What Is A Good Retirement Budget Planeasy

Good Retirement Budget 1600x1000 W Words Planeasy Even small changes in spending can have a big impact on the success of a retirement plan, so making a good retirement budget is critical. depending on your level of spending, that last $10,000 in spending could incur marginal tax rates of 30 40% . for example, going from $70,000 to $80,000 per year in spending will incur a high marginal tax. Retirement calculator. enter some basic inputs and get a simple, rough approximation of whether you'll be able to retire when you wish to. $833 per month. $2,917 per month. $2,988 per month. 50 60 70 80 90 $0 $500k $1.0m $1.5m $2.0m $2.5m $3.0m $3.5m life expect. retirement age.

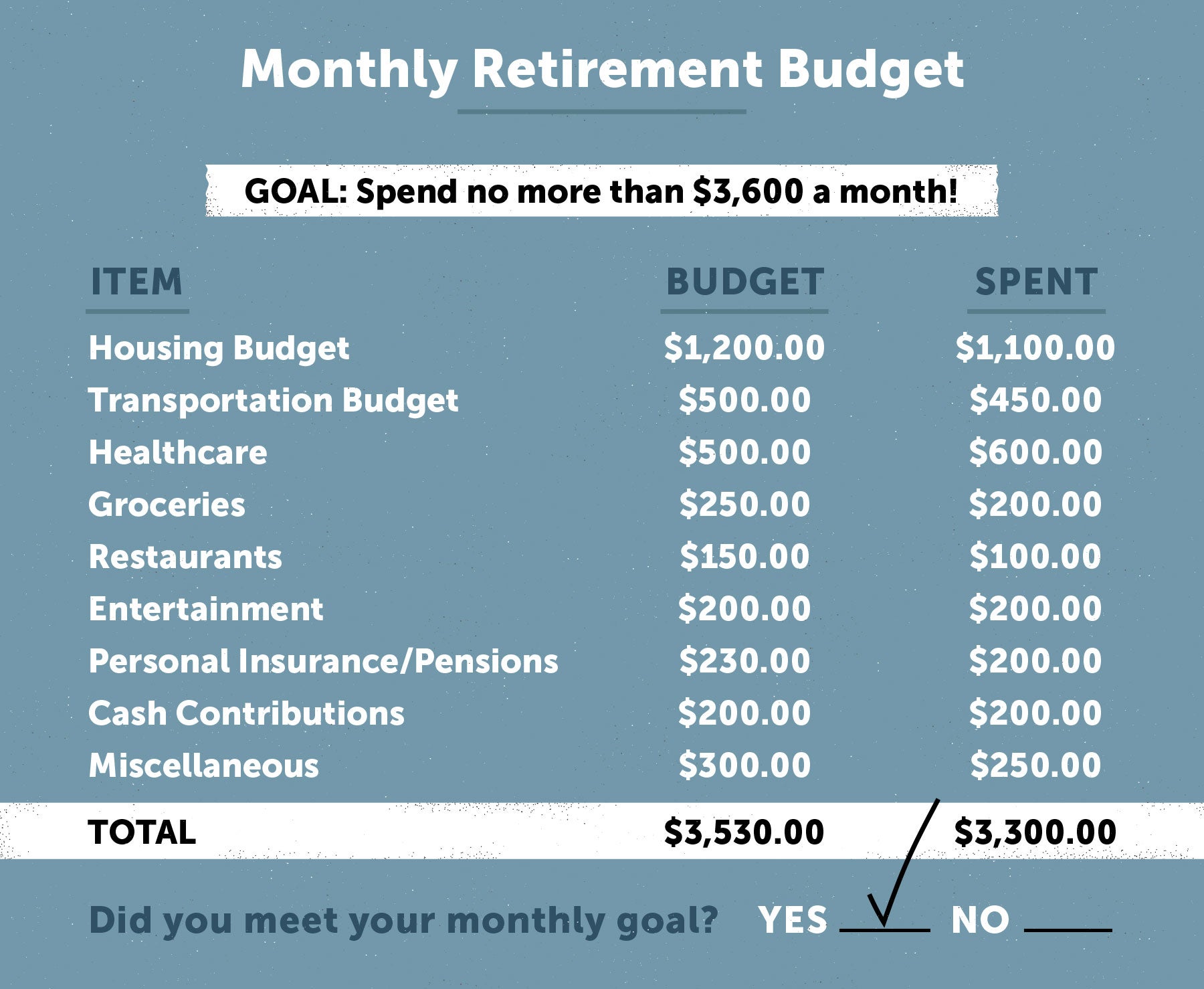

Retirement Planning Guide For Seniors Lexington Law Ask! 3. create a zero based monthly budget. now that you have a good idea of what your income and expenses will look like in retirement, you can use those numbers to create a zero based monthly retirement budget. zero based budgeting is when your income minus your expenses equals…you guessed it…zero. Use lined paper or a computer spreadsheet program to account for the timing of expenses. list the months, january through december, across the top in separate columns. down the left side of the spreadsheet, list each expense on a separate line. if your utility bill runs an average of $200 a month, put $200 in each monthly column. Plan ahead for inflation. budgeting ahead of retirement will help reduce stress later in life. you'll find that some expenses can be reduced or eliminated, while others may even increase as you. So if you spent $1,000 each month before you retired, you could expect to spend about $700 to $800 each month in retirement. now, this is just a rule of thumb. your exact spending will depend on where you live, your lifestyle and how much you have in your retirement savings. so while the 70% to 80% figure is useful for getting you started, you.

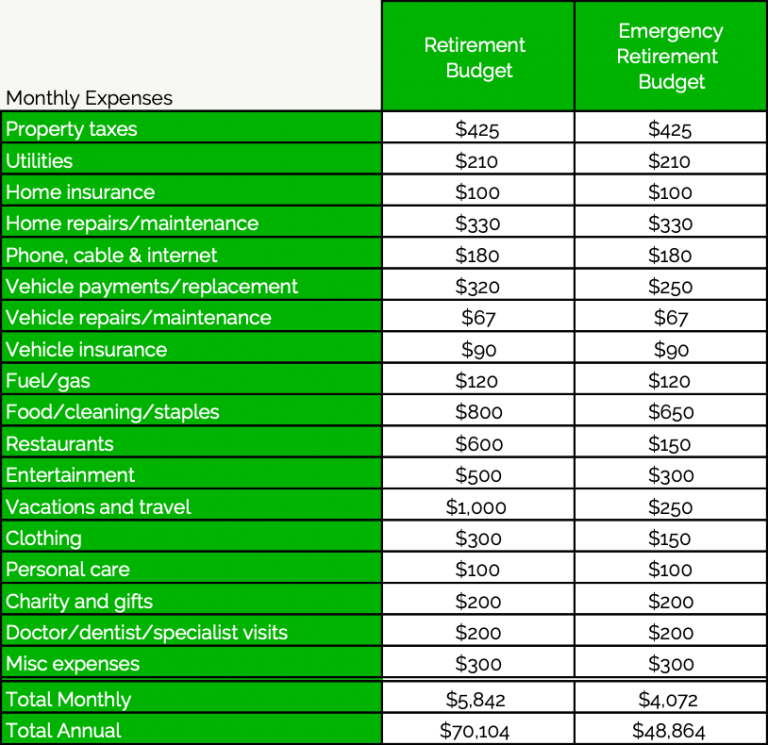

Creating An Emergency Budget For Your Retirement Planeasy Plan ahead for inflation. budgeting ahead of retirement will help reduce stress later in life. you'll find that some expenses can be reduced or eliminated, while others may even increase as you. So if you spent $1,000 each month before you retired, you could expect to spend about $700 to $800 each month in retirement. now, this is just a rule of thumb. your exact spending will depend on where you live, your lifestyle and how much you have in your retirement savings. so while the 70% to 80% figure is useful for getting you started, you. It is important to design a personalized retirement budget that suits your needs and objectives. to establish an effective plan, consider these key considerations: identify all expected expenses. the first step in setting up a retirement budget is listing variable and fixed expenses. take the sum of all figures and calculate the total expected. Add up your expenses. next, identify all of your expenses in retirement. check out your bank or credit card statements from the past three months to get an idea of how much you’re already.

Comments are closed.