Us Treasury Interest Rate Yield Curve

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

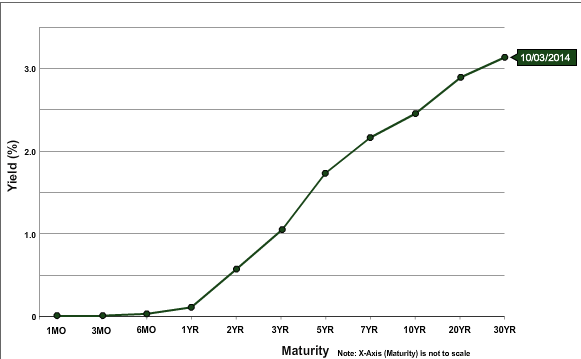

Understanding Treasury Yield And Interest Rates This is a web application for exploring us treasury interest rates. you can view past interest rate yield curves by using the arrows around the date slider or by changing the date within the box. use the pin button to stick a copy to the chart for comparison against other dates. y axis values represent the constant maturity interest rate for a. Notice: see developer notice on changes to the xml data feeds. daily treasury par yield curve rates this par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned treasury securities in the over the counter market. the par yields are derived from input market prices, which are indicative.

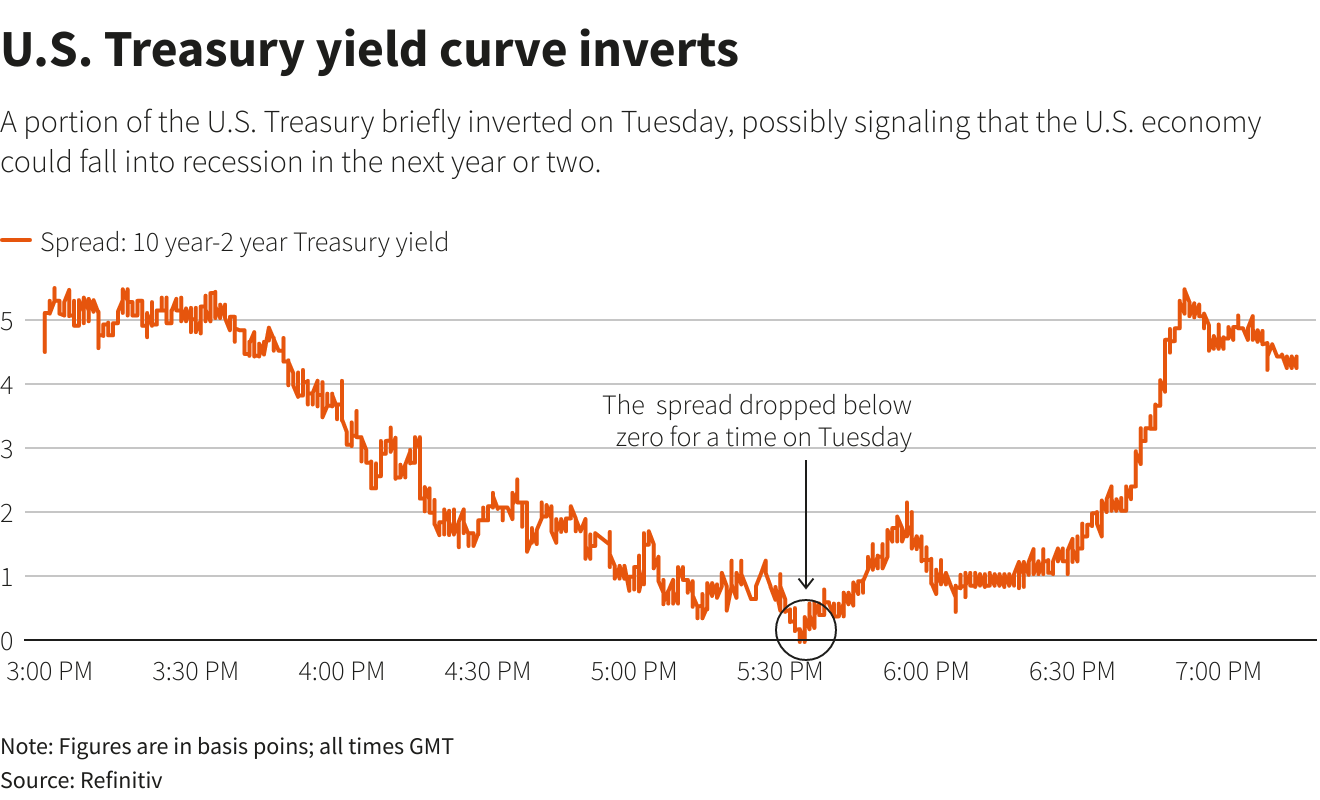

Us Treasury Yield Curve Anchor Capital Advisors The us treasury yield curve rates are updated at the end of each trading day. all data is sourced from the daily treasury par yield curve rates data provided by the treasury.gov website. However, the yield curve can sometimes become flat or inverted. the left graph selects three different time periods to show the three different yield curve shapes: april 2021 shows the normal upward sloping yield curve, may 2007 shows a flat yield curve, and august 2000 shows an inverted yield curve. Prior to this date, treasury had issued treasury bills with 17 week maturities as cash management bills. the 2 month constant maturity series began on october 16, 2018, with the first auction of the 8 week treasury bill. 30 year treasury constant maturity series was discontinued on february 18, 2002 and reintroduced on february 9, 2006. Get updated data about us treasuries. find information on government bonds yields, muni bonds and interest rates in the usa.

Explainer U S Yield Curve Inversion What Is It Telling Us Reuters Prior to this date, treasury had issued treasury bills with 17 week maturities as cash management bills. the 2 month constant maturity series began on october 16, 2018, with the first auction of the 8 week treasury bill. 30 year treasury constant maturity series was discontinued on february 18, 2002 and reintroduced on february 9, 2006. Get updated data about us treasuries. find information on government bonds yields, muni bonds and interest rates in the usa. Stay on top of current data on government bond yields in united states, including the yield curve, daily high, low and change for each bond. The "daily treasury long term rates" are simply the arithmetic average of the daily closing bid yields on all outstanding fixed coupon bonds (i.e., inflation indexed bonds are excluded) that are neither due nor callable for at least 10 years as of the date calculated. "the daily treasury par yield curve rates" are specific rates read from the.

Understanding Treasury Yields And Interest Rates Stay on top of current data on government bond yields in united states, including the yield curve, daily high, low and change for each bond. The "daily treasury long term rates" are simply the arithmetic average of the daily closing bid yields on all outstanding fixed coupon bonds (i.e., inflation indexed bonds are excluded) that are neither due nor callable for at least 10 years as of the date calculated. "the daily treasury par yield curve rates" are specific rates read from the.

Understanding The Treasury Yield Curve Rates Investopedia

Comments are closed.