What Is Equity Ratio Capital Structure Ratios Leverage Ratio

What Is Equity Ratio Capital Structure Ratios Leverage Ratio вђ Otosection Leverage ratio: a leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt (loans), or assesses the ability of a company to meet its. Leverage ratios represent the extent to which a business is utilizing borrowed money. it also evaluates company solvency and capital structure. having high leverage in a firm’s capital structure can be risky, but it also provides benefits. the use of leverage is beneficial during times when the firm is earning profits, as they become amplified.

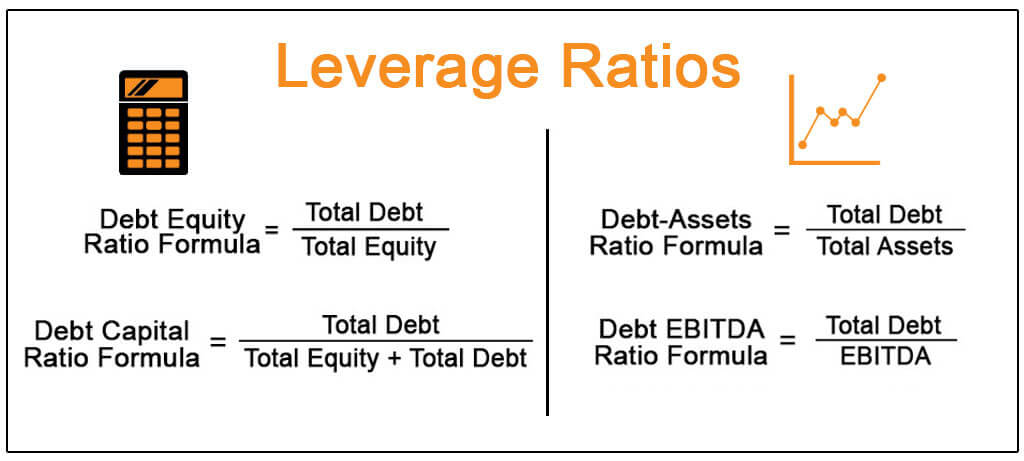

Leverage Ratios Definition Examples How To Interpret Leverage ratio calculation example. suppose there’s a company with the following balance sheet data: total assets = $70 million. total debt = $30 million. total equity = $40 million. to calculate the b s ratios, we’d use the following formulas: debt to equity = $30 million ÷ $40 million = 0.8x. Important ratios used to analyze capital structure include the debt ratio, the debt to equity ratio, and the long term debt to capitalization ratio. credit agency ratings help investors assess the. A leverage ratio is a financial measurement of debt. it puts an entity's debt into better context by showing it as a ratio relative to another financial metric like equity or earnings. a leverage. A leverage ratio is used to evaluate a company’s debt load in relation to its equity and assets. investors use leverage ratios to understand how a company plans to meet its financial obligations and to determine how its debt is used to finance operations. these types of financial ratios shouldn’t be used alone but alongside other metrics to.

Comments are closed.