Year Ender 2022 Banks Ride The Year On Healthy Loan Growth And

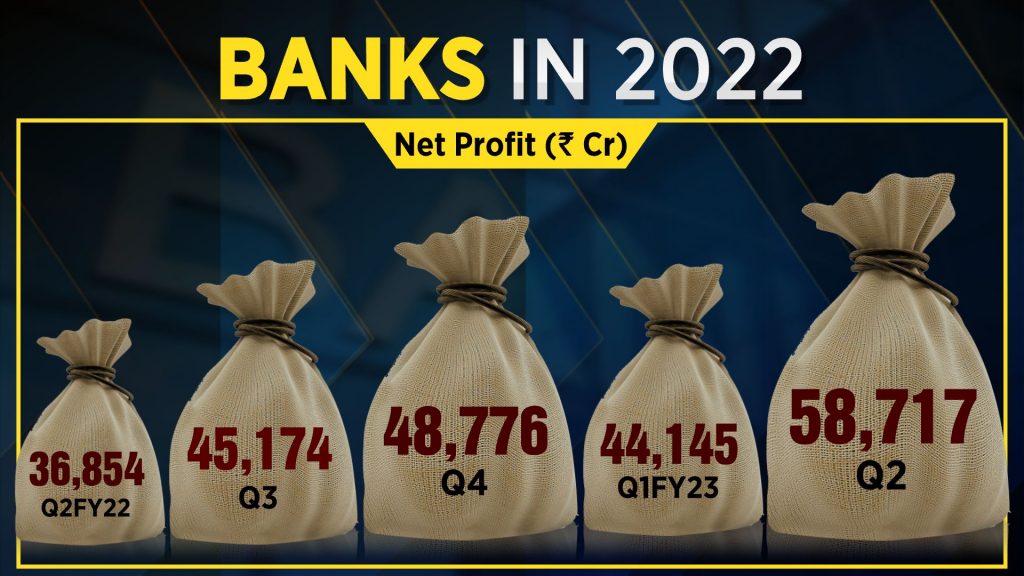

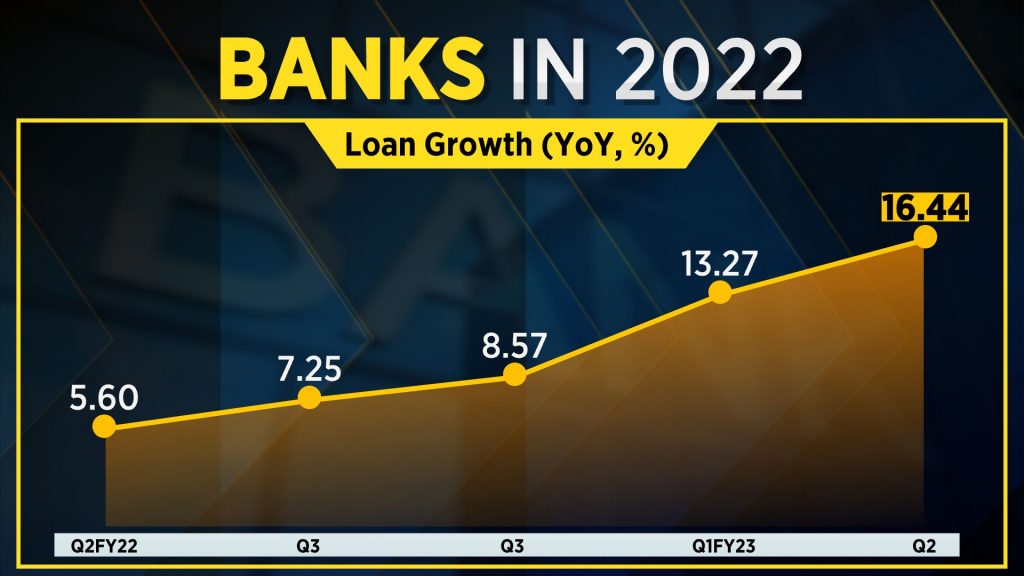

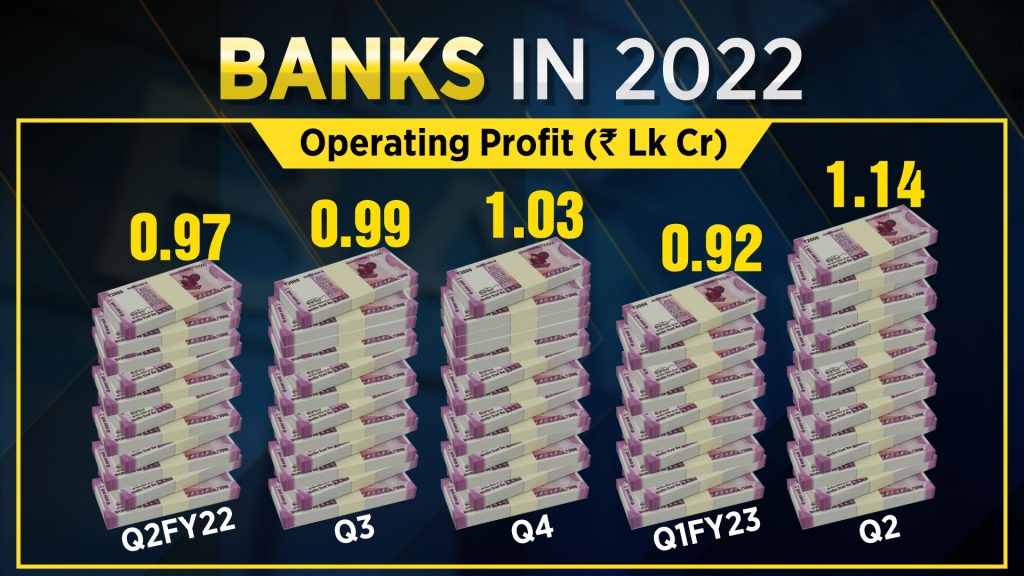

Year Ender 2022 Banks Ride The Year On Healthy Loan Growth And The loan growth for the banking sector as of q2 fy23 was at 16.44 percent perhaps one of the highest from the first of november 2013. the rise in loan growth helped in stronger topline growth for the banking sector, which has helped the bottom line or the earnings of the banks. so, the loan growth incrementally has been driven by the retail. Feb 8 (reuters) while u.s. bank stocks had a rocky start to the year, investors and analysts see accelerating loan growth and federal reserve interest rate hikes boosting the sector. the u.s.

Year Ender 2022 Banks Ride The Year On Healthy Loan Growth And Of the 20 banks with the largest increases in loan to deposit ratios, 19 recorded loan growth and only 5 booked deposit growth year over year. bankers' bank led the list with a 58.2 percentage point increase in its ratio to 116.2%. tradition capital bank ranked second as its ratio rose 43.5 percentage points to 118.1%. High yield corporate bonds returned 13.5 percent and bank loans returned 13 percent, the strongest results since 2019 for bonds and since 2009 for loans. high yield bond credit spreads narrowed to just 363 basis points by year end, the tightest since april 2022, marking a significant reduction from 491 basis points at the beginning of the year. Banks have continued to add to credit lines even as loan growth has returned, according to data from s&p global market intelligence, with unused commitments across the industry up 1.4% in the second half of 2021 to $9.042 trillion even as loans increased 3.5% to $11.245 trillion. in the 2022 first quarter, loan growth continued to be broad. Median loan growth rate was 12.3 percent in 2022, the second highest median loan growth rate since 1984. the 2022 median loan growth was more than double the median loan growth rate of 5.7 percent in 2021 and the ten year average median loan growth rate of 4.5 percent. all but the largest banks had higher median loan growth rates in 2022 than.

Year Ender 2022 Banks Ride The Year On Healthy Loan Growth And Banks have continued to add to credit lines even as loan growth has returned, according to data from s&p global market intelligence, with unused commitments across the industry up 1.4% in the second half of 2021 to $9.042 trillion even as loans increased 3.5% to $11.245 trillion. in the 2022 first quarter, loan growth continued to be broad. Median loan growth rate was 12.3 percent in 2022, the second highest median loan growth rate since 1984. the 2022 median loan growth was more than double the median loan growth rate of 5.7 percent in 2021 and the ten year average median loan growth rate of 4.5 percent. all but the largest banks had higher median loan growth rates in 2022 than. On a year over year basis, loans were up 9.9%. third quarter deposits amounted to $19.357 trillion, down 1.0% from the linked quarter and up 1.0% from a year earlier. views on loans, deposits. loan growth at banks continued in the third quarter even as rates moved higher, prompting many banks to raise their provisions for credit losses. Also read: year ender 2022 | banks ride the year on healthy loan growth and reduction in stress portfolio watch the accompanying video of cnbc tv18’s sapna das to know more about the decisions taken by the government to deal with these challenges and to know what lies ahead in 2023.

Comments are closed.