Uncertainty And Consumer Behavior Prepared By Pdf Risk Aversion

Uncertainty And Consumer Behavior Pdf Risk Aversion Risk P Risk aversion and income the extent of an individual’s risk aversion depends on the nature of the risk and on the person’s income. other things being equal, risk averse people prefer a smaller variability of outcomes. we saw that when there are two outcomes—an income of $10,000 and an income of $30,000—the risk premium is $4000. This measure also is a unit free measure, unlike the absolute risk premium, which is measured in euros. it is defined implicitly via the following equation: eu(w(1 ̃z)) u(w(1 ˆΠ)). obviously, the relative risk premium and the absolute risk premium are equal if we normalize initial wealth to unity.

Uncertainty And Consumer Behavior Prepared By Pdf Risk Aversion Chapter 5: uncertainty and consumer behavior 65 6. why is an insurance company likely to behave as if it is risk neutral even if its managers are risk averse individuals? most large companies have opportunities for diversifying risk. managers acting for the owners of a company choose a portfolio of independent, profitable projects at. Abstract. consumers' decision making power is irrational in everyday life due to risk uncertainty, limited information, perceived cost, and other variables; hence, it is critical to research. The word risk refers to the degree of variation of the outcome we call this risk compensation as risk premium our personality based degree of risk fear is known as risk aversion so, we end up paying $50 minus risk premium to play the game risk premium grows with outcome variance & risk aversion ashwin rao (stanford) utility theory february 3. Based on a structural equation modeling analysis, this study reveals that risk aversion and uncertainty avoidance have different effects on consumers’ information search, perceived quality and brand loyalty. therefore, future research should recognize the different roles of risk aversion and uncertainty avoidance in consumer behavior.

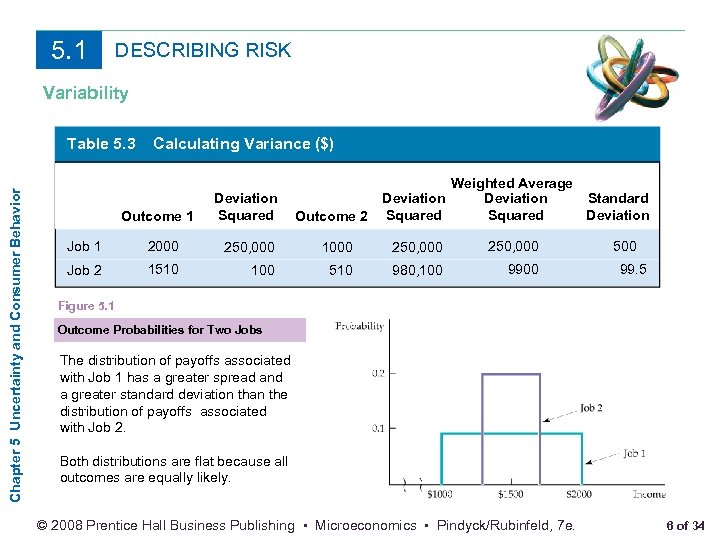

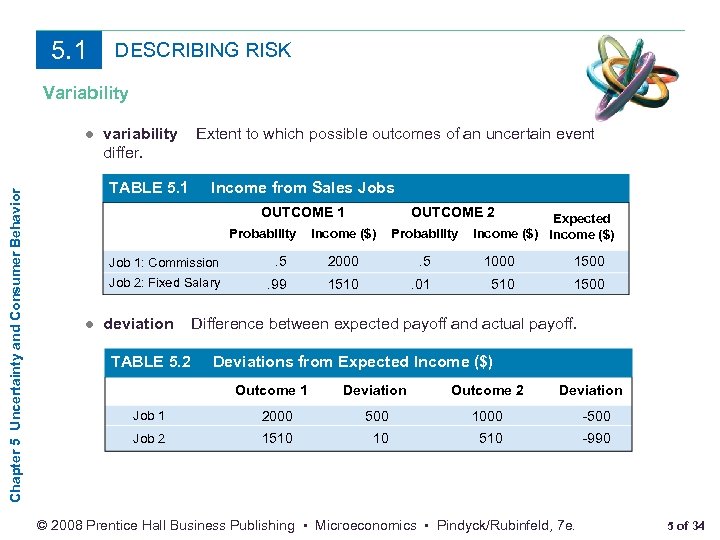

Uncertainty And Consumer Behavior Chapter 5 Pdf Risk Aversion The word risk refers to the degree of variation of the outcome we call this risk compensation as risk premium our personality based degree of risk fear is known as risk aversion so, we end up paying $50 minus risk premium to play the game risk premium grows with outcome variance & risk aversion ashwin rao (stanford) utility theory february 3. Based on a structural equation modeling analysis, this study reveals that risk aversion and uncertainty avoidance have different effects on consumers’ information search, perceived quality and brand loyalty. therefore, future research should recognize the different roles of risk aversion and uncertainty avoidance in consumer behavior. This chapter discusses uncertainty and consumer behavior. section 5.1 describes how to quantify risk through concepts like probability, expected value, variability, and standard deviation. probability is the likelihood of an outcome occurring, while expected value is the probability weighted average payoff. variability measures how outcomes can differ, and is described using deviation from the. Abstract for decades, research and practice have recognized the significant effects of risk aversion and uncertainty avoidance on consumer behavior. these two concepts are often used interchangeably and studied as an integrated factor in marketing literature. despite the relationship between risk aversion and uncertainty avoidance, it is necessary to differentiate between the two concepts to.

Chapter 5 Uncertainty And Consumer Behavior Prepared By This chapter discusses uncertainty and consumer behavior. section 5.1 describes how to quantify risk through concepts like probability, expected value, variability, and standard deviation. probability is the likelihood of an outcome occurring, while expected value is the probability weighted average payoff. variability measures how outcomes can differ, and is described using deviation from the. Abstract for decades, research and practice have recognized the significant effects of risk aversion and uncertainty avoidance on consumer behavior. these two concepts are often used interchangeably and studied as an integrated factor in marketing literature. despite the relationship between risk aversion and uncertainty avoidance, it is necessary to differentiate between the two concepts to.

Chapter 5 Uncertainty And Consumer Behavior Prepared By

Comments are closed.