Top 7 Benefits Of Artificial Intelligence In Banking And Finance

Top 7 Benefits Of Artificial Intelligence In Banking And Finance Interest in artificial intelligence technology is sky high in the banking and finance sector. the reason is not surprising. the strategic application of ai's many technologies including machine learning, natural language processing and computer vision can drive meaningful results for banks, from enhancing employee and customer experiences to improving back office operations. The mckinsey global institute (mgi) estimates that across the global banking sector, gen ai could add between $200 billion and $340 billion in value annually, or 2.8 to 4.7 percent of total industry revenues, largely through increased productivity. 1 however, as banks and other financial institutions move to quickly implement the technology.

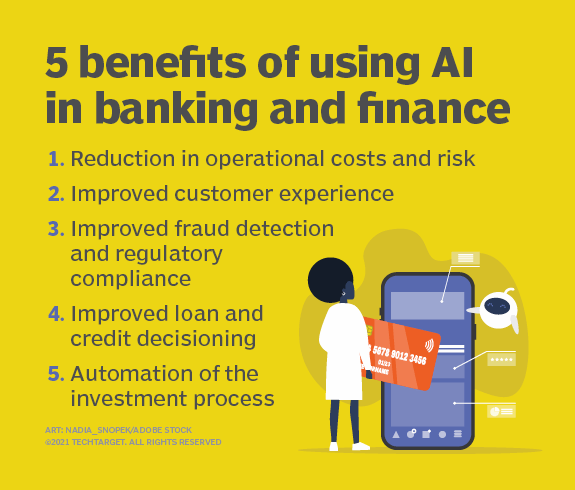

Top 5 Benefits For Artificial Intelligence In Banking And Financeођ Some of the top benefits of using ai in the banking and finance sector worth mentioning include: 1) operational costs risk and reduction although the banking sector is highly digital in operation there are still human based processes where banks can face risks due to human errors. it is robotic process automation (rpa), a software that mimics. The benefits of implementing ai in finance—for task automation, fraud detection, and delivering personalized recommendations—are monumental. ai use cases in the front and middle office can transform the finance industry by: enabling frictionless, 24 7 customer interactions. reducing the need for repetitive work. Generative ai (gen ai) burst onto the scene in early 2023 and is showing clearly positive results—and raising new potential risks—for organizations worldwide. banking leaders appear to be on board, even with the possible complications. two thirds of senior digital and analytics leaders attending a recent mckinsey forum on gen ai 1 said they. Artificial intelligence in finance refers to the application of a set of technologies, particularly machine learning algorithms, in the finance industry. this fintech enables financial services organizations to improve the efficiency, accuracy and speed of such tasks as data analytics, forecasting, investment management, risk management, fraud detection, customer service and more.

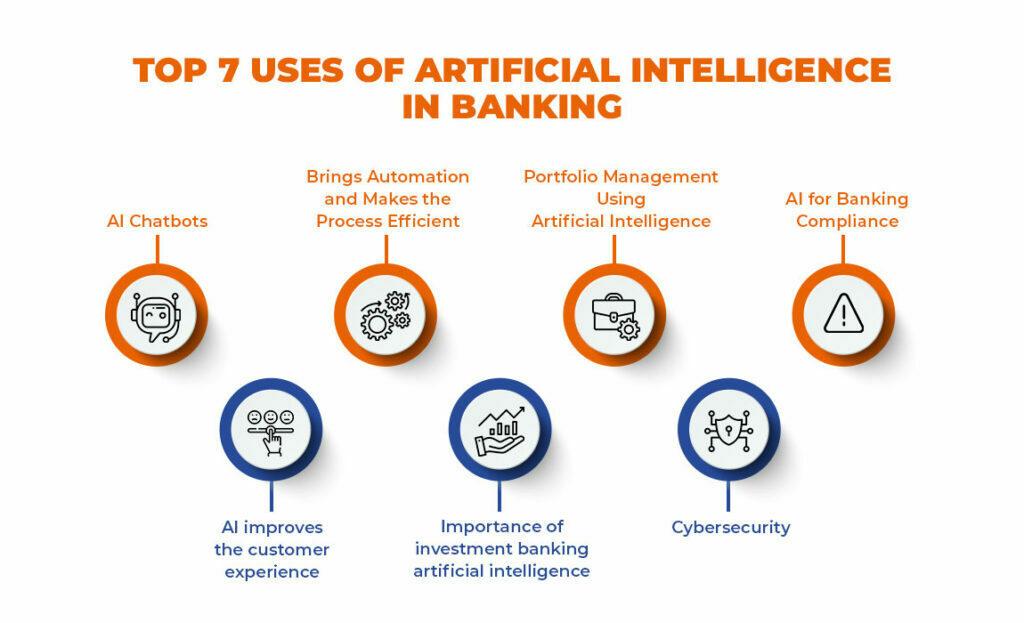

Top 7 Uses Of Ai In Banking Generative ai (gen ai) burst onto the scene in early 2023 and is showing clearly positive results—and raising new potential risks—for organizations worldwide. banking leaders appear to be on board, even with the possible complications. two thirds of senior digital and analytics leaders attending a recent mckinsey forum on gen ai 1 said they. Artificial intelligence in finance refers to the application of a set of technologies, particularly machine learning algorithms, in the finance industry. this fintech enables financial services organizations to improve the efficiency, accuracy and speed of such tasks as data analytics, forecasting, investment management, risk management, fraud detection, customer service and more. Artificial intelligence is already widespread across banking, payments and insurance. whether we know it or not, algorithms make decisions about our finances every day. at present, the technology. For global banking, mckinsey estimates that ai technologies could potentially deliver up to $1 trillion of additional value each year. 2. many banks, however, have struggled to move from experimentation around select use cases to scaling ai technologies across the organization. reasons include the lack of a clear strategy for ai, an inflexible.

Top 7 Uses Of Ai In Banking Artificial intelligence is already widespread across banking, payments and insurance. whether we know it or not, algorithms make decisions about our finances every day. at present, the technology. For global banking, mckinsey estimates that ai technologies could potentially deliver up to $1 trillion of additional value each year. 2. many banks, however, have struggled to move from experimentation around select use cases to scaling ai technologies across the organization. reasons include the lack of a clear strategy for ai, an inflexible.

The Top 5 Benefits Of Ai In Banking And Finance

Comments are closed.