When Should You File Bankruptcy And How Much Debt Is Needed

When Should You File Bankruptcy And How Much Debt Is Needed Bononi Legislation and statistics. $1,000 is the minimum debt needed to file for bankruptcy in canada, according to the bankruptcy & insolvency act, which is the federal legislation that governs the bankruptcy process. however, very few people with $1,000 in debts actually go bankrupt. statistics from the office of the superintendent of bankruptcy. How much debt you should have in chapter 7 bankruptcy. most attorneys won't accept a chapter 7 bankruptcy client with less than $10,000 in dischargeable debt. not only can $10,000 be difficult to repay, but anything less, and the court might question whether bankruptcy would be in the filer's best interests. it's because bankruptcy comes with.

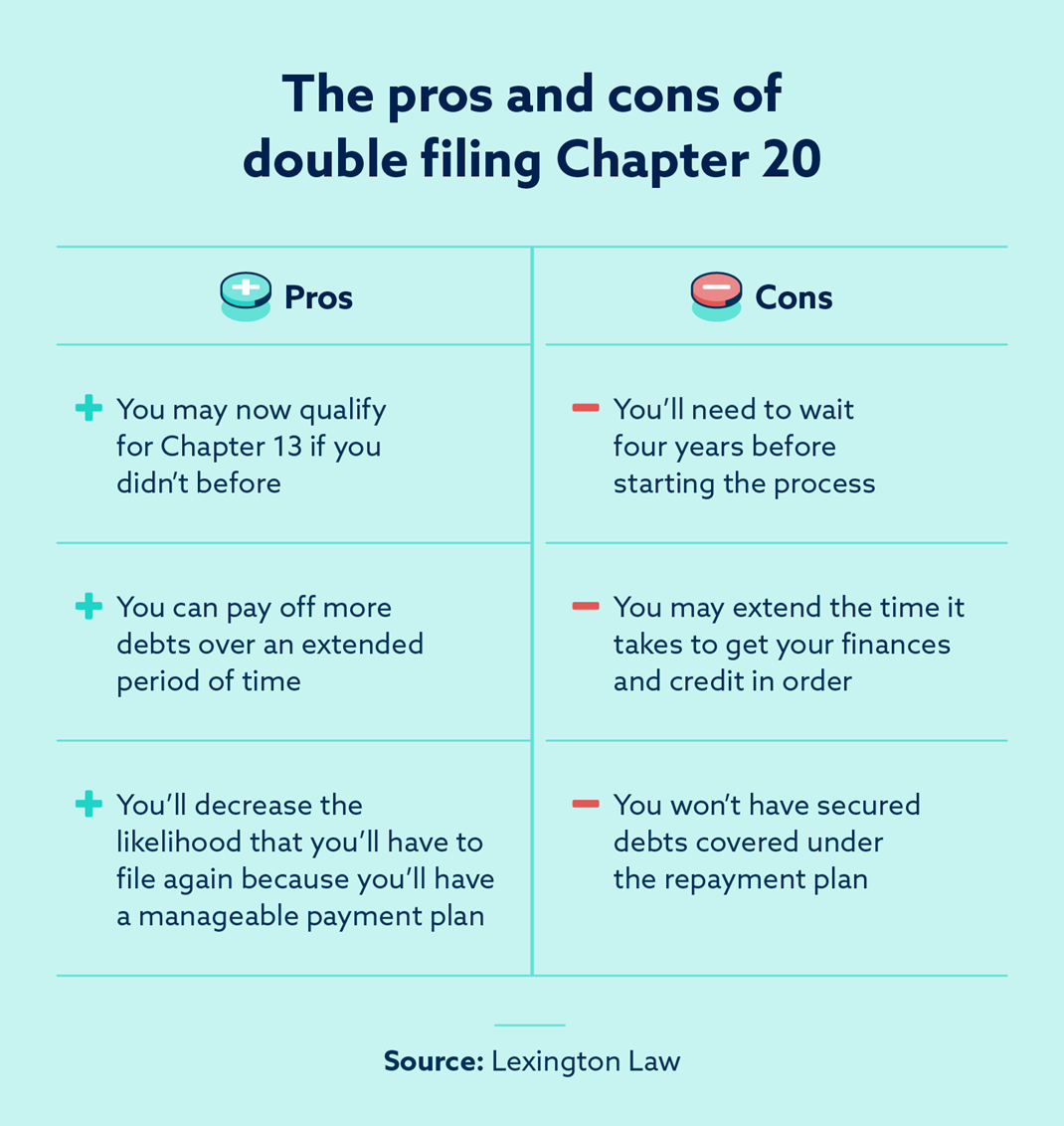

How Often Can You File Bankruptcy Lexington Law Step 2: contact a licensed insolvency trustee (lit) once you’ve established that you need to take action, the next step is contacting a licensed insolvency trustee. an lit is the only professional authorized to administer government related insolvency proceedings, such as consumer proposals or bankruptcies. The licensed insolvency trustee should ask you questions about your debts and budgeting to try and find the best solution for you. 2. completing the necessary paperwork. if, after consulting with. 2. complete and file the formal paperwork to declare bankruptcy in canada. the lit you choose to work with will be with you for the entire bankruptcy process. he or she will ensure you understand your rights and obligations, and will communicate with your lenders and creditors. If one of your creditors opposes your bankruptcy discharge, your situation would need to be heard in bankruptcy court, which you would need to attend with your trustee. that said, this is not a common situation. usually, creditors oppose discharges for any one of the following reasons: you owe more than $200,000 which represents at least three.

When Should You File Bankruptcy And How Much Debt Is Needed 2. complete and file the formal paperwork to declare bankruptcy in canada. the lit you choose to work with will be with you for the entire bankruptcy process. he or she will ensure you understand your rights and obligations, and will communicate with your lenders and creditors. If one of your creditors opposes your bankruptcy discharge, your situation would need to be heard in bankruptcy court, which you would need to attend with your trustee. that said, this is not a common situation. usually, creditors oppose discharges for any one of the following reasons: you owe more than $200,000 which represents at least three. 25% of those consumers went on to declare bankruptcy (7,580) average assets at the time of filing: $21,907.90. average liabilities (debts) at the time of filing: $89,758.27. with an average household income of $80,322 in ontario, [5] the average filer effectively owed $1.12 for every dollar they earned. When should you file for bankruptcy?.

Chapter 7 Bankruptcy How Much Debt Do You Need To File Youtube 25% of those consumers went on to declare bankruptcy (7,580) average assets at the time of filing: $21,907.90. average liabilities (debts) at the time of filing: $89,758.27. with an average household income of $80,322 in ontario, [5] the average filer effectively owed $1.12 for every dollar they earned. When should you file for bankruptcy?.

Comments are closed.