critical part of any trading strategy.

Basic Money Management Strategies Reward To Risk Ratio In Forex Trading Understanding the theories and techniques of money management is fundamental, but practical implementation requires discipline and practice. here are some valuable tips for mastering money management: formulate a trading plan. your trading plan should outline your financial goals, risk tolerance, trading strategies, and money management rules. Successful forex traders understand the importance of money management. they know that they must allocate their funds wisely and use appropriate risk management strategies to stay in the game. money management is about managing risk, and it is a critical part of any trading strategy.

Forex Money Management Simple Forex Trading Money Managementо

Comments are closed.