Understanding Income Tax Deductions And Taxable Income A Course

Understanding Income Tax Deductions And Taxable Income A Course Hero Business income & deductions. gain a thorough understanding of what constitutes business income. learn to accurately report various types of income, including sales, services, and other business related earnings. identifying deductible expenses: discover the wide range of deductible business expenses reduce taxable income. from office supplies. Find out what you’ll need to know before doing your taxes and the different ways to do them. 3 lessons; 27 minutes total; completing a basic tax return. an introduction to a basic income tax and benefit return. what you need to report, how to claim deductions and tax credits, and finding out whether you will get a refund or owe tax. 7 lessons.

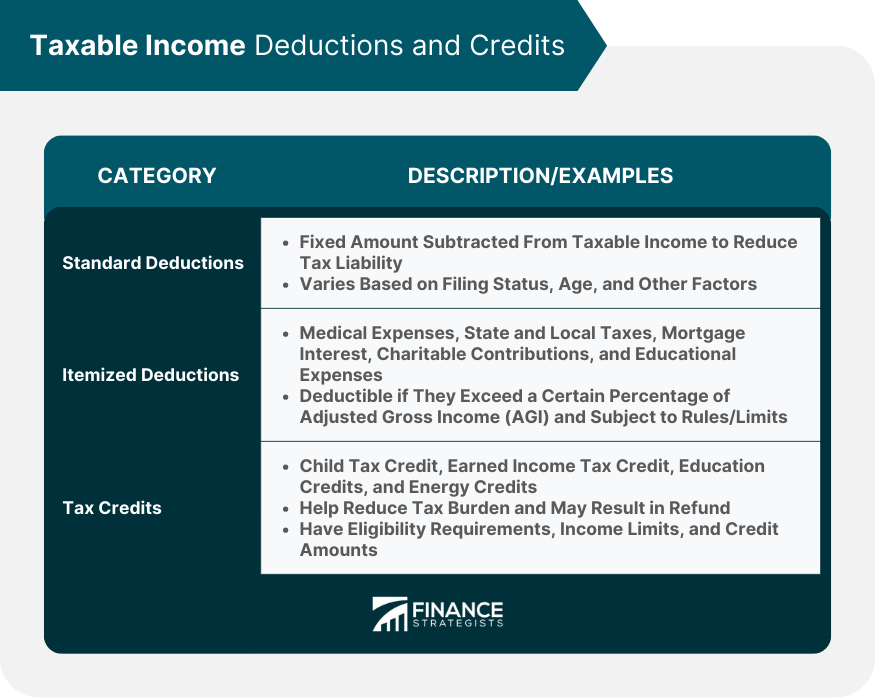

Income Tax Deductions Chart A Complete Guide Indiafilings When income taxes were first introduced, in 1917, single people had a personal exemption of $29,757 in today’s dollars, while married people had an exemption of $59,514. over those amounts, they were taxed just 4%. now, married and single people have identical federal personal exemptions, at around $15,000. the top federal tax rate is 33%. This course provides a comprehensive exploration of the fundamental principles and concepts governing personal and corporate income taxation. designed for individuals with varying levels of financial literacy, the curriculum covers key topics such as canadian income tax, canadian pension plan, employment income deductions, and more. students. You will then subtract your federal non refundable tax credits from the total taxes you calculated on your income. the result of this calculation is your net federal tax. the first federal non refundable tax credit is the basic personal amount. the basic federal personal amount is $14,398 for the 2022 tax year. The amount of income tax you pay is based on how much taxable income you have earned that year. taxable income could include employment income, ei benefits, pension income, and investment income such as interest or capital gains. if you have regular employment income, then your tax may be deducted directly from your paycheque.

Ppt Taxable Income Formula For Individuals Powerpoint Presentation You will then subtract your federal non refundable tax credits from the total taxes you calculated on your income. the result of this calculation is your net federal tax. the first federal non refundable tax credit is the basic personal amount. the basic federal personal amount is $14,398 for the 2022 tax year. The amount of income tax you pay is based on how much taxable income you have earned that year. taxable income could include employment income, ei benefits, pension income, and investment income such as interest or capital gains. if you have regular employment income, then your tax may be deducted directly from your paycheque. Required payroll deductions by law include income tax, contributions to employment insurance (ei) and contributions to the canada pension plan (cpp). your income will be taxed, depending on your level of income, but you do not pay federal income tax on the first $15,705 of your taxable income which is your federal basic personal amount. This is the income earned when a person works for an employer. this takes many different forms including salaries, wages, bonuses, and commissions. this type of income is the easiest to manage taxwise as it is subject to various deductions and taxes at the source, the taxes are automatically deducted from each of your paycheques.

Taxable Income Definition Components Formula Required payroll deductions by law include income tax, contributions to employment insurance (ei) and contributions to the canada pension plan (cpp). your income will be taxed, depending on your level of income, but you do not pay federal income tax on the first $15,705 of your taxable income which is your federal basic personal amount. This is the income earned when a person works for an employer. this takes many different forms including salaries, wages, bonuses, and commissions. this type of income is the easiest to manage taxwise as it is subject to various deductions and taxes at the source, the taxes are automatically deducted from each of your paycheques.

Comments are closed.