What Is A Mortgage Infographic Credit Carrots

What Is A Mortgage Infographic Credit Carrots Let’s consider a house that was purchased for $100,000 where the buyer took out an $80,000 mortgage. in a deflationary environment the prices of things drop. this means that the $100,000 may now be worth only $60,000. however, the buyer still owes the bank $80,000 on the loan. These are visual representations of mortgage related information and data. they utilize graphics, charts, icons, and concise text to present complex concepts in a clear and engaging manner. mortgage infographics serve as educational tools, making it simpler to comprehend essential aspects of the mortgage industry.

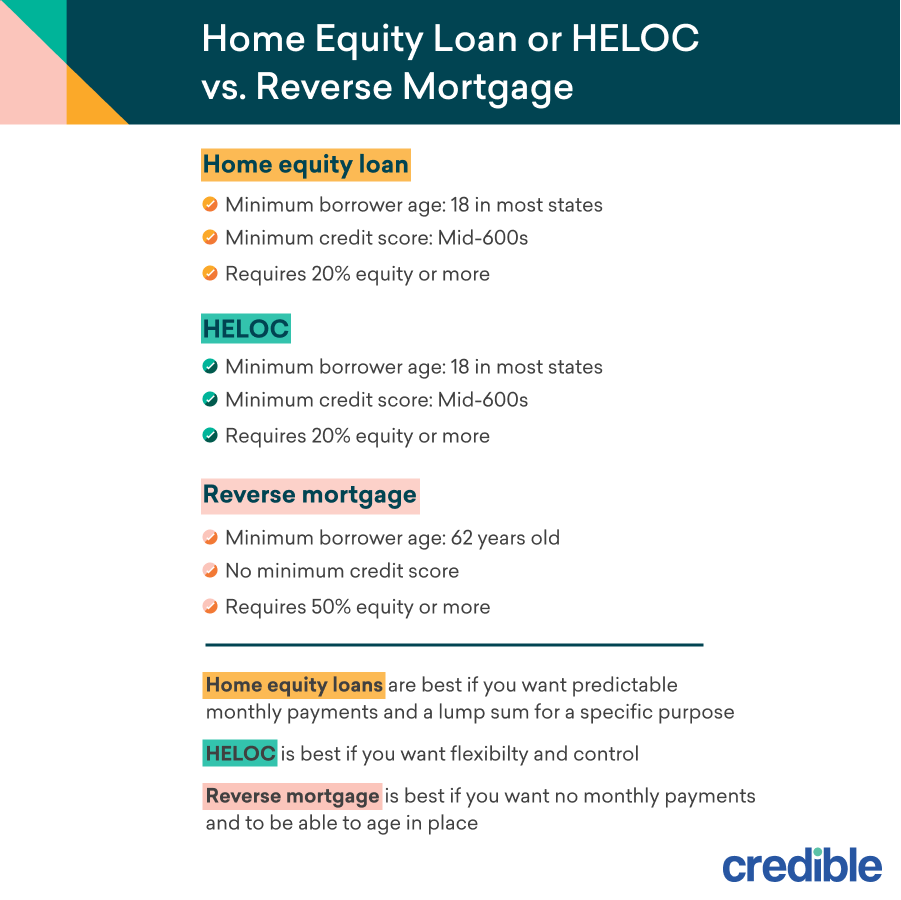

Home Equity Loan Or Heloc Vs Reverse Mortgage How To Choose Credible So what are the fees associated with these td index funds? in general, they range from 0.28% to 0.50%. the td e series mer for a canadian index fund is usually on the lower end of 0.28%. the us index funds are typically around 0.33%, and the global equity index funds are usually around the 0.45% 0.50% range. for the latest on td index fund fees. The savvy entrepreneur’s guide to making smart business decisions with accurate financial projections. Infographics for loan officers. our collection of mortgage infographics provide easy to understand insights for loan officers who want to better understand their markets, marketing strategies and the mortgage industry. from quick tips to quick stats, these infographics can help you succeed. In nevada, all advertised loans are offered and funded by homeamerican mortgage corporation, 770 e. warm springs road, suite 250b, las vegas, nv 89139, 702.638.4450, license #67. buying a new home soon? check out our mortgage infographic to help you weigh your different financing options.

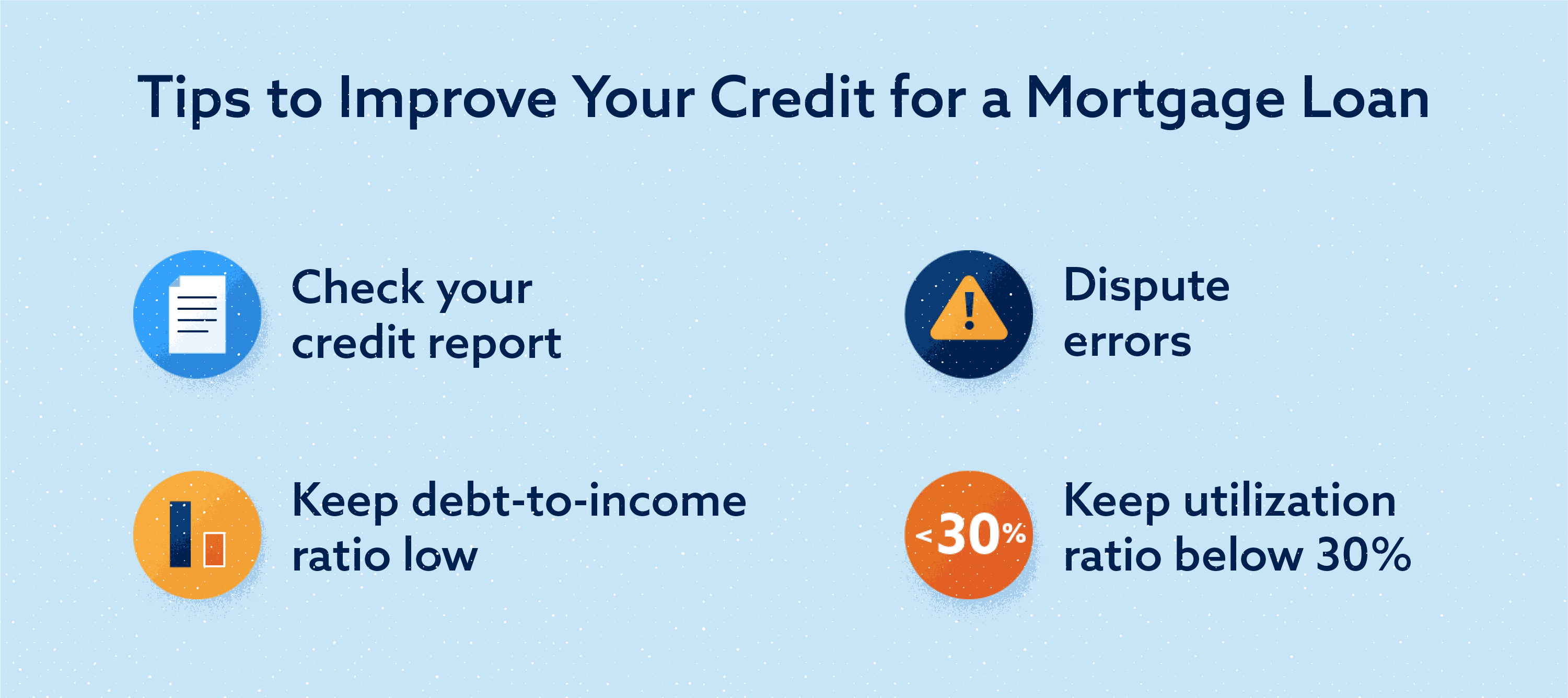

How To Get A Mortgage With Bad Credit In 4 Simple Steps Lexington Law Infographics for loan officers. our collection of mortgage infographics provide easy to understand insights for loan officers who want to better understand their markets, marketing strategies and the mortgage industry. from quick tips to quick stats, these infographics can help you succeed. In nevada, all advertised loans are offered and funded by homeamerican mortgage corporation, 770 e. warm springs road, suite 250b, las vegas, nv 89139, 702.638.4450, license #67. buying a new home soon? check out our mortgage infographic to help you weigh your different financing options. Refinancing your mortgage involves replacing your existing mortgage with a new loan, often to take advantage of a better interest rate, change your loan term or alter the monthly payment structure. the refinance amortization schedule is at the heart of this process, which dictates how payments are split between principal and interest over the. We’ve created a handy mortgage infographic to help you understand some of the factors that affect your credit score and the ways you can improve your score—an important consideration for any lender reviewing your mortgage application. your credit score may influence what types of loans you can qualify for and what rate lenders will offer.

Top Tips For Healthier Credit Infographic Credit Solutions Refinancing your mortgage involves replacing your existing mortgage with a new loan, often to take advantage of a better interest rate, change your loan term or alter the monthly payment structure. the refinance amortization schedule is at the heart of this process, which dictates how payments are split between principal and interest over the. We’ve created a handy mortgage infographic to help you understand some of the factors that affect your credit score and the ways you can improve your score—an important consideration for any lender reviewing your mortgage application. your credit score may influence what types of loans you can qualify for and what rate lenders will offer.

National Get Smart About Credit Day Credit Tips Agamerica Good

Comments are closed.