What Is Public Provident Fund Ppf Guidelines Forms Benefits

How To Start A Ppf Account Soupcrazy1 Features of a ppf account. the key characteristics of a public provident fund scheme can be listed as follows–. interest rate of ppf. 7.1% per annum. tax benefit. up to rs.1.5 lakh under section 80c. risk profile. offers guaranteed, risk free returns. minimum investment amount. The public provident fund (ppf), introduced in india in 1968, is a long term investment option with tax benefits and guaranteed returns. it offers stability and tax free interest, requires monthly contributions for earning interest, and has a minimum 15 year tenure.

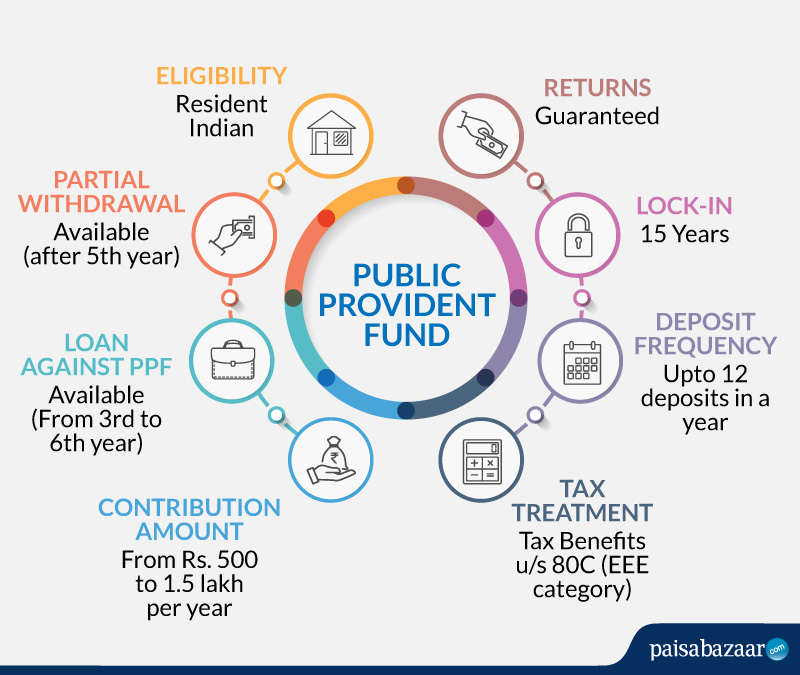

Create A Large Corpus With Ppf Here S All You Need To Know Ppf, or public provident fund, is a government backed saving scheme with multiple benefits. it is one of india’s most popular and tax efficient savings schemes and is primarily designed to encourage savings and provide financial security to individuals. it is a long term investment option that matures after 15 years. it offers guaranteed returns. Public provident fund (ppf) definition: a public provident fund (ppf) scheme is one of the indian government saving schemes which aims at regulating the small savings of the individuals to convert such savings into investments yielding returns with tax saving benefits. it is considered to be one of the safest investments. The public provident fund (ppf) is a long term savings scheme for consumers with low to zero risk appetite to invest in a government backed scheme that helps them protect their investments from. Interest rates: the ppf (public provident fund) interest rate is fixed by the finance ministry every quarter. the current ppf interest rate is 7.9%. and, though the interest is calculated every month, it gets credited to your account on 31st march every year.

Public Provident Fund Ppf Ppf Account Types Benefits The public provident fund (ppf) is a long term savings scheme for consumers with low to zero risk appetite to invest in a government backed scheme that helps them protect their investments from. Interest rates: the ppf (public provident fund) interest rate is fixed by the finance ministry every quarter. the current ppf interest rate is 7.9%. and, though the interest is calculated every month, it gets credited to your account on 31st march every year. Tax benefits under the public provident fund scheme. the public provident fund is categorized under eee (exempt exempt exempt). ppf offers an income tax deduction of up to rs. 1.5 lakh under section 80c income tax act. with this deduction, the entire tax is made exempt. interest earned on maturity is also exempt. The public provident fund (ppf), a cornerstone of prudent financial planning, was introduced by the government of india with the aim of fostering a culture of systematic savings. widely embraced by the masses, ppf stands out as a long term investment scheme renowned for its attractive interest rates, robust returns, and a host of safety features.

Public Provident Fund Ppf Features Benefits Tax benefits under the public provident fund scheme. the public provident fund is categorized under eee (exempt exempt exempt). ppf offers an income tax deduction of up to rs. 1.5 lakh under section 80c income tax act. with this deduction, the entire tax is made exempt. interest earned on maturity is also exempt. The public provident fund (ppf), a cornerstone of prudent financial planning, was introduced by the government of india with the aim of fostering a culture of systematic savings. widely embraced by the masses, ppf stands out as a long term investment scheme renowned for its attractive interest rates, robust returns, and a host of safety features.

Comments are closed.