What Is Payment Fraud

Payment Fraud Types Detection And Prevention In E Commerce What is payment fraud? payment fraud is a type of financial fraud that involves the use of false or stolen payment information to obtain money or goods. payment fraud can occur in a variety of ways, but it often includes fraudulent actors stealing credit card or bank account information, forging checks, or using stolen identity information to make unauthorized transactions. Fraud prevention is the process of preventing fraudulent activities from impacting the business, customer, or financial institution. to do this effectively, businesses need to maintain full control and reduce operational workload. this is done by combining risk rules with machine learning and manual reviews.

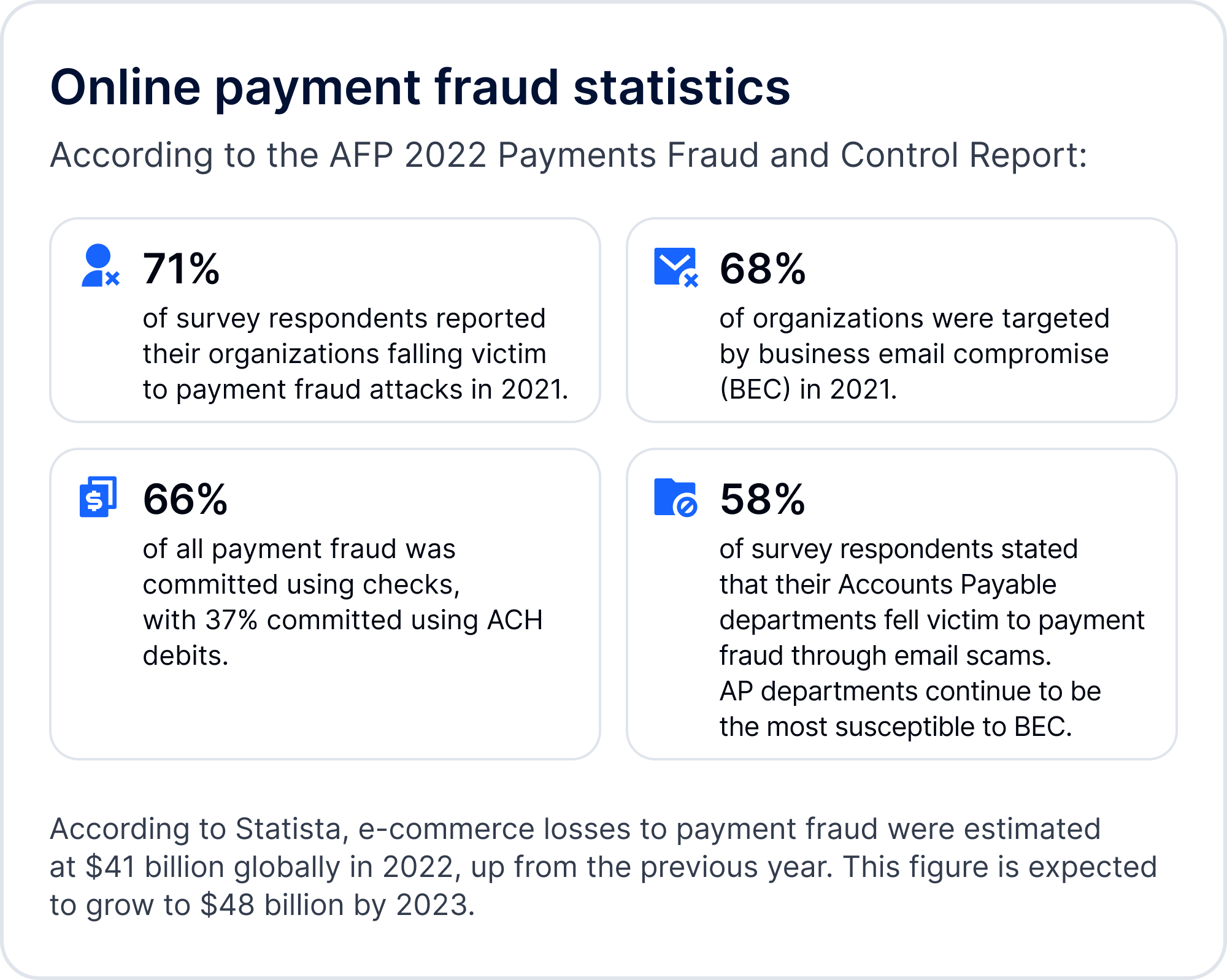

Payment Fraud How To Protect Yourself And Your Business Fraud Payment fraud is when someone steals another person’s payment information – or tricks them into sharing it – to make false or illegal transactions. the 2022 afp® payments fraud and control survey reports that 71% of organizations were victims of payment fraud attacks attempts in 2021, costing businesses billions of dollars globally. Conduct a comprehensive risk assessment to identify the types of payment fraud most relevant to the business, based on its industry, size, customer base, and transaction methods. assess the existing systems, processes, and controls to identify vulnerabilities and potential areas for improvement. prioritization. Payment fraud is a growing concern for businesses of all sizes and industries, with losses estimated at over $42 billion worldwide in 2020 alone. for most businesses, particularly those that deal with a high volume of customer payments, payment fraud is an unfortunate yet unavoidable part of doing business. 3) clean fraud: this type of transaction fraud is the hardest to detect. fraudsters carefully analyze businesses’ fraud detection systems, and use stolen valid payment information to navigate around them. these are some of the most common ways payment fraud occurs.

.jpg)

Payment Fraud Types Detection And Prevention In E Commerce Payment fraud is a growing concern for businesses of all sizes and industries, with losses estimated at over $42 billion worldwide in 2020 alone. for most businesses, particularly those that deal with a high volume of customer payments, payment fraud is an unfortunate yet unavoidable part of doing business. 3) clean fraud: this type of transaction fraud is the hardest to detect. fraudsters carefully analyze businesses’ fraud detection systems, and use stolen valid payment information to navigate around them. these are some of the most common ways payment fraud occurs. Payment fraud often targets customer payment information at the point of payment. that means working with a highly secure, proactive credit card service provider can help reduce the risk that your. Payment fraud is, at its core, a false or illegitimate transaction. before the internet, payment fraud was typically a simple case of bounced checks or erroneous chargebacks. however, with the advent of ecommerce, it’s become much more complex. consumers are losing personal identity data and credit card numbers to phishing scams, malware.

What Is Payment Fraud Types Examples And Prevention Payment fraud often targets customer payment information at the point of payment. that means working with a highly secure, proactive credit card service provider can help reduce the risk that your. Payment fraud is, at its core, a false or illegitimate transaction. before the internet, payment fraud was typically a simple case of bounced checks or erroneous chargebacks. however, with the advent of ecommerce, it’s become much more complex. consumers are losing personal identity data and credit card numbers to phishing scams, malware.

Payment Fraud 2024 The Sumsuber

Comments are closed.