What Is A Mortgage A Comprehensive Guide Usmortgage

What Is A Mortgage A Comprehensive Guide Usmortgage A mortgage is a loan that is used to buy or refinance a house or any other real estate property. it is a type of secured loan, which means that the house or real estate property itself is used as collateral against the loan. the borrower agrees to pay back the loan with interest over a fixed period of time, usually 15 or 30 years. A mortgage is a type of loan used to purchase a home. when you get a mortgage, you agree that the lender can foreclose on your property if you fail to repay the loan. this is because a mortgage is.

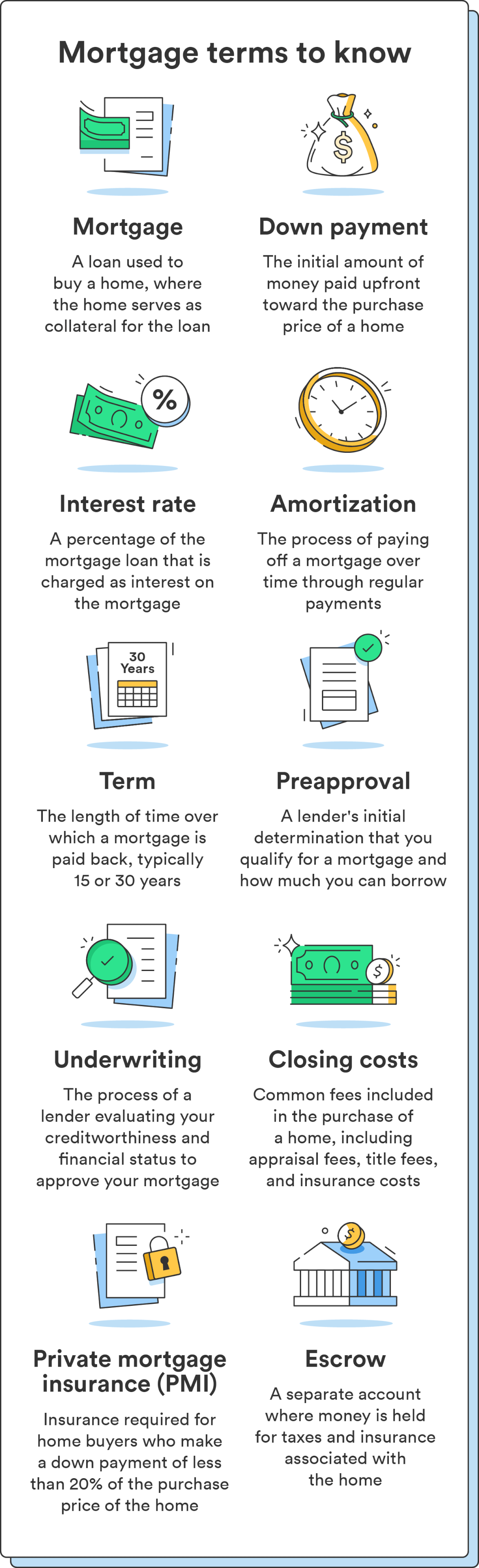

Mortgagese 101 A Guide To Mortgage Terminology Jargon Midwest The mortgage calculations do not include the following costs and savings: certain recurring costs associated with home ownership (e.g., utilities, home warranty, home maintenance costs etc.) savings such as tax deductions on your mortgage payments; if you opt for arms, your mortgage interest rates (and monthly payment) will change over time. A mortgage works by using the property as collateral for the loan. as the home buyer, you pay the upfront down payment on the house. the lender pays the difference between the down payment and the total sale price of the home. a mortgage gives many people the financial support they need to be able to afford a home and become a homeowner. Mortgage: a mortgage is a debt instrument , secured by the collateral of specified real estate property, that the borrower is obliged to pay back with a predetermined set of payments. mortgages. A front end ratio is calculated by taking the full mortgage payment and dividing it by your gross monthly income. for example, if a borrower’s mortgage payment including principal, interest, taxes and insurance is $1,500 and their monthly income is $6,000, the front end ratio is 25%. the back end ratio is calculated the same way with all.

How To Get A Mortgage A 7 Step Guide Chime Mortgage: a mortgage is a debt instrument , secured by the collateral of specified real estate property, that the borrower is obliged to pay back with a predetermined set of payments. mortgages. A front end ratio is calculated by taking the full mortgage payment and dividing it by your gross monthly income. for example, if a borrower’s mortgage payment including principal, interest, taxes and insurance is $1,500 and their monthly income is $6,000, the front end ratio is 25%. the back end ratio is calculated the same way with all. A comprehensive introduction to getting the right mortgage and the right lender, for the right price. reverse mortgage guide: types, costs, and requirements. convertible arm: meaning, history. To determine ltv, simply divide the loan amount by the asset’s purchased value. for example, if someone borrows $100,000 to purchase a house worth $200,000, the ltv would be 50%. this means the lender is only willing to lend 50% of the purchase price, and the borrower would be responsible for the remaining 50%.

Comments are closed.