What Is An Insurance Deductible Napkin Finance

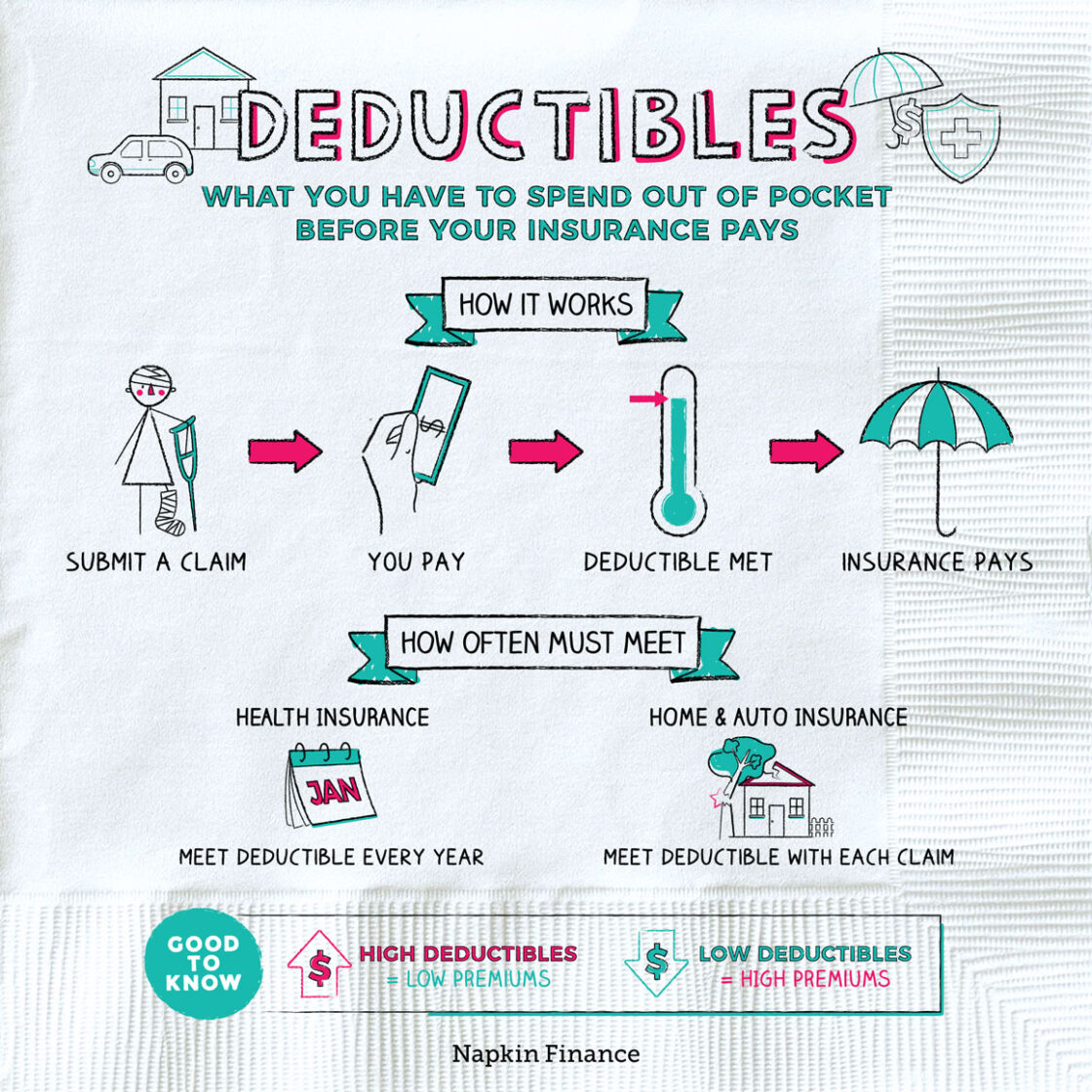

What Is An Insurance Deductible Napkin Finance Key takeaways. your deductible is the amount you must pay out of pocket before your insurance provider will cover all or some of your costs. deductibles typically apply to health, auto, and homeowners insurance. deductibles vary from policy to policy, but generally the lower it is, the higher your premiums and vice versa. Insurance companies, health care insurance, auto insurance cost, prescription insurance, medical insurance plans, homeowners insurance cost, monthly insurance , health insurance cost, deduction meaning, auto insurance, home insurance, health insurance, insurance companies.

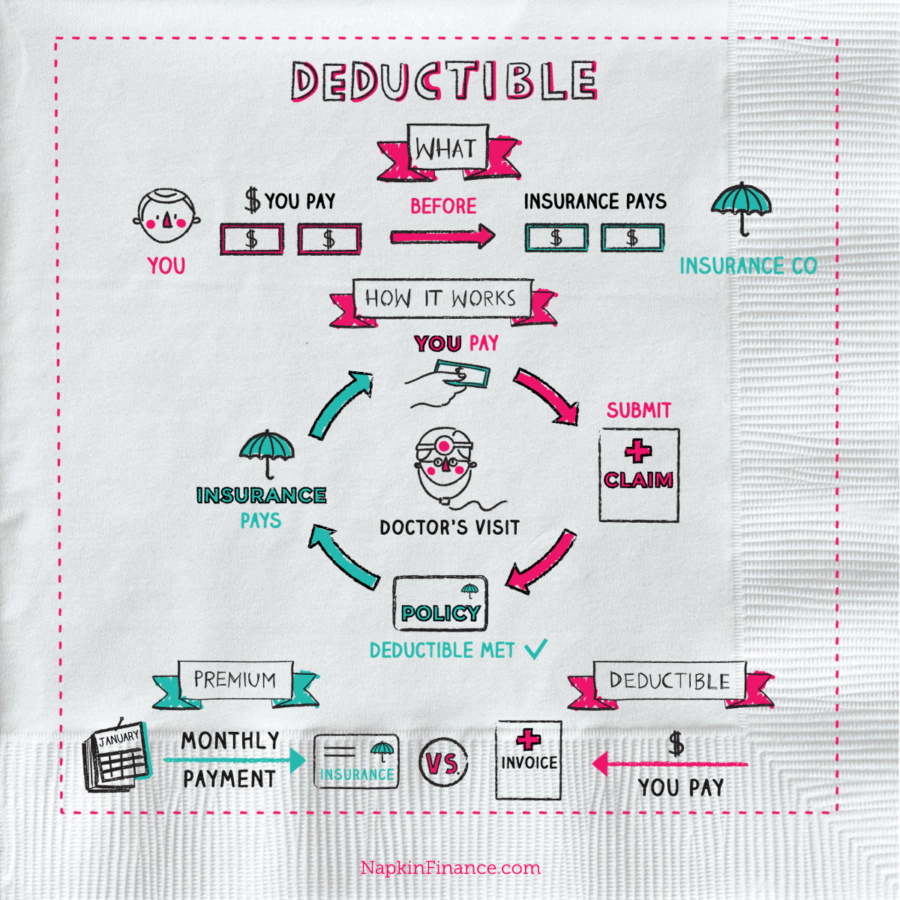

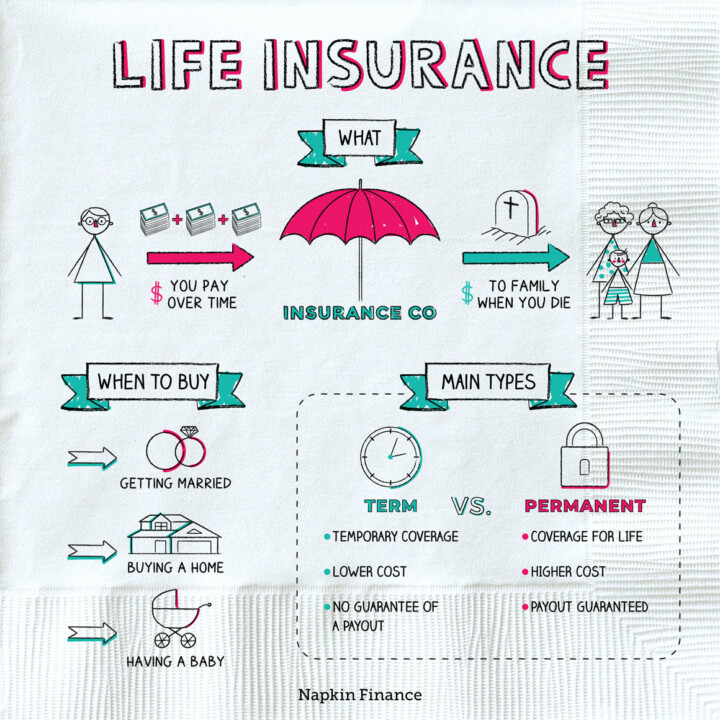

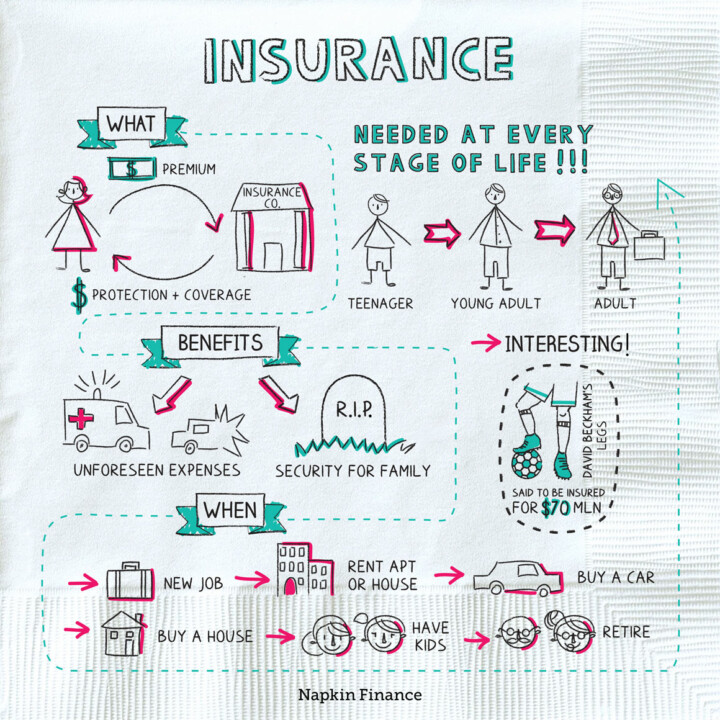

Deductible вђ Napkin Finance Insurance. insurance is financial protection. along with your emergency fund, insurance makes up your safety net so that any number of potential disasters—such as an accident, illness, fire in your home, or death in your family—don’t wreck your financial security. when you buy an insurance policy, you usually agree to periodically pay the. When you make a claim, your insurance deductible is the amount you have to cover yourself before your insurance company will chip in. insurance deductible amounts are typically written into your. An insurance deductible is the amount that a policyholder must pay out of pocket before their insurance coverage begins to pay for a covered claim. for example, if a policy has a $500 deductible and the policyholder files a claim for $1,000 in damages, they would pay the first $500, and the insurance company would cover the remaining $500. An insurance deductible is the amount taken out of an insurance check when you make certain types of claims. you may hear the phrase that coverage begins “after you pay a deductible.”. you don.

Napkins вђ Insurance вђ Napkin Finance An insurance deductible is the amount that a policyholder must pay out of pocket before their insurance coverage begins to pay for a covered claim. for example, if a policy has a $500 deductible and the policyholder files a claim for $1,000 in damages, they would pay the first $500, and the insurance company would cover the remaining $500. An insurance deductible is the amount taken out of an insurance check when you make certain types of claims. you may hear the phrase that coverage begins “after you pay a deductible.”. you don. Example: car insurance deductible. there are two types of deductibles when it comes to car or auto insurance. the first type is a collision deductible, which is for covering the cost of repairs to a vehicle in case of a collision unless you are deemed at fault for the accident. on the other hand, a comprehensive deductible is reserved for. An insurance deductible is an amount you pay before your insurer picks up its share of an insured loss. the amount you'll owe will differ from plan to plan. you'll pay one deductible per claim, but each time you make a claim during a term, you will have to pay it again until you reach your limit.

What Is Insurance Napkin Finance Example: car insurance deductible. there are two types of deductibles when it comes to car or auto insurance. the first type is a collision deductible, which is for covering the cost of repairs to a vehicle in case of a collision unless you are deemed at fault for the accident. on the other hand, a comprehensive deductible is reserved for. An insurance deductible is an amount you pay before your insurer picks up its share of an insured loss. the amount you'll owe will differ from plan to plan. you'll pay one deductible per claim, but each time you make a claim during a term, you will have to pay it again until you reach your limit.

Comments are closed.