What Is Round Tripping In Accounting Examples How It Works

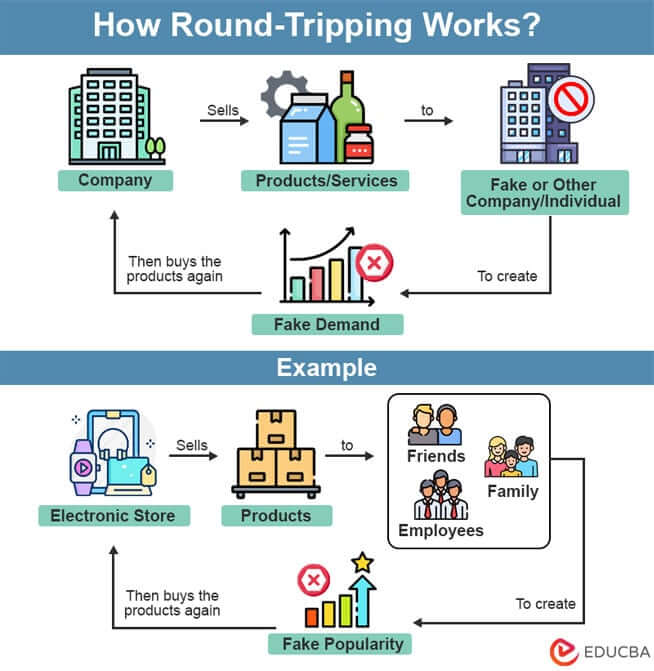

Round Tripping Meaning Examples Purpose Reasons Benefits Round tripping is when a company uses fake transactions, i.e., fake buying and selling of products services, to show they have higher sales and their product is in demand. the main company does this by either creating a subsidiary or a fake company or working with another company they know. here, the main company sells its products services to. Definition: round trip transactions refer to a series of transactions where a company sells an asset and then repurchases the same or similar asset, often at a similar price and within a short time frame. these transactions can artificially inflate a company’s revenue and trading volume, creating a misleading impression of its financial.

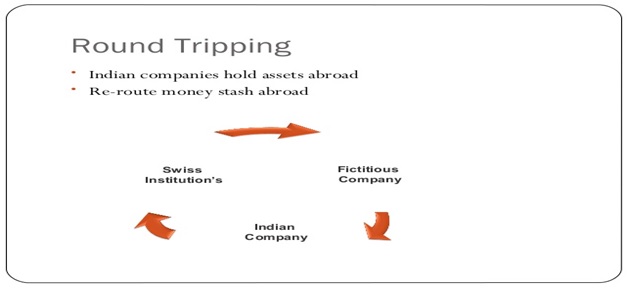

Star Citizen Discussion Thread V12 Page 3001 Frontier Forums Loss of tax revenue: round tripping is often used as a means of tax evasion to avoid paying taxes on income or profits. this deprives governments of much needed tax revenue, which could otherwise be used to fund public services and infrastructure projects. in summary, round tripping is a deceptive financial practice that involves sending funds. The accounting slang term "round tripping" refers to a series of transactions between companies that bolster the revenue of the companies involved but that, in the end, don't provide real economic. Round tripping is an illegitimate way to boost earnings, by trading shell transactions or assets. it is mostly done on a no profit basis or mutual agreement. round tripping benefits the organization by inflating the revenue to demonstrate the organization’s expansion, to demoanstrate that the company is conducting more business than rivals. Round tripping occurs when one company sells to another party in order to generate , and later buys back the assets. the intent of doing so is to artificially boost a firm’s reported sales. this can be quite useful for a publicly held business, since investors will see the revenue increase and bid up the price of the firm’s shares accordingly.

Poem Round Tripping Optimize Ias Round tripping is an illegitimate way to boost earnings, by trading shell transactions or assets. it is mostly done on a no profit basis or mutual agreement. round tripping benefits the organization by inflating the revenue to demonstrate the organization’s expansion, to demoanstrate that the company is conducting more business than rivals. Round tripping occurs when one company sells to another party in order to generate , and later buys back the assets. the intent of doing so is to artificially boost a firm’s reported sales. this can be quite useful for a publicly held business, since investors will see the revenue increase and bid up the price of the firm’s shares accordingly. Detecting round tripping within financial statements requires a keen eye for anomalies and inconsistencies. one of the first indicators auditors and analysts look for is unusual patterns in revenue recognition. for instance, a sudden spike in revenue without a corresponding increase in cash flow or operational activity can be a red flag. Round tripping. “round tripping” refers to a financial transaction or series of transactions that involve selling and then repurchasing assets, typically with little to no economic purpose or benefit other than to artificially inflate volume or manipulate financial statements. the transactions usually involve two companies that collude to.

Comments are closed.