What Is The Difference Between Cash Flow Statement And Fund Flow Statement

Cash Flow Vs Fund Flow Differences Structure Efm The fund flow statement is the earlier version of the cash flow statement. the cash flow statement is more comprehensive and details the multiple cash flows of a company, rather than just focusing. The cash flow statement shows the changes in the cash position (inflows and outflows) of a firm. it is an analytical reconciliation statement that explains the reasons for the differences between the opening and closing cash balances over a period.

Explain Difference Between Cash Flow And Fund Flow Statementо Difference between cash flow and fund flow. The cash flow statement tracks the actual movement of cash in and out of a company, while the fund flow statement tracks the movement of funds, including non cash items. the cash flow statement emphasizes cash inflows and outflows, whereas the fund flow statement centers on sources and uses of funds. although both financial statements offer. Cash flow refers to the movement of cash in and out of a business during a specific period, focusing on the actual cash transactions. it helps assess a company's ability to generate cash from its operations, investments, and financing activities. on the other hand, fund flow focuses on the movement of funds within a company, including both cash. Cash flow is based on a narrow concept called “cash.”. fund flow is based on a wider concept called “working capital.”. usefulness. the cash flow statement’s utility is finding out the net cash flow. the utility of fund flow is to understand the financial position of the company. source.

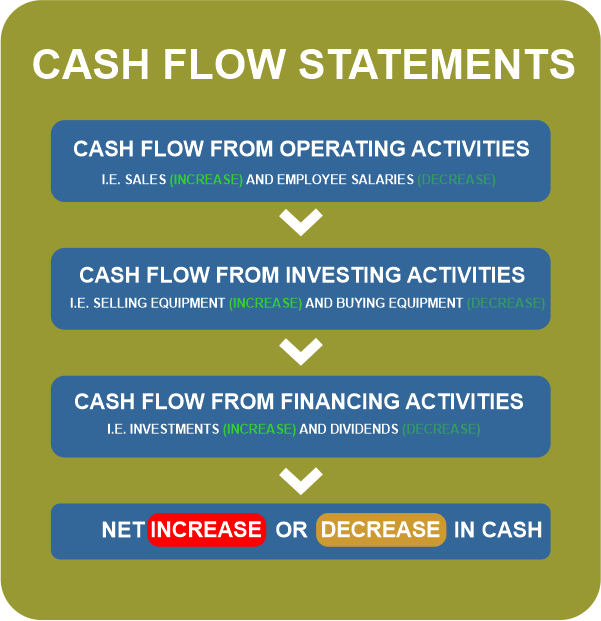

Difference Between Cash Flow And Fund Flow Javatpoint Cash flow refers to the movement of cash in and out of a business during a specific period, focusing on the actual cash transactions. it helps assess a company's ability to generate cash from its operations, investments, and financing activities. on the other hand, fund flow focuses on the movement of funds within a company, including both cash. Cash flow is based on a narrow concept called “cash.”. fund flow is based on a wider concept called “working capital.”. usefulness. the cash flow statement’s utility is finding out the net cash flow. the utility of fund flow is to understand the financial position of the company. source. The major cash flows are presented in one of three classifications: the cash flow statement has been required by the financial accounting standards board (fasb) since 1988, when it issued its statement no. 95. the funds flow statement was required prior to 1988. generally, the funds flow statement summarized a company’s changes in its working. Cash flow is a financial statement that details the cash inflows and outflows that happened during that particular accounting period. it describes how each transaction has resulted in a change in the company’s cash position and calculates the company’s net cash flows at the end of the accounting period. table of contents.

Comments are closed.