What Is Implied Volatility How To Use It Iv Iv Percentile Iv Rank

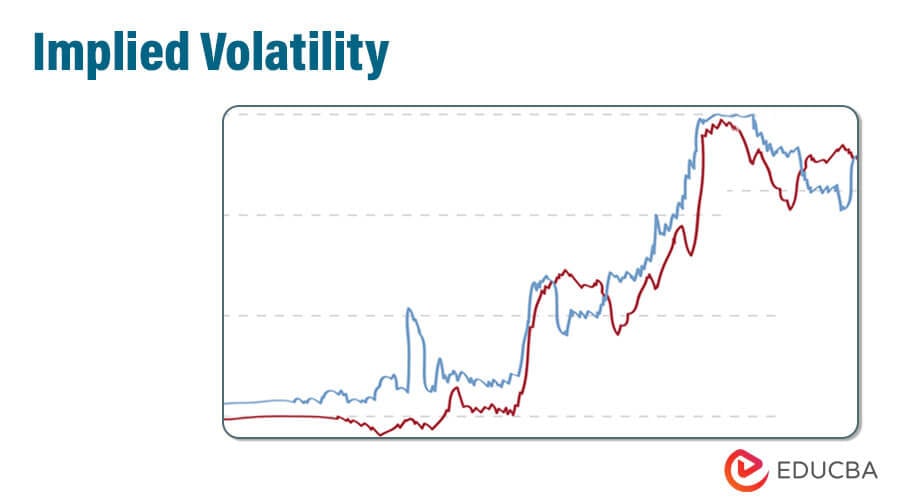

Implied Volatility Iv Rank Percentile Explained Tastylive Iv rank and iv percentile summed up. implied volatility rank (aka iv rank or ivr) is a statistic measurement used when trading options, and reports how the current level of implied volatility in a given underlying compares to the last 52 weeks of historical data. that means if implied volatility ranged between 30% and 60% during the last 52. Historical volatility (hv) measures the fluctuation of past prices over a period of time. so, hv tells you how volatile a stock has been in the past. a stock with an hv of 10 has been less volatile than a stock with an hv of 35. it's also possible for a stock to have an hv of 50 during one time period and 15 during another.

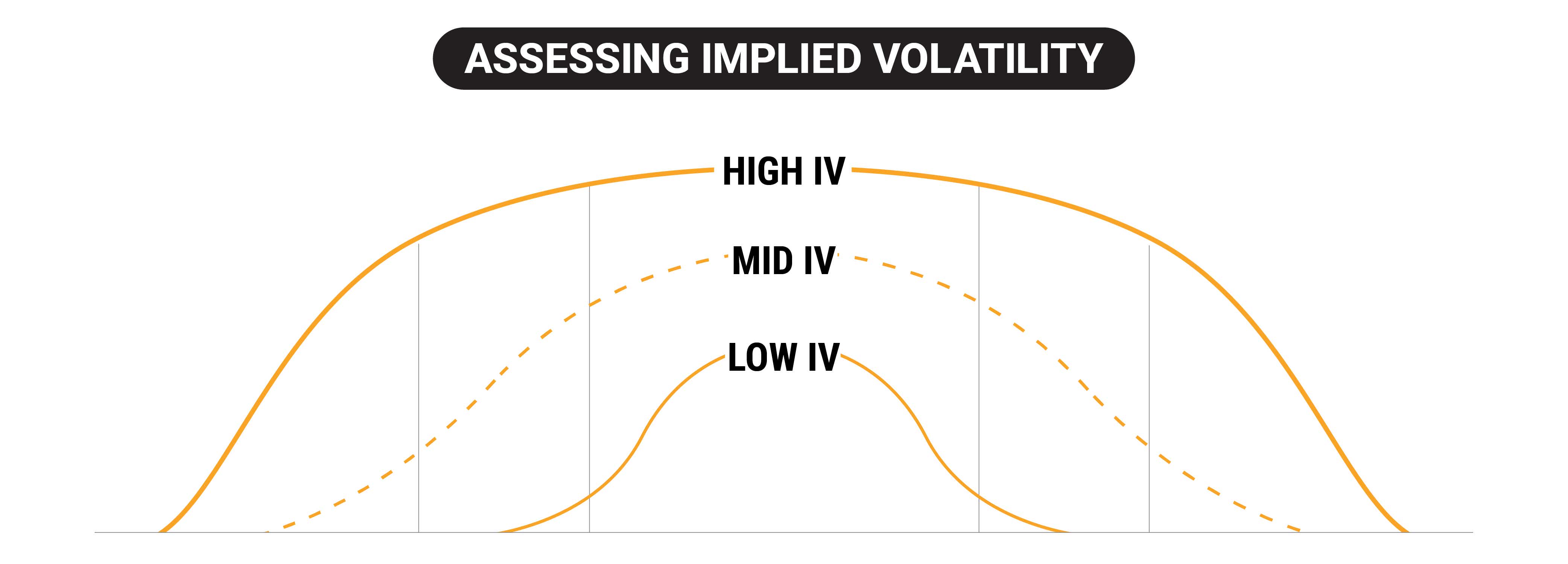

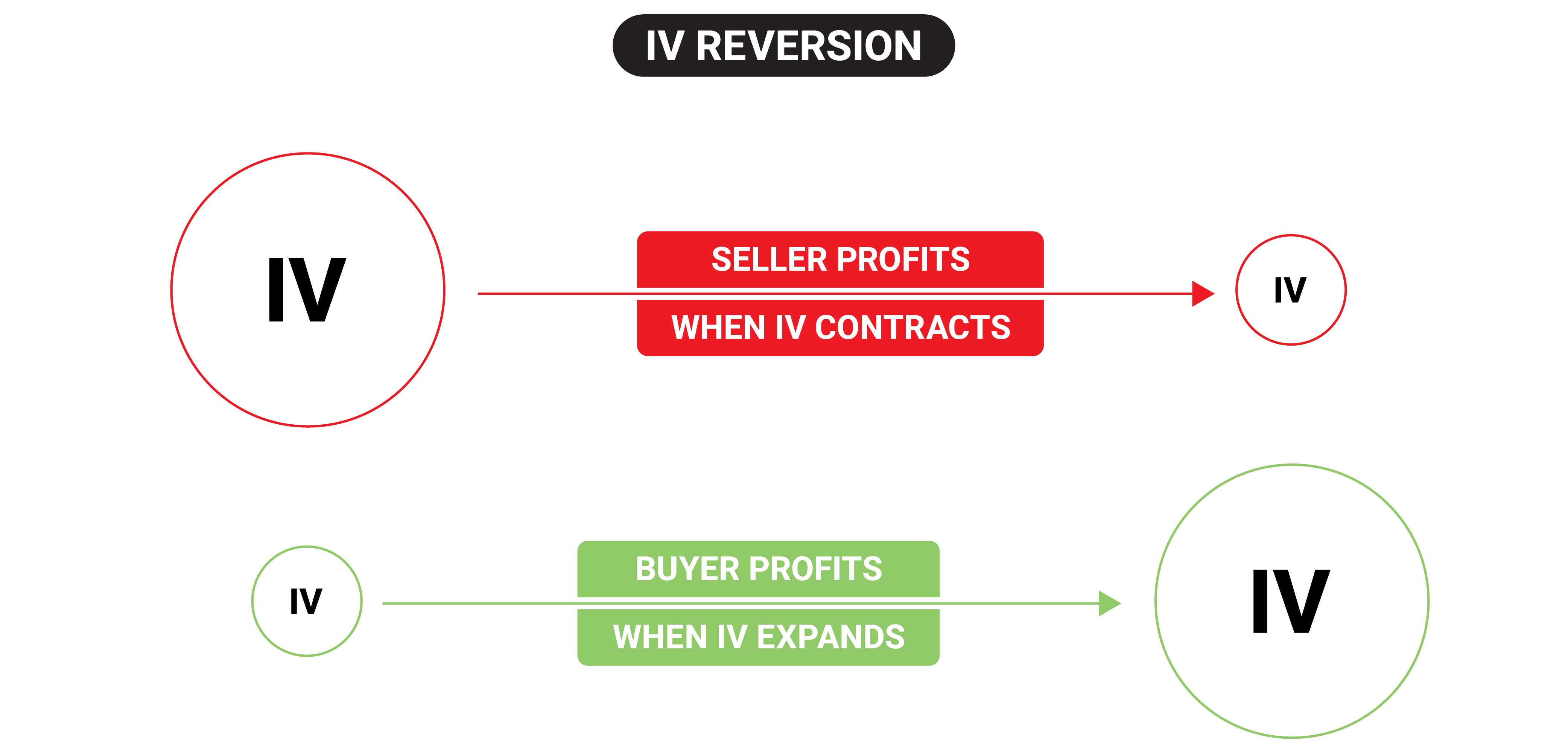

What Is Implied Volatility Iv Rank And Why It Matters Youtube Implied volatility percentile (are rank) is important because iv is mean reverting. this means that after high iv, we can expect it to go lower and vice versa: after low iv, we can expect it to go higher. the iv percentile rank is standardized from 0 100, where 0 is the lowest value in recent history, and 100 is the highest value. Our crm example indicated that iv rank is low but iv percentile is high. personally, i think that iv rank is slightly flawed because the data gets skewed whenever there is a large spike in volatility. we see this in our crm example, when implied volatility is at 43.80% which is higher than the majority of the values seen in the preceding 12. Understanding and mastering these differences between the stock’s actual implied volatility and that stock’s iv percentile or rank (going back historically) is one of the biggest keys to your ability to be successful when trading. this is because our whole concept of trading options and selecting the strategies hinges on this idea of. For example, using a one year iv percentile, if the stock had 51 days trading under the current volatility level, we would divide that number by the total number of trading days in a year (252). this would give us an iv percentile of (51 252) = 20.2%. how to use iv percentile to trade. now, of course, the first thing everyone wants to know is.

Implied Volatility Iv Rank Percentile Explained Tastytrade Understanding and mastering these differences between the stock’s actual implied volatility and that stock’s iv percentile or rank (going back historically) is one of the biggest keys to your ability to be successful when trading. this is because our whole concept of trading options and selecting the strategies hinges on this idea of. For example, using a one year iv percentile, if the stock had 51 days trading under the current volatility level, we would divide that number by the total number of trading days in a year (252). this would give us an iv percentile of (51 252) = 20.2%. how to use iv percentile to trade. now, of course, the first thing everyone wants to know is. Options iv rank explained. ivr, or implied volatility rank, is the one year ranking of the current implied volatility between 0 and 100. implied volatility percentile (ivp) is similar to iv rank, except it then reports the percent of days (in the last year) where the volatility was lower than it is now. if we want to know who is making big. Iv rank & iv percentile options traders often look at iv rank and iv percentiles, which are relative measures based on the underlying implied volatility of a financial asset. iv rank is where a.

Implied Volatility Basics Factors Importance Chart Example Options iv rank explained. ivr, or implied volatility rank, is the one year ranking of the current implied volatility between 0 and 100. implied volatility percentile (ivp) is similar to iv rank, except it then reports the percent of days (in the last year) where the volatility was lower than it is now. if we want to know who is making big. Iv rank & iv percentile options traders often look at iv rank and iv percentiles, which are relative measures based on the underlying implied volatility of a financial asset. iv rank is where a.

Implied Volatility Iv Rank Percentile Explained Tastylive

Comments are closed.