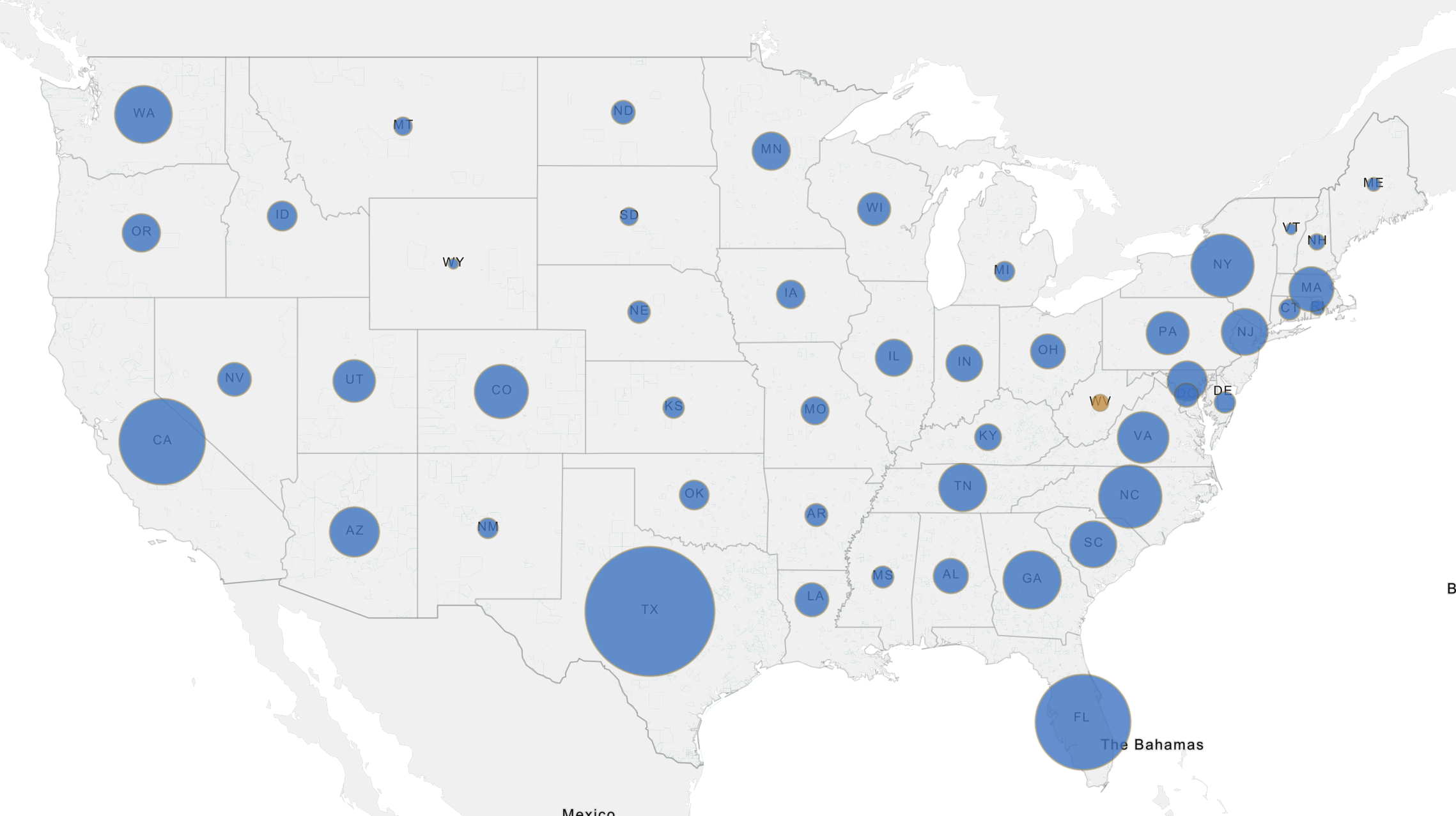

Us Housing Boom Bust And Recovery Maps Visualizing Economics

An Interactive View Of The Housing Boom And Bust Data Smart City The model matches the distribution of house values for homeowners and the distribution of ltvs for mort gagors well. below the top decile, the wealth distribution in the model closely repro duces the wealth distribution in the scf. the gini coefficient for net worth is 0.69, compared with 0.80 in the data. We build a model of the u.s. economy with multiple aggregate shocks (income, housing finance conditions, and beliefs about future housing demand) that generate fluctuations in equilibrium house prices. through a series of counterfactual experiments, we study the housing boom and bust around the great recession and obtain three main results.

The Boom Bust And Recovery In The Mountain States Housing Markets Greg kaplan & kurt mitman & giovanni l. violante, 2020. "the housing boom and bust: model meets evidence," journal of political economy, vol 128 (9), pages 3285 3345. founded in 1920, the nber is a private, non profit, non partisan organization dedicated to conducting economic research and to disseminating research findings among academics. We build a model of the us economy with multiple aggregate shocks that generate fluctuations in equilibrium house prices. through counterfactual experiments, we study the housing boom bust around the great recession, with three main results. first, the main driver of movements in house prices and rents was a shift in beliefs, not a change in credit conditions. second, the boom bust in house. To housing demand and lending standards needed to replicate the boom bust patterns in u.s. housing value and mortgage debt from 1993 to 2015. conditional on the observed paths for u.s. real consumption growth, the real mortgage interest rate, and the supply of residential –xed assets, a speci–cation with random walk expectations outperforms one. Our evidence points to abnormal u.s. housing market behavior for the first time since the boom of the early 2000s. reasons for concern are clear in certain economic indicators—the price to rent ratio, in particular, and the price to income ratio—which show signs that 2021 house prices appear increasingly out of step with fundamentals.

Where Did The Housing Market Go Boom Or Bust In 2020 To housing demand and lending standards needed to replicate the boom bust patterns in u.s. housing value and mortgage debt from 1993 to 2015. conditional on the observed paths for u.s. real consumption growth, the real mortgage interest rate, and the supply of residential –xed assets, a speci–cation with random walk expectations outperforms one. Our evidence points to abnormal u.s. housing market behavior for the first time since the boom of the early 2000s. reasons for concern are clear in certain economic indicators—the price to rent ratio, in particular, and the price to income ratio—which show signs that 2021 house prices appear increasingly out of step with fundamentals. Real estate economics is a leading journal facilitating communication between researchers and industry professionals and improving the analysis of real estate decisions. abstract u.s. house prices fell nearly 30% between 2006 and 2012. Housing booms and busts, labor market opportunities, and college attendance by kerwin kofi charles, erik hurst and matthew j. notowidigdo. published in volume 108, issue 10, pages 2947 94 of american economic review, october 2018, abstract: we study how the recent housing boom and bust affected coll.

Comments are closed.