Top Fintech Trends 2022 Silicon Valley Bank

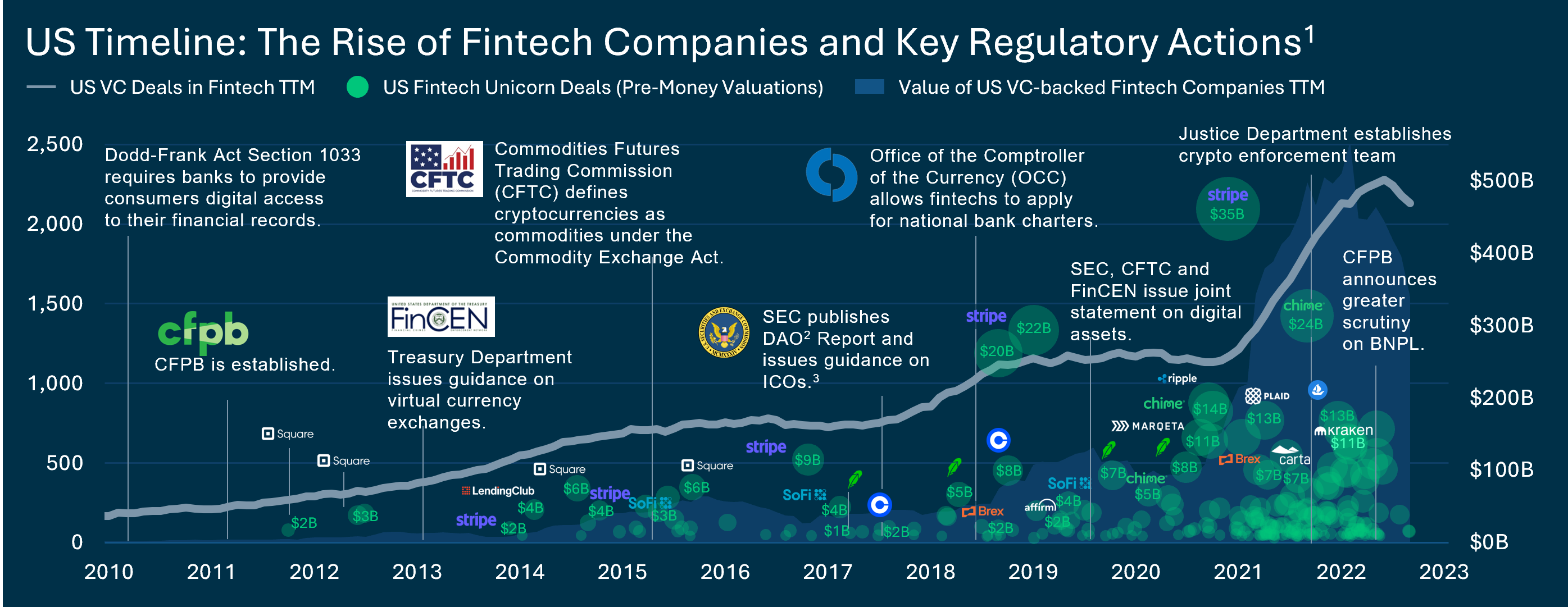

Top Fintech Trends 2022 Silicon Valley Bank For example, 43% of fintechs cut payroll in q3 2022, compared to 25% cutting in q1 2022. overall we’re seeing stalling growth rates, which 66% of fintechs growing slower than they were in q2 2022. for the increasing stable of fintech unicorns — up 38% from q4 2021 — they’re facing the longest ipo drought since 2018 19. Companies heed warnings to rein in spending. according to svb proprietary data, more fintech companies decreased net burn in q3 2022 than at any point since the onset of the covid 19 pandemic. the cuts help illustrate that companies are right sizing their expenses to match decreased expectations for spending and slower revenue growth.

Top Fintech Trends 2022 Silicon Valley Bank The median pre money valuation for a series a blockchain deal jumped 56% in 2023 to $95m. an ongoing slowdown in the blockchain investment cycle isn’t diminishing the promise investors see in individual deals. a rise in digital asset prices and a move toward more regulatory clarity is boosting that confidence, as momentum builds for the next. The future of fintech: 2024 forecast, trends & risks subscribe now get the financial brand's free email newsletter before its collapse in early 2023, silicon valley bank enjoyed an enviable position at the nexus of west coast digital innovation and venture capital. now a division of first citizens, svb is working to reclaim its role and resumes. A new report from silicon valley bank – a division of first citizens bank – reveals how the fintech ecosystem has shown resilience among the vc slowdown. according to the future of fintech. San francisco. 1. san francisco (silicon valley) top of our list of the world’s top fintech hubs is san francisco, namely silicon valley. there are (at the time of writing) a whopping 506 fintech organisations based in the area, which have seen a total investment of us$32bn across 828 funding rounds.

State Of Fintech Report 2022 Silicon Valley Bank A new report from silicon valley bank – a division of first citizens bank – reveals how the fintech ecosystem has shown resilience among the vc slowdown. according to the future of fintech. San francisco. 1. san francisco (silicon valley) top of our list of the world’s top fintech hubs is san francisco, namely silicon valley. there are (at the time of writing) a whopping 506 fintech organisations based in the area, which have seen a total investment of us$32bn across 828 funding rounds. With over 2,600 fintech clients, silicon valley bank is a lender, banking partner, and payments technology provider. we map out some of its biggest clients and partnerships using cb insights’ business relationship data to show its impact on the fintech industry. The number of cvc fintech deals is on track to increase 64 per cent over 2020 with an aggregate deal size projected to increase 158 per cent. valuations and deals are also on the rise, which has resulted in european and american fintech companies raising a combined $70billion in 2021 (up from $29.3billion in 2020). emerging opportunities in.

Fintech Trends Fund Investments And Silicon Valley Bank With over 2,600 fintech clients, silicon valley bank is a lender, banking partner, and payments technology provider. we map out some of its biggest clients and partnerships using cb insights’ business relationship data to show its impact on the fintech industry. The number of cvc fintech deals is on track to increase 64 per cent over 2020 with an aggregate deal size projected to increase 158 per cent. valuations and deals are also on the rise, which has resulted in european and american fintech companies raising a combined $70billion in 2021 (up from $29.3billion in 2020). emerging opportunities in.

Business Banking Payment Solutions For Fintechs Silicon Valley Bank

Comments are closed.