Types Of Cash Flow And Cash Flow Calculations Guide Arbor Asset

Cash Flow Guide Types How To Analyze Quickbooks Cash flow metrics can be invaluable for comparison research and ratio analysis with enterprise value, or various other measurements. different types of cash flow. i have put together a summary of the different types of cash flow calculations for investment analysis. let’s start with the three types of cash flow in the cash flow statement:. Management has three choices for its cash flow earnings (net cash flow); invest for future growth (buildings, equipment, inventory, etc.), pay off debt (reduces future interest expenses and improves the balance sheet), or return money to shareholders (dividends and stock buybacks). the priorities of these company choices will change over time.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples The cash flow statement provides the cash flow of the operating, investing, and financing activities to disclose the entire cash flow in a consolidated statement. the operating cash flow calculation will provide the analyst with the most important metric for evaluating the health of a company’s core business operations. related reading:. Operating cash flow (or sometimes called “cash from operations”) is a measure of cash generated (or consumed) by a business from its normal operating activities. like ebitda, depreciation and amortization are added back to cash from operations. however, all other non cash items like stock based compensation, unrealized gains losses, or. Cash flow from financing activities = debt issuances equity issuances − share buybacks − debt repayment − dividends paid. where, debt issuance is the funds raised by a company through the issuance of bonds or taking on loans. equity issuance is capital obtained by a company by issuing new shares of stock. How to calculate operating cash flow. just as with our free cash flow calculation above, you’ll want to have your balance sheet and income statement at the ready, so you can pull the numbers involved in the operating cash flow formula. there’s one other financial metric you’ll need to know for this calculation: operating income.

Cash Flow From Operations Cfo Calculations Ratios Arbor Asset Cash flow from financing activities = debt issuances equity issuances − share buybacks − debt repayment − dividends paid. where, debt issuance is the funds raised by a company through the issuance of bonds or taking on loans. equity issuance is capital obtained by a company by issuing new shares of stock. How to calculate operating cash flow. just as with our free cash flow calculation above, you’ll want to have your balance sheet and income statement at the ready, so you can pull the numbers involved in the operating cash flow formula. there’s one other financial metric you’ll need to know for this calculation: operating income. Here's how to calculate the cash flow from assets: $18,500 15,000 30,000 = 26,500 betty's bloom's flower shops had a $26,500 cash flow from assets from july to december. this is a negative cash flow. this shows they spent more than they earned in this period. learn about what cash flow from assets is, find out why it's important and. What is cash flow from assets? cash flow from assets is the aggregate total of all cash flows related to the assets of a business. this information is used to determine the net amount of cash being spun off by or used in the operations of a business. the concept is comprised of the following three types of cash flows: cash flow generated by.

Cash Flow Pdf Here's how to calculate the cash flow from assets: $18,500 15,000 30,000 = 26,500 betty's bloom's flower shops had a $26,500 cash flow from assets from july to december. this is a negative cash flow. this shows they spent more than they earned in this period. learn about what cash flow from assets is, find out why it's important and. What is cash flow from assets? cash flow from assets is the aggregate total of all cash flows related to the assets of a business. this information is used to determine the net amount of cash being spun off by or used in the operations of a business. the concept is comprised of the following three types of cash flows: cash flow generated by.

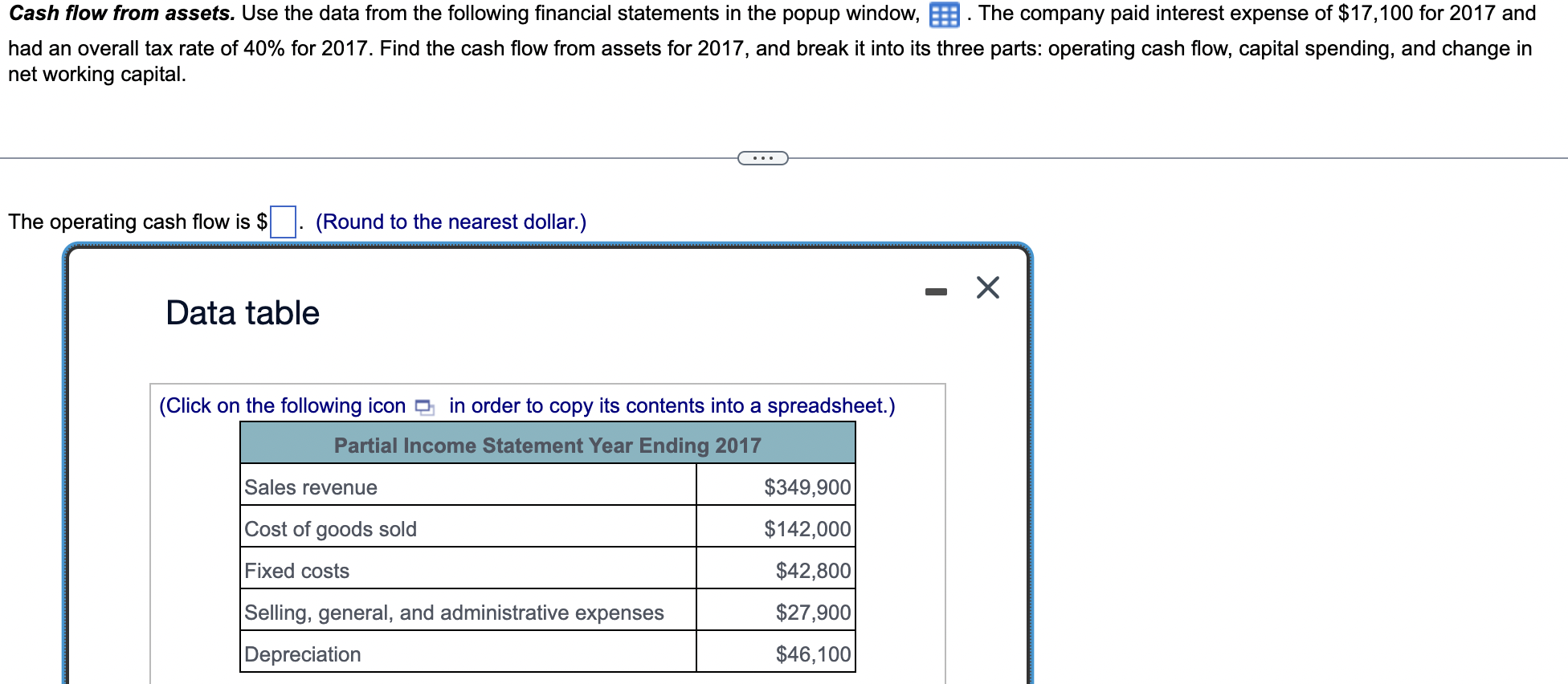

Solved Cash Flow From Assets Use The Data From The Chegg

Comments are closed.