What Is Capital Budgeting Capital Budgeting In A Nutshell Fourweekmba

What Is Capital Budgeting Capital Budgeting In A Nutshell Fourweekmba Capital budgeting in a nutshell fourweekmba. business by gennaro cuofano march 17, 2024. capital budgeting is the process used by a company to determine whether a long term investment is worth pursuing. unlike similar methods that focus on profit, capital budgeting focuses on cash flow. capital budgeting is used to determine which fixed. Cost of capital, a critical financial concept, encompasses components such as debt and equity costs. it’s vital for investment decisions and capital budgeting, aiding in resource allocation. calculations involve assessing debt interest and equity returns. factors like market conditions, risk, and tax rates affect it. cost of capital plays a pivotal role in valuations and […].

What Is Capital Budgeting Neil Lee Definition. the weighted average cost of capital (wacc) is a financial metric that represents the average cost a company incurs to finance its operations and investments. it takes into account the cost of debt, cost of equity, and cost of preferred stock, each weighted by its respective proportion in the company’s capital structure. Capital budgeting: definition, methods, and examples. A) capital budgeting is a method used by investors to assess the profitability of investment projects. b) the three primary techniques for evaluating projects are the payback period (pb), internal rate of return (irr), and net present value (npv). c) the payback period measures the time required for a company to recoup its initial investment. The capital budgeting process helps business leaders make better informed decisions about how to invest their company’s capital. the quality of the data used in the process is important to ensure the best analyses are made. netsuite planning and budgeting can help.

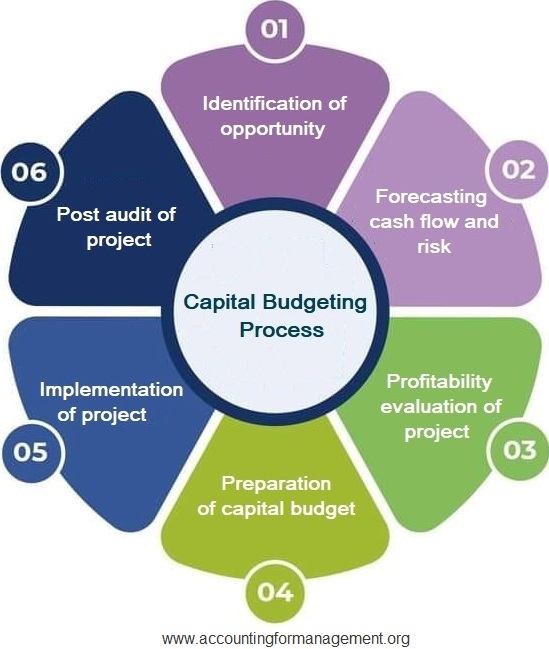

Capital Budgeting Process Definition Explanation Steps Accounting A) capital budgeting is a method used by investors to assess the profitability of investment projects. b) the three primary techniques for evaluating projects are the payback period (pb), internal rate of return (irr), and net present value (npv). c) the payback period measures the time required for a company to recoup its initial investment. The capital budgeting process helps business leaders make better informed decisions about how to invest their company’s capital. the quality of the data used in the process is important to ensure the best analyses are made. netsuite planning and budgeting can help. What is capital budgeting? process, methods, formula,. Capital budgeting is a critical financial process that involves evaluating and selecting long term investments that are worth more than their cost. this method prioritizes projects based on their potential to increase a company’s value, focusing on cash flows, timing, and risk analysis. let’s dive into the world of capital budgeting.

Comments are closed.