What Are Nsf Fees And Why Do Banks Charge Them The Tech Edvocate

What Are Nsf Fees And Why Do Banks Charge Them The Tech Edvocate Understanding what nsf fees are and why banks charge them can help consumers make informed decisions about their financial practices. by taking precautions to maintain a sufficient account balance and avoid situations that may lead to non sufficient funds, consumers can save money and build a healthier relationship with their bank. Spread the loveintroduction non sufficient funds (nsf) fees are a common yet often misunderstood aspect of personal banking. in this article, we will provide an in depth look at what these fees are, why banks charge them, and how you can avoid them. what are nsf fees? nsf fees, also known as insufficient funds fees or bounced check fees, are charges imposed by banks when a customer tries to.

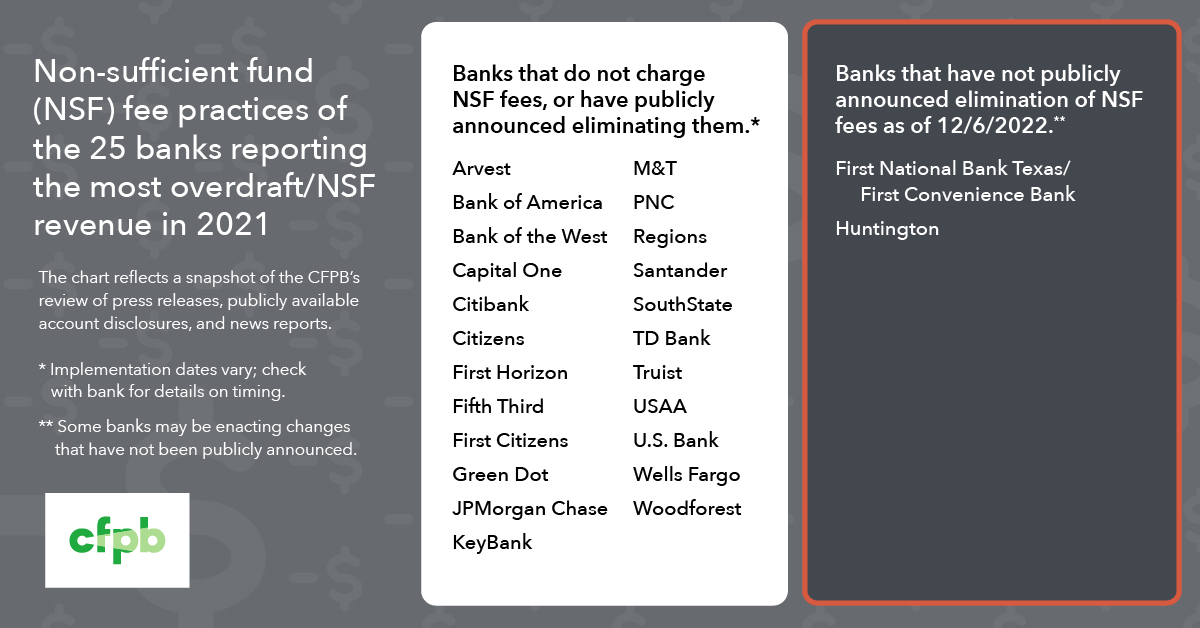

What Are Nsf Fees And Why Do Banks Charge Them Cnet Money A bank can charge you money for not having enough money. it’s why the consumer financial protection bureau has been pushing banks to do away with nsf fees. the efforts have been paying off, too. Nonsufficient funds (nsf) fees are punitive bank fees that can cost you money you don’t have. your bank may charge an nsf fee when your account lacks the funds to cover a transaction and it’s. In a nutshell. banks and credit unions charge nonsufficient funds, or nsf, fees when you don’t have enough money in your account to process a transaction. nsf fees can add up quickly, so it’s important to take steps to avoid them. editorial note: intuit credit karma receives compensation from third party advertisers, but that doesn’t. Non sufficient funds (nsf), or insufficient funds, is the status of a checking account that does not have enough money to cover all transactions. nsf also describes the fee charged when a check is.

What Are Nsf Fees And Why Do Banks Charge Them Cnet Money In a nutshell. banks and credit unions charge nonsufficient funds, or nsf, fees when you don’t have enough money in your account to process a transaction. nsf fees can add up quickly, so it’s important to take steps to avoid them. editorial note: intuit credit karma receives compensation from third party advertisers, but that doesn’t. Non sufficient funds (nsf), or insufficient funds, is the status of a checking account that does not have enough money to cover all transactions. nsf also describes the fee charged when a check is. While nsf fees may sound similar to overdraft fees, there is a critical difference between the two. an nsf fee is charged when the bank returns a payment for insufficient funds. but with an. Bankrate's 2023 checking account survey found the average overdraft fee to be $26.61, and the average nsf fee to be $19.94. while overdraft and nsf fees are generally on the decline, they’re.

An Introduction To Nsf Fees Why Were You Charged Tech Geeked While nsf fees may sound similar to overdraft fees, there is a critical difference between the two. an nsf fee is charged when the bank returns a payment for insufficient funds. but with an. Bankrate's 2023 checking account survey found the average overdraft fee to be $26.61, and the average nsf fee to be $19.94. while overdraft and nsf fees are generally on the decline, they’re.

Comments are closed.